by Calculated Risk on 4/29/2015 08:30:00 AM

Wednesday, April 29, 2015

BEA: Real GDP increased at 0.2% Annualized Rate in Q1

From the BEA: Gross Domestic Product: First Quarter 2015 (Advance Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 0.2 percent in the first quarter of 2015, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.2 percent.The advance Q1 GDP report, with 0.2% annualized growth, was below expectations of a 1.0% increase.

...

The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE) and private inventory investment that were partly offset by negative contributions from exports, nonresidential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the first quarter reflected a deceleration in PCE, downturns in exports, in nonresidential fixed investment, and in state and local government spending, and a deceleration in residential fixed investment that were partly offset by a deceleration in imports and upturns in private inventory investment and in federal government spending.

The price index for gross domestic purchases, which measures prices paid by U.S. residents, decreased 1.5 percent in the first quarter, compared with a decrease of 0.1 percent in the fourth. Excluding food and energy prices, the price index for gross domestic purchases increased 0.3 percent, compared with an increase of 0.7 percent.

Real personal consumption expenditures increased 1.9 percent in the first quarter, compared with an increase of 4.4 percent in the fourth.

Personal consumption expenditures (PCE) increased at a 1.9% annualized rate.

The key negatives were trade (subtracted 1.25 percentage point) and investment in nonresidential structures (subtracted 0.75 percentage points). Trade was impacted by the West Coast port issues, and the decline in nonresidential structures was probably due to bad weather and less investment in oil and gas.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Apps up 21% YoY

by Calculated Risk on 4/29/2015 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 24, 2015. ...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index was unchanged from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 21 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.85 percent from 3.83 percent, with points increasing to 0.35 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 21% higher than a year ago.

Tuesday, April 28, 2015

Wednesday: GDP, FOMC

by Calculated Risk on 4/28/2015 09:00:00 PM

From Bloomberg: Fed Decision Day Guide: From Cooling Economy to Forward Guidance

Investors will scrutinize changes to the description of the economy for hints on the likely timing of liftoff after policy makers all but ruled out an interest-rate increase at this meeting.Wednesday:

Expectations for the first increase since 2006 have shifted out to September from June as the economy weakened in the first quarter ...

Inflation: Signs that consumer prices are stabilizing following a rebound in oil costs could encourage policy makers to tweak their language on inflation. ...

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2015 (advance estimate). The consensus is that real GDP increased 1.0% annualized in Q1.

• At 10:00 AM, Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

• At 2:00 PM, FOMC Meeting Statement. No change to policy is expected.

A Comment on House Prices: Real Prices and Price-to-Rent Ratio in February

by Calculated Risk on 4/28/2015 04:37:00 PM

The expected slowdown in year-over-year price increases has occurred. In October 2013, the National index was up 10.9% year-over-year (YoY). In February 2015, the index was up 4.2% YoY. However the YoY change has only declined slightly over the last six months.

Looking forward, I expect the YoY increases for the indexes to move more sideways (as opposed to down). Two points: 1) I don't expect (as some) for the indexes to turn negative YoY (in 2015) , and 2) I think most of the slowdown on a YoY basis is now behind us. This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (36%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.6% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to May 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to December 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to March 2003, and the CoreLogic index back to April 2003.

In real terms, house prices are back to 2003 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to March 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to 2003 levels - and maybe moving a little sideways now.

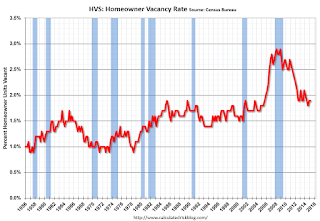

HVS: Q1 2015 Homeownership and Vacancy Rates

by Calculated Risk on 4/28/2015 01:45:00 PM

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2015.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 63.7% in Q1, from 64.0% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

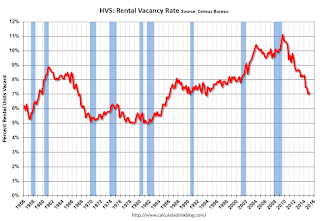

Are these homes becoming rentals?

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.