by Calculated Risk on 5/01/2015 07:02:00 PM

Friday, May 01, 2015

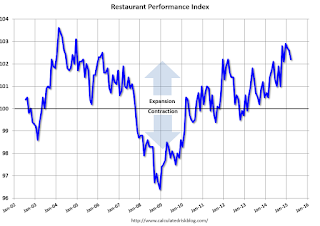

Restaurant Performance Index shows Expansion in March

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index Remained Positive in March

As a result of higher same-store sales and a continued optimistic outlook for future business conditions, the National Restaurant Association’s Restaurant Performance Index (RPI) remained in positive territory in March. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.2 in March, down 0.4 percent from February’s level of 102.6. Despite the decline, March marked the 25th consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

“Although a majority of restaurant operators reported higher same-store sales in March, customer traffic levels were somewhat dampened,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Looking forward, restaurant operators remain solidly optimistic about future business conditions, with six in 10 expecting to have higher sales in six months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 102.2 in March, down from 102.6 in February. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is another solid reading - and it is likely restaurants are benefiting from lower gasoline prices and are having to raise wages - a little - to attract and retain workers.

U.S. Light Vehicle Sales declined to 16.5 million annual rate in April

by Calculated Risk on 5/01/2015 02:38:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 16.5 million SAAR in April. That is up 3.3% from April 2014, and down 3.2% from the 17.05 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for April (red, light vehicle sales of 16.5 million SAAR from WardsAuto).

This was below the consensus forecast of 16.9 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Although below the consensus forecast, this was still a solid month for vehicle sales.

Construction Spending decreased 0.6% in March

by Calculated Risk on 5/01/2015 12:12:00 PM

Earlier today, the Census Bureau reported that overall construction spending decreased in March:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during March 2015 was estimated at a seasonally adjusted annual rate of $966.6 billion, 0.6 percent below the revised February estimate of $972.9 billion. The March figure is 2.0 percent above the March 2014 estimate of $947.3 billion.Both Private and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $702.4 billion, 0.3 percent below the revised February estimate of $704.7 billion. ...Note: Non-residential for offices and hotels is generally increasing, but spending for oil and gas is declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because oil prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In March, the estimated seasonally adjusted annual rate of public construction spending was $264.2 billion, 1.5 percent below the revised February estimate of $268.2 billion.

emphasis added

As an example, construction spending for lodging is up 22% year-over-year, whereas spending for power (includes oil and gas) construction peaked in mid-2014 and is down 16% year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been moving sideways, and is 48% below the bubble peak.

Non-residential spending is 15% below the peak in January 2008.

Public construction spending is now 19% below the peak in March 2009 and about 1% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 2.5%. Non-residential spending is up 9% year-over-year. Public spending is unchanged year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup (except oil and gas), and public spending has probably hit bottom after several years of austerity.

This was below the consensus forecast of a 0.5% increase, however spending for January and February was revised up.

ISM Manufacturing index unchanged at 51.5 in April

by Calculated Risk on 5/01/2015 10:01:00 AM

The ISM manufacturing index suggested sluggish expansion in April. The PMI was at 51.5% in April, unchanged from 51.5% in March. The employment index was at 48.3%, down from 50.0% in March, and the new orders index was at 53.5%, up from 51.8%.

From the Institute for Supply Management: April 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in April for the 28th consecutive month, and the overall economy grew for the 71st consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The April PMI® registered 51.5 percent, the same reading as in March. The New Orders Index registered 53.5 percent, an increase of 1.7 percentage points from the reading of 51.8 percent in March. The Production Index registered 56 percent, 2.2 percentage points above the March reading of 53.8 percent. The Employment Index registered 48.3 percent, 1.7 percentage points below the March reading of 50 percent, reflecting contracting employment levels from March. Inventories of raw materials registered 49.5 percent, a decrease of 2 percentage points from the March reading of 51.5 percent. The Prices Index registered 40.5 percent, 1.5 percentage points above the March reading of 39 percent, indicating lower raw materials prices for the sixth consecutive month. While the March and April PMI® were equal, both registering 51.5 percent, 15 of the 18 manufacturing industries reported growth in April while only 10 industries reported growth in March, indicating a broader distribution of growth in April among the 18 industries."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 52.0%, but still indicates expansion in April.

Zillow Forecast: Expect Case-Shiller National House Price Index up 4.2% year-over-year change in March

by Calculated Risk on 5/01/2015 07:11:00 AM

The Case-Shiller house price indexes for February were released this week. Zillow forecasts Case-Shiller a month early - now including the National Index - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: March Case-Shiller Forecast: 20-City Index to Show Annual Growth Above 5% Once Again

The February S&P/Case-Shiller (SPCS) data published today showed a slight uptick in home value appreciation for the 10- and 20-City indices, compared to the prior month. However, appreciation in the national index fell slightly in February, to an annual pace of 4.2 percent, from 4.4 percent in January 2015. Annual appreciation in the national series hit a post-bubble peak of 10.9 percent in October 2013 and has declined in every month since December 2013.So the year-over-year change in for March Case-Shiller National index will be about the same as in the February report.

The 10- and 20-City Composite Indices both experienced modest bumps in annual growth rates in February; the 10-City index rose 4.8 percent and the 20-City Index rose to 5 percent, up from rates of 4.3 percent and 4.5 percent, respectively, in January. The non-seasonally adjusted (NSA) 10- and 20-City indices were each up 0.5 percent in February from January, and we expect both to show further gains in March.

All forecasts are shown in the table below. These forecasts are based on the February SPCS data release and the March 2015 Zillow Home Value Index (ZHVI), published April 22. Officially, the SPCS Composite Home Price Indices for March will not be released until Tuesday, May 26.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| February Actual YoY | 4.8% | 4.8% | 5.0% | 5.0% | 4.2% | 4.2% |

| March Forecast YoY | 4.9% | 4.9% | 5.2% | 5.2% | 4.2% | 4.2% |

| March Forecast MoM | 0.9% | 1.0% | 1.0% | 0.9% | 0.5% | 0.2% |

From Zillow:

Annual appreciation in the Zillow Home Value Index (ZHVI) peaked in April 2014 and has declined since then. In March, the U.S. ZHVI rose 3.9 percent year-over-year, the first month in two years that home values grew at less than 4 percent annually. The annual appreciation rate in home values has fallen for the past 11 months. The February Zillow Home Value Forecast calls for a 2.6 percent rise in home values through February 2016. Further details on our forecast of home values can be found here.