by Calculated Risk on 3/13/2015 07:51:00 PM

Friday, March 13, 2015

Year 4: It Never Rains in California

Another heat wave in California this weekend (the high was 90 where I live). This is the fourth year in a row with little rain or snow in the mountains (the statewide snowpack is about 17% of normal for this date). California is the largest agricultural state, and an ongoing drought could have an impact on food prices - and on the economy.

An Op-Ed in the LA Times: California has about one year of water left. Will you ration now?

January was the driest in California since record-keeping began in 1895. Groundwater and snowpack levels are at all-time lows. We're not just up a creek without a paddle in California, we're losing the creek too.Maybe it is time to revisit the Alaska-California Undersea Aqueduct proposal.

Data from NASA satellites show that the total amount of water stored in the Sacramento and San Joaquin river basins — that is, all of the snow, river and reservoir water, water in soils and groundwater combined — was 34 million acre-feet below normal in 2014. That loss is nearly 1.5 times the capacity of Lake Mead, America's largest reservoir.

Statewide, we've been dropping more than 12 million acre-feet of total water yearly since 2011. Roughly two-thirds of these losses are attributable to groundwater pumping for agricultural irrigation in the Central Valley. ... Wells are running dry. In some areas of the Central Valley, the land is sinking by one foot or more per year.

As difficult as it may be to face, the simple fact is that California is running out of water.

Energy expenditures as a percentage of consumer spending

by Calculated Risk on 3/13/2015 04:06:00 PM

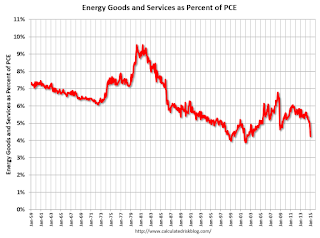

Here is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through January 2015.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

With some further declines - WTI oil futures fell 4% today to $45.09 per barrel - we might see energy expenditures as a percent of PCE at new lows and resume the long term down trend.

CoStar: Commercial Real Estate prices increased in January

by Calculated Risk on 3/13/2015 11:18:00 AM

Here is a price index for commercial real estate that I follow.

From CoStar: CRE Price Indices Start 2015 on a Strong Note with Solid Gains in January

COMPOSITE PRICE INDICES POST SOLID GAINS IN JANUARY 2015. Following a strong 2014, prices for commercial real estate (CRE) continued to climb in January 2015, supported by an expanding economy, strengthening market fundamentals and continued low interest rates. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—each increased by 1.2% in January 2015, contributing to annual gains of more than 12% in each index.

VALUE-WEIGHTED COMPOSITE INDEX REACHES NEW HIGH. Thanks to steady gains in recent months, the value-weighted U.S. Composite Index reached a record high in January 2015, and now stands 7.5% above its prerecession peak in 2007, reflecting strong competition among investors for large, high-quality commercial properties.

EQUAL-WEIGHTED COMPOSITE INDEX RISES TO WITHIN 13.4% OF PRERECESSION HIGH. After beginning its recovery later in the current cycle, the equal-weighted U.S. Composite Index has continued to grow steadily in the 12 months since January 2014, although it remains 13.4% below its 2007 prerecession peak. The increase in the equal-weighted U.S. Composite Index, which is influenced by smaller deals, reflects the general movement of capital into secondary markets and property types, as investors search for higher yields after property pricing has escalated in core U.S. coastal markets.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is at a record high, but the equal weighted is still 13.4% below the pre-recession peak.

There are indexes by sector and region too.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak, but still a little elevated.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

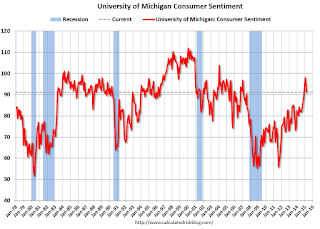

Preliminary March Consumer Sentiment decreases to 91.2

by Calculated Risk on 3/13/2015 10:02:00 AM

Thursday, March 12, 2015

Friday: PPI, Consumer Sentiment

by Calculated Risk on 3/12/2015 07:51:00 PM

On mortgage rates from Matthew Graham at Mortgage News Daily: Mortgage Rates Steady Near March Lows

Mortgage rates were mixed today depending on the lender, but moved just slightly lower on average. This wasn't the case this morning as essentially all lenders came out with noticeably lower rates following the weaker-than-expected Retail Sales report. As the day progressed, early gains in bond markets faded, especially after the afternoon's 30yr Bond auction. While that refers to 30yr Treasuries, the goings-on in the Treasury market always have some effect on the mortgage-backed-securities that dictate mortgage rates. Today was no exception, and as prices fell into the afternoon, most lenders 'repriced' to higher rates. ...CR Note: The Ten Year yield decreased slightly to 2.10% today from 2.11% on Wednesday.

That puts us very close to the lowest levels in March, seen on the first two days of the month. Most lenders are quoting conventional 30yr fixed rates of 3.875% to top tier borrowers. A few of the stronger lenders are at 3.75% and fewer still remain at 4.0%.

Friday:

• 8:30 AM ET, the Producer Price Index for February from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (preliminary for March). The consensus is for a reading of 95.5, up from 95.4 in February.