by Calculated Risk on 4/29/2015 11:59:00 AM

Wednesday, April 29, 2015

Q1 GDP: Investment

Note: I'll probably be late to the FOMC analysis party today. No change in policy is expected. Here is the link for the statement at 2:00 PM ET.

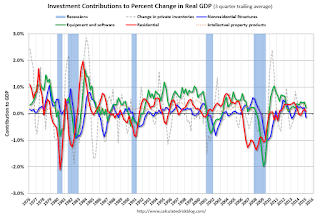

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline early last year was not a concern.

Residential investment (RI) increased at a 1.3% annual rate in Q1. Equipment investment increased at a 0.1% annual rate, and investment in non-residential structures decreased at a 23.1% annual rate. On a 3 quarter trailing average basis, RI is slightly positive (red), equipment is a slower positive (green), and nonresidential structures are down (blue).

Note: Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a decline.

I expect investment to be solid going forward (except for energy and power), and for the economy to grow at a decent pace for the remained of 2015.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but it still below the levels of previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

I'll add details for investment in offices, malls and hotels after the supplemental data is released.

NAR: Pending Home Sales Index increased 1.1% in March, up 11% year-over-year

by Calculated Risk on 4/29/2015 10:00:00 AM

From the NAR: Pending Home Sales Increase in March for Third Consecutive Month

The Pending Home Sales Index, a forward-looking indicator based on contract signings, climbed 1.1 percent to 108.6 in March from an upward revision of 107.4 in February and is now 11.1 percent above March 2014 (97.7). The index has now increased year-over-year for seven consecutive months and is at its highest level since June 2013 (109.4).This was close to expectations of a 1.0% increase.

...

The PHSI in the Northeast fell (1.5 percent) for the fourth straight month to 80.2 in March, but is still 0.6 percent above a year ago. In the Midwest the index declined 2.5 percent to 107.5 in March, but is 11.3 percent above March 2014.

Pending home sales in the South increased 4.0 percent to an index of 126.5 in March and are 12.4 percent above last March. The index in the West rose 1.7 percent in March to 103.7, and is now 15.6 percent above a year ago.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in April and May.

BEA: Real GDP increased at 0.2% Annualized Rate in Q1

by Calculated Risk on 4/29/2015 08:30:00 AM

From the BEA: Gross Domestic Product: First Quarter 2015 (Advance Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 0.2 percent in the first quarter of 2015, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.2 percent.The advance Q1 GDP report, with 0.2% annualized growth, was below expectations of a 1.0% increase.

...

The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE) and private inventory investment that were partly offset by negative contributions from exports, nonresidential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the first quarter reflected a deceleration in PCE, downturns in exports, in nonresidential fixed investment, and in state and local government spending, and a deceleration in residential fixed investment that were partly offset by a deceleration in imports and upturns in private inventory investment and in federal government spending.

The price index for gross domestic purchases, which measures prices paid by U.S. residents, decreased 1.5 percent in the first quarter, compared with a decrease of 0.1 percent in the fourth. Excluding food and energy prices, the price index for gross domestic purchases increased 0.3 percent, compared with an increase of 0.7 percent.

Real personal consumption expenditures increased 1.9 percent in the first quarter, compared with an increase of 4.4 percent in the fourth.

Personal consumption expenditures (PCE) increased at a 1.9% annualized rate.

The key negatives were trade (subtracted 1.25 percentage point) and investment in nonresidential structures (subtracted 0.75 percentage points). Trade was impacted by the West Coast port issues, and the decline in nonresidential structures was probably due to bad weather and less investment in oil and gas.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Apps up 21% YoY

by Calculated Risk on 4/29/2015 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 24, 2015. ...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index was unchanged from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 21 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.85 percent from 3.83 percent, with points increasing to 0.35 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 21% higher than a year ago.

Tuesday, April 28, 2015

Wednesday: GDP, FOMC

by Calculated Risk on 4/28/2015 09:00:00 PM

From Bloomberg: Fed Decision Day Guide: From Cooling Economy to Forward Guidance

Investors will scrutinize changes to the description of the economy for hints on the likely timing of liftoff after policy makers all but ruled out an interest-rate increase at this meeting.Wednesday:

Expectations for the first increase since 2006 have shifted out to September from June as the economy weakened in the first quarter ...

Inflation: Signs that consumer prices are stabilizing following a rebound in oil costs could encourage policy makers to tweak their language on inflation. ...

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2015 (advance estimate). The consensus is that real GDP increased 1.0% annualized in Q1.

• At 10:00 AM, Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

• At 2:00 PM, FOMC Meeting Statement. No change to policy is expected.