by Calculated Risk on 3/17/2015 08:57:00 PM

Tuesday, March 17, 2015

Wednesday: Fed Day!

From Jon Hilsenrath at the WSJ: Fed to Markets: No More Promises

Ahead of their policy meeting that ends Wednesday, Fed officials have signaled they want to drop the latest iteration in a succession of low-rate promises—a line in their policy statement pledging to be “patient” before deciding to raise rates.Wednesday:

The move could be a test for investors. In theory, less-clear-cut interest-rate guidance from the Fed should lead to more volatility in financial markets. That’s because investors will be left less certain about a key variable in every asset-valuation model: the cost of funds.

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: the AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

• At 2:00 PM, the FOMC Meeting Announcement. The FOMC is expected to make no change to policy, however the word "patient" will probably be removed from the statement opening the possibility of a rate hike as early as June.

• At 2:00 PM, the FOMC Forecasts. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

DataQuick: Southern California February Home Sales down 3% Year-over-year

by Calculated Risk on 3/17/2015 05:24:00 PM

From DataQuick: Southern California Home Sales Dip Year Over Year Again; Median Price Edges Higher

CoreLogic® ... today released its February 2015 Southern California housing market report, which shows the number of homes sold rose slightly from January but hit the lowest level for a February in seven years. ... A total of 13,650 new and existing houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in February 2015. That was up 0.7 percent month over month from 13,560 sales in January 2015, and down 2.7 percent year over year from 14,027 sales in February 2014, according to CoreLogic DataQuick data.A couple of key points: 1) the percent of distress sales usually increases in the winter months, because traditional sales fall off sharply - so it is important to look at the year-over-year change in distressed sales (down to 12.1% from 15.7% a year ago), and 2) we might see more upward price pressure unless inventory increases.

"This feels a lot like early 2014, with home sales off to a slow start as many would-be home buyers struggle with inventory constraints, credit hurdles and reduced affordability," said Andrew LePage, data analyst for CoreLogic DataQuick. "And just like a year ago, one of the big questions hanging over the market is whether we'll see a sizeable jump in inventory this spring and summer. A nearly three-year stretch of price appreciation has given many more owners enough equity to sell their homes and buy another. Recent job growth has helped fuel housing demand and if that’s met with only a modest rise in the supply of homes for sale it will put upward pressure on prices. Of course, the direction of mortgage rates, among other factors, will also play a role in determining how the housing market shapes up this year."

...

Foreclosure resales represented 6.0 percent of the resale market in February. That was up from a revised 5.7 percent in January 2015 and down from 6.7 percent in February 2014. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009. Foreclosure resales are purchased homes that have been previously foreclosed upon in the prior 12 months.

Short sales made up an estimated 6.1 percent of resales in February, down from a revised 6.6 in January 2015 and down from 9.0 percent in February 2014. Short sales are transactions in which the sale price fell short of what was owed on the property.

emphasis added

Comments on February Housing Starts

by Calculated Risk on 3/17/2015 02:24:00 PM

As always, we we shouldn't let one month of data influence us too much. For February it appears housing starts were impacted by the weather, especially in the Northeast.

Here is a table showing starts in the four Census Bureau regions. Starts in the Northeast were down 46% year-over-year:

| Housing Starts (000) | |||

|---|---|---|---|

| Feb-15 | Feb-14 | YoY Change | |

| Northeast | 47 | 87 | -46.0% |

| Midwest | 97 | 122 | -20.5% |

| South | 514 | 502 | 2.4% |

| West | 239 | 217 | 10.1% |

| Total | 897 | 928 | -3.3% |

However, even if starts had increased year-over-year in February at the rate in the South and the West, housing starts would still have been below expectations. So overall this was a disappointing report.

Note: It is also possible that the West Coast port slowdown impacted starts a little. The labor situation was resolved in February, so any impact should disappear quickly.

Click on graph for larger image.

Click on graph for larger image.This graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Even with the weak February, starts are running 8.4% ahead of 2014 through February.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

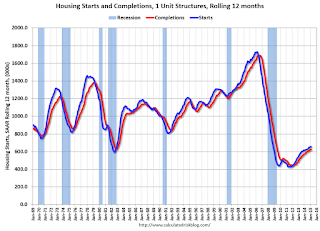

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Note that the blue line (multi-family starts) might be starting to move more sideways.

I think most of the growth in multi-family starts is probably behind us - although I expect solid multi-family starts for a few more years (based on demographics).

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

BLS: Twenty-four States had Unemployment Rate Decreases in January

by Calculated Risk on 3/17/2015 10:55:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in January. Twenty-four states had unemployment rate decreases from December, 8 states had increases, and 18 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

North Dakota had the lowest jobless rate in January, 2.8 percent. Mississippi and Nevada had the highest unemployment rates among the states, 7.1 percent each.

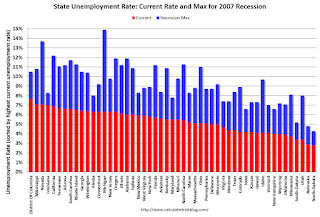

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Mississippi and Nevada, at 7.1%, had the highest state unemployment rate although D.C was higher.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Three states and D.C. are still at or above 7% (dark blue).

CoreLogic: "1.2 Million US Borrowers Regained Equity in 2014, 5.4 Million Properties Remain in Negative Equity"

by Calculated Risk on 3/17/2015 09:38:00 AM

From CoreLogic: CoreLogic Reports 1.2 Million US Borrowers Regained Equity in 2014

CoreLogic ... today released new analysis showing 1.2 million borrowers regained equity in 2014, bringing the total number of mortgaged residential properties with equity at the end of Q4 2014 to approximately 44.5 million or 89 percent of all mortgaged properties. Nationwide, borrower equity increased year over year by $656 billion in Q4 2014. The CoreLogic analysis also indicates approximately 172,000 U.S. homes slipped into negative equity in the fourth quarter of 2014 from the third quarter 2014, increasing the total number of mortgaged residential properties with negative equity to 5.4 million, or 10.8 percent of all mortgaged properties. This compares to 5.2 million homes, or 10.4 percent, that were reported with negative equity in Q3 2014, a quarter-over-quarter increase of 3.3 percent. Compared to 6.6 million homes, or 13.4 percent, reported for Q4 2013, the number of underwater homes has decreased year over year by 1.2 million or 18.9 percent.

... Of the 49.9 million residential properties with a mortgage, approximately 10 million, or 20 percent, have less than 20-percent equity (referred to as “under-equitied”) and 1.4 million of those have less than 5-percent equity (referred to as near-negative equity). Borrowers who are “under-equitied” “under-equitied” may have a more difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Borrowers with near negative equity are considered at risk of moving into negative equity if home prices fall. In contrast, if home prices rose by as little as 5 percent, an additional 1 million homeowners now in negative equity would regain equity. ...

“The share of homeowners that had negative equity increased slightly in the fourth quarter of 2014, reflecting the typical weakness in home values during the final quarter of the year,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Our CoreLogic HPI dipped 0.7 percent from September to December, and the percent of owners 'underwater' increased to 10.8 percent. However, from December-to-December, the CoreLogic index was up 4.8 percent, and the negative equity share fell by 2.6 percentage points.”

emphasis added

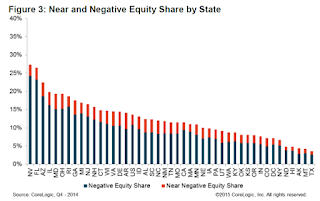

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 24.2 percent; followed by Florida (23.2 percent); Arizona (18.7 percent); Illinois (16.2 percent) and Rhode Island (15.8 percent). These top five states combined account for 31.7 percent of negative equity in the United States."

Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago (Q4 2013) when the negative equity share in Nevada was at 30.4 percent, and at 28.1 percent in Florida.

The second graph shows the distribution of home equity in Q4 compared to Q3 2014. Close to 4% of residential properties have 25% or more negative equity.

The second graph shows the distribution of home equity in Q4 compared to Q3 2014. Close to 4% of residential properties have 25% or more negative equity.In Q4 2013, there were 6.6 million properties with negative equity - now there are 5.4 million. A significant change.