by Calculated Risk on 3/22/2015 07:59:00 PM

Sunday, March 22, 2015

Monday: Existing Home Sales

From Nick Timiraos at the WSJ: Oil Price Drop Hurts Spending on Business Investments

Prospects for an uptick in business investment this year are facing a major drag: The collapse in oil prices is spurring significant cutbacks for the energy-production industry, which had been a standout in an otherwise lackluster U.S. expansion.Overall the decline in oil prices will be a positive for the US economy, but there are clearly certain sectors that are taking a hit.

Business capital spending increased 6% last year because of gains from a broad base of U.S. industries. The drag from energy this year could cut that growth rate in half in 2015, according to economists at Goldman Sachs.

Monday:

• 8:30 AM ET, the Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for sales of 4.94 million on seasonally adjusted annual rate (SAAR) basis. Sales in January were at a 4.82 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.87 million SAAR.

• At 12:20 PM, Speech by Fed Vice Chairman Stanley Fischer, Monetary Policy Lessons and the Way Ahead, At the Economic Club of New York, New York, N.Y

Weekend:

• Schedule for Week of March 22, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 3 and DOW futures are up 30 (fair value).

Oil prices were up slightly over the last week with WTI futures at $46.16 per barrel and Brent at $54.81 per barrel. A year ago, WTI was at $100, and Brent was at $107 - so prices are down 50%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.42 per gallon (down more than $1.00 per gallon from a year ago). Prices in California are now declining following a refinery fire in February and a strike that is now over.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Fed: Q4 Household Debt Service Ratio near Record Low

by Calculated Risk on 3/22/2015 10:38:00 AM

The Fed's Household Debt Service ratio through Q4 2014 was released Friday: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio decreased in Q4, and is near the record low set in Q4 2012. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

The DSR for mortgages (blue) declined further in Q4. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With lower interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household cash flow is in much better shape now.

Saturday, March 21, 2015

Schedule for Week of March 22, 2015

by Calculated Risk on 3/21/2015 11:58:00 AM

The key economic reports this week are February new home sales on Tuesday, existing home sales on Monday, the Consumer Price Index on Tuesday, and the third estimate of Q4 GDP on Friday.

Fed Chair Janet Yellen will speak on Monetary Policy on Friday.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for sales of 4.94 million on seasonally adjusted annual rate (SAAR) basis. Sales in January were at a 4.82 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.87 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

12:20 PM, Speech by Fed Vice Chairman Stanley Fischer, Monetary Policy Lessons and the Way Ahead, At the Economic Club of New York, New York, N.Y

8:30 AM: Consumer Price Index for February. The consensus is for a 0.2% increase in CPI, and for core CPI to increase 0.1%.

9:00 AM: FHFA House Price Index for January 2015. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for February from the Census Bureau.

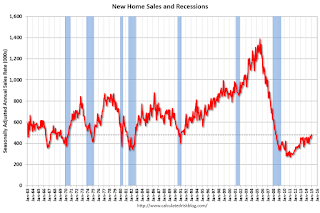

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the January sales rate.

The consensus is for a decrease in sales to 475 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 481 thousand in January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 291 thousand.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM: Gross Domestic Product, 4th quarter 2014 (third estimate). The consensus is that real GDP increased 2.4% annualized in Q4, up from the second estimate of 2.2%.

10:00 AM: University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 91.8, up from the preliminary reading of 91.2, but down from the February reading of 95.4.

10:00 AM: Regional and State Employment and Unemployment (Monthly), February 2015

3:45 PM: Speech, Fed Chair Janet Yellen, Monetary Policy, At the Federal Reserve Bank of San Francisco Conference: The New Normal for Monetary Policy, San Francisco, Calif

Goldman: "The Path to Exit"

by Calculated Risk on 3/21/2015 09:05:00 AM

A few excerpts from a research piece by Goldman Sachs economist Kris Dawsey: The Path to the Exit

The March FOMC statement and “dot plot” were more dovish than the market expected. The probability of a September hike looks much higher than a June hike, with a risk that the first hike could be pushed even later. Despite this week’s events, the Fed is busily planning how it will lift off from the zero lower bound when the time comes ...

We think that the most likely outcome for the first hike is an increase in the target range to 25 to 50 basis points (from 0 to 25 basis points currently). Although not likely, there is an outside chance that the Fed could decide to start with a “mini” hike. Once the first hike occurs, the Fed probably has sufficient tools to ensure that the effective fed funds rate trades within—but likely in the bottom half of—the target range most of the time.

Despite the Fed’s guidance that interest paid on excess reserves (IOER) will be the primary tool for firming rates, we think that the Committee will significantly increase the cap on the overnight RRP (O/N RRP) facility around the time of the first hike as an insurance policy. ... In our view, flexibility with regard to tactics and a process of “learning by doing” will probably be key features of the early part of the exit.

Sometime after the first hike the Fed will allow its balance sheet to begin shrinking, resulting in a gradual increase in the term premium. ... Our forecast for the start of portfolio runoff is 2016 Q1, with risk skewed toward a later date, and we think that the initial step will probably be a switch to a policy of partial reinvestment. Although the Fed has stated that asset sales are not part of its normalization plan at this time, it is possible to imagine scenarios which could push the Fed in this direction.

Friday, March 20, 2015

30 Year Mortgage Rates decline to March Lows

by Calculated Risk on 3/20/2015 06:15:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates End Week at March Lows

Mortgage rates moved modestly lower on average today after doing an admirable job of holding their ground amid weaker market conditions yesterday. That weakness was largely the result of a technical correction to the immense strength seen after Wednesday's Fed Announcement and Press Conference. The following two days have essentially legitimized that strength as something other than a temporary knee jerk reaction.Note: rates are still above the level required for a significant increase in refinance activity. Historically refinance activity picks up significantly when mortgage rates fall about 50 bps from a recent level.

...

Most lenders are now quoting a conventional 30yr fixed rate of 3.75% for top tier scenarios. There's more consensus on that one rate than normal. Many lenders that had been at 3.875% are just barely into the 3.75% territory after this week's gains, but underlying market levels are quite strong enough and haven't been maintained long enough for too many lenders to make the foray down to 3.625%.

Based on the relationship between the 30 year mortgage rate and 10-year Treasury yields, the 10-year Treasury yield would probably have to decline to 1.5% or lower for a significant refinance boom (in the near future). With the 10-year yield currently at 1.93%, I don't expect a significant increase in refinance activity.

Here is a table from Mortgage News Daily: