by Calculated Risk on 3/12/2015 08:42:00 AM

Thursday, March 12, 2015

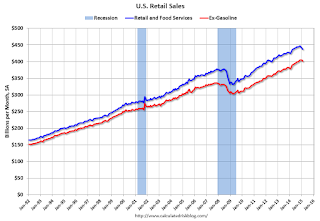

Retail Sales decreased 0.6% in February

On a monthly basis, retail sales decreased 0.6% from January to February (seasonally adjusted), and sales were up 1.7% from February 2014. Sales in December were unrevised at a 0.8% decrease.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $437.0 billion, a decrease of 0.6 percent from the previous month, but up 1.7 percent above February 2014. ... The December 2014 to January 2015 percent change was unrevised from -0.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline decreased 0.8%.

Retail sales ex-autos decreased 0.1%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 5.1% on a YoY basis (1.7% for all retail sales).

Retail and Food service sales ex-gasoline increased by 5.1% on a YoY basis (1.7% for all retail sales).The decrease in February was below consensus expectations of a 0.3% increase. This was a weak report.

Wednesday, March 11, 2015

Thursday: Retail Sales, Flow of Funds, Unemployment Claims

by Calculated Risk on 3/11/2015 08:11:00 PM

Thursday:

• 8:30 AM ET, Retail sales for February will be released. On a monthly basis, retail sales decreased 0.8% from December to January (seasonally adjusted), and sales were up 3.3% from January 2014. The consensus is for retail sales to increase 0.3% in February, and to increase 0.5% ex-autos.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 309 thousand from 320 thousand.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.1% increase in inventories.

• At 12:00 PM, the Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

• At 2:00 PM ET, the Monthly Treasury Budget Statement for February.

Fed Fails Deutsche Bank and Santander Capital Plans, BofA required to Submit New Plan by Q3

by Calculated Risk on 3/11/2015 04:41:00 PM

From the Federal Reserve: Comprehensive Capital Analysis and Review (CCAR)

The Federal Reserve on Wednesday announced it has not objected to the capital plans of 28 bank holding companies participating in the Comprehensive Capital Analysis and Review (CCAR). One institution received a conditional non-objection based on qualitative grounds, and the Federal Reserve objected to two firms' plans on qualitative grounds.From the WSJ: Federal Reserve Rejects 2 Banks’ Capital Plans in Annual ‘Stress Tests’

...

The Federal Reserve did not object to the capital plan of Bank of America Corporation, but is requiring the institution to submit a new capital plan by the end of the third quarter to address certain weaknesses in its capital planning processes. The Federal Reserve objected to the capital plans of Deutsche Bank Trust Corporation and Santander Holdings USA on qualitative concerns.

Twenty-eight of 31 large banks received Federal Reserve approval to return capital to investors on Wednesday but only after some of the biggest Wall Street firms came perilously close to failing the regulator’s annual “stress test.”

A 29th firm, Bank of America Corp. , received conditional approval of its capital plan and can move forward with boosting dividends or stock buybacks, but must resubmit its proposal to address “certain weaknesses” including its ability to measure losses and revenue, the Fed said. ... The Fed rejected the capital plans of two large banks, the U.S. units of Deutsche Bank AG and Banco Santander SA, for “qualitative” deficiencies including ability to model losses and identify risks. ...

Deutsche Bank, which took the stress test for the first time this year, was rejected for “numerous and significant deficiencies” across several areas of the capital planning process including the bank’s ability to identify risks, the Fed said.

Quarterly Services Survey suggests upward revision to Q4 GDP to 2.5%

by Calculated Risk on 3/11/2015 12:14:00 PM

From Reuters: U.S. services data suggest upward revision to Q4 growth

The Commerce Department's quarterly services survey ... showed consumption ... increased at a faster clip than the government had assumed in its second estimate of [GDP].Here is the Q4 Quarterly Services Press Release

Economists said the data suggested fourth-quarter consumer spending could be raised by at least six-tenths of a percentage point to a 4.9 percent annual rate ... the QSS suggested fourth-quarter GDP growth could be raised to a 2.5 percent pace from the 2.2 percent rate reported last month ...

Real Estate Data Resource for Local Area Sales and Inventory

by Calculated Risk on 3/11/2015 10:43:00 AM

Each month I track sales and inventory data for several previous bubble areas (like Las Vegas, Phoenix, Sacramento). These areas are interesting because they had huge prices bubbles, and large price declines - followed by significant investor buying (that is now declining). I also track these areas because the data is available on line.

Housing economist Tom Lawler is tracking a number of other areas, and has been kind enough to share that data with us (focused on distressed sales and cash buying).

If you are looking for data on your own area, you could try the local MLS, or look at the Zillow Research data. In addition to prices, Zillow tracks inventory and sales by metro area and zip code. Scroll down to "Other Metrics" and look at "Home Sales" and "For-sale Inventory" for the last five years.

Caution: Zillow has been expanding their coverage, so use caution when creating a data series based on aggregate data.