by Calculated Risk on 5/04/2015 05:15:00 PM

Monday, May 04, 2015

Update: Framing Lumber Prices down Year-over-year

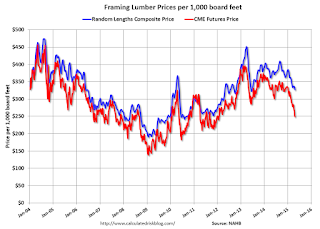

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand), however prices didn't fall as sharply either.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through April 2015 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down about 11% from a year ago, and CME futures are down around 25% year-over-year.

Fed Survey: Banks ease Standards for Residential Mortgages, CRE Loans

by Calculated Risk on 5/04/2015 02:00:00 PM

From the Federal Reserve: The April 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, the April survey results indicated that, on balance, banks reported little change in their standards on commercial and industrial (C&I) loans in the first quarter of 2015. On net, banks reported having eased some price terms. With respect to commercial real estate (CRE) lending, on balance, survey respondents reported having eased standards on loans secured by nonfarm nonresidential properties. A few large banks also indicated that they had eased standards on construction and land development loans, and some large banks reported that they had eased standards on loans secured by multifamily properties. In addition, survey respondents reported having eased some CRE loan terms, on net, over the past year. On the demand side, banks indicated having experienced little change in demand for C&I loans in the first quarter; in contrast, respondents reported stronger demand for all three categories of CRE loans covered in the survey.

The survey contained a set of special questions about lending to firms in the oil and natural gas drilling or extraction sector. Banks expected delinquency and charge-off rates on such loans to deteriorate over 2015, but they indicated that their exposures were small, and that they were undertaking a number of actions to mitigate the risk of loan losses.

Regarding loans to households, banks reported having eased lending standards for a number of categories of residential mortgage loans over the past three months on net. Most banks reported no change in standards and terms on consumer loans. On the demand side, moderate net fractions of banks reported stronger demand across most categories of home-purchase loans. Similarly, respondents experienced stronger demand for auto and credit card loans on balance.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Banks are loosening their standards for CRE loans, and for various categories of CRE (right half of graph). Multifamily is seeing slightly tighter standards.

The second graph shows the change in demand for CRE loans.

Banks are seeing a pickup in demand for all categories of CRE.

Banks are seeing a pickup in demand for all categories of CRE.This suggests that we will see a further increase in commercial real estate development.

Also the banks are easing credit a little for residential mortgages (see graph on page 3).

NAHB: Builder Confidence improves Year-over-year for the 55+ Housing Market in Q1

by Calculated Risk on 5/04/2015 11:09:00 AM

This is a quarterly index that was released last week by the the National Association of Home Builders (NAHB). This index is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low

From the NAHB: Builder Confidence in the 55+ Housing Market Remains Positive in the First Quarter

Builder confidence in the single-family 55+ housing market remains in positive territory for the first quarter of 2015, according to the National Association of Home Builders’ (NAHB) 55+ Housing Market Index (HMI) released today. Compared to the previous quarter, the single-family index edged down slightly by one point to 58, which is the fourth consecutive quarter above 50.

Two of the three components of the 55+ single-family HMI posted increases from the previous quarter: present sales increased one point to 64 and expected sales for the next six months rose three points to 67, while traffic of prospective buyers dropped eight points to 40.

...

“The strong eight-point surge in the 55+ HMI survey’s index for multifamily rental production is a positive sign, and a contrast to the relatively low attitudes builders are currently expressing towards 55+ multifamily condos,” said NAHB Chief Economist David Crowe. “This suggests that there is a significant number of 55+ households who desire to live in dense multifamily settings but not to own, at least not right away.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ Single Family HMI through Q1 2015. And reading above 50 indicates that more builders view conditions as good than as poor. The index declined slightly in Q1, and increased in Q1 2015 to 58 from 47 in Q1 2014.

There are two key drivers in addition to the improved economy: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Black Knight March Mortgage Monitor: "Negative Equity Population Shrinks to Just Over 4 Million"

by Calculated Risk on 5/04/2015 08:06:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for March today. According to BKFS, 4.70% of mortgages were delinquent in March, down from 5.36% in February. BKFS reported that 1.55% of mortgages were in the foreclosure process, down from 2.13% in March 2014.

This gives a total of 6.25% delinquent or in foreclosure. It breaks down as:

• 1,409,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 971,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 782,000 loans in foreclosure process.

For a total of 3,162,000 loans delinquent or in foreclosure in March. This is down from 3,840,000 in March 2014.

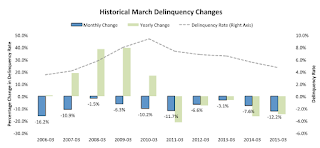

Typically there is a large decline in the March delinquency rate, but the decline this year was especially large.

From Black Knight:

March’s 12.2 percent drop in delinquency rates was the largest monthly decline in 9 yearsAlso from Black Knight on negative equity:

Delinquencies were down approximately 15 percent year-over-year

While seasonal decreases in March are typical (they’ve been seen in each of the past 10 years), this year’s drop was the largest since the 16.2 percent decline seen in March of 2006

Black Knight analyzed the latest available data on the nation’s negative equity situation. As explained by Ben Graboske, senior vice president, Black Knight Data and Analytics, the trend remains one of overall improvement – though negative equity distribution varies considerably depending upon geographical location and home values within a given market.

...

“Our most recent data shows that just over 8 percent of borrowers are currently underwater on their mortgages, representing a nearly 30 percent reduction in the negative equity rate since last year. We also observed that 29 percent of underwater borrowers are seriously delinquent on their mortgages and that borrowers in negative equity positions make up 77 percent of all active foreclosures. In fact, one of every three borrowers in active foreclosure has a current loan-to-value ratio of 150 or more, meaning they owe 50 percent more than their homes are worth." [said Graboske.]

Just over 4 million borrowers (8.08 percent of active mortgage universe) are in a negative equity position as of January 2015There is much more in the mortgage monitor.

Last year this population stood at 5.7 million borrowers (11.4 percent), marking a reduction of nearly 29 percent, or 1.6 million fewer underwater borrowers in 2015

The current population of underwater borrowers is just a quarter of the negative equity population at its peak in early 2011 (when 30 percent of borrowers were in negative equity positions)

Sunday, May 03, 2015

Sunday Night Futures

by Calculated Risk on 5/03/2015 08:53:00 PM

Looking for wages ... from Greg Ip at the WSJ: In Labor vs. Capital, Workers Gain a Slight Edge

Hopefully there will be some small sign of a pickup in wages in the April employment report (to be released Friday).

Monday:

• Early, the Black Knight March Mortgage Monitor report. This is a monthly report of mortgage delinquencies and other mortgage data.

• At 10:00 AM ET, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for March. The consensus is a 2.1% increase in orders.

• At 2:00 PM: the April 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

Weekend:

• Schedule for Week of May 3, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $59.09 per barrel and Brent at $66.48 per barrel. A year ago, WTI was at $100, and Brent was at $109 - so, even with the recent increases, prices are down 40%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.63 per gallon (down just over $1.00 per gallon from a year ago).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |