by Calculated Risk on 3/10/2015 04:45:00 PM

Tuesday, March 10, 2015

Phoenix Real Estate in February: Sales Up 9%, Inventory DOWN 8% Year-over-year

For the third consecutive month, inventory was down year-over-year in Phoenix. This is a significant change.

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in January were up 9.0% year-over-year. Another change.

2) Cash Sales (frequently investors) were down about 8% to 29.9% of total sales. Non-cash sales were up 18.3% year-over-year.

3) Active inventory is now down 8.4% year-over-year. Note: House prices bottomed in Phoenix in 2011 at about the current level of inventory.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline).

| February Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Feb-2008 | 3,445 | --- | 650 | 18.9% | 57,3051 | --- |

| Feb-2009 | 5,477 | 59.0% | 2,188 | 39.9% | 52,013 | -9.2% |

| Feb-2010 | 6,595 | 20.4% | 2,997 | 45.4% | 42,388 | -18.5% |

| Feb-2011 | 7,171 | 8.7% | 3,776 | 52.7% | 40,666 | -4.1% |

| Feb-2012 | 7,249 | 1.1% | 3,616 | 49.9% | 23,736 | -41.6% |

| Feb-2013 | 6,618 | -8.7% | 3,053 | 46.1% | 21,718 | -8.5% |

| Feb-2014 | 5,476 | -17.3% | 1,939 | 35.4% | 29,899 | 37.7% |

| Feb-2015 | 5,970 | 9.0% | 1,784 | 29.9% | 27,382 | -8.4% |

| 1 February 2008 probably included pending listings | ||||||

FNC: Residential Property Values increased 4.3% year-over-year in January

by Calculated Risk on 3/10/2015 01:38:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their January 2015 index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values decreased 0.3% from December to January (Composite 100 index, not seasonally adjusted).

The 10 city MSA, the 20-MSA and 30-MSA RPIs all decreased . These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was lower in January than in December, with the 100-MSA composite up 4.3% compared to January 2014 (this index was up 5.0% year-over-year in December). In general, for FNC, the YoY increase has been slowing since peaking in March at 9.0%.

The index is still down 19.8% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through January 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the price indexes have been showing a slowdown in price increases.

Note: The January Case-Shiller index will be released on Tuesday, Tuesday, March 31.

Las Vegas Real Estate in February: Sales Decline 2.6%, Non-contingent Inventory up 16% YoY

by Calculated Risk on 3/10/2015 11:24:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR report points to steady housing market, prices still up about 8 percent for year

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in February was 2,452, up from 2,239 in January, but down from 2,518 one year ago. At this sales pace, Lynam said Southern Nevada continues to have roughly a four-month supply of available homes, while a six-month supply is considered to be a balanced market.There are several key trends that we've been following:

...

GLVAR is tracking a two-year trend of fewer distressed sales and more traditional sales, where lenders are not controlling the transaction. In February, 9.3 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 9.7 percent in January and from 14 percent one year ago. Another 9.7 percent of February sales were bank-owned, up from 9.4 percent in January, but down from 12 percent last year.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in February was 13,188, up 4.1 percent from 12,666 in January, but down 3.2 percent from one year ago. GLVAR tracked a total of 3,558 condos, high-rise condos and townhomes listed for sale on its MLS in February, up 3.8 percent from 3,429 in January, but down 0.1 percent from February 2014.

By the end of February, GLVAR reported 7,313 single-family homes listed without any sort of offer. That’s down 0.9 percent from January, but up 15.8 percent from one year ago. For condos and townhomes, the 2,425 properties listed without offers in February represented a 4.2 percent increase from January and a 9.6 percent increase from one year ago.

emphasis added

1) Overall sales were down 2.6% year-over-year.

2) However conventional (equity, not distressed) sales were up 6.6% year-over-year. In February 2014, only 74.0% of all sales were conventional equity. In February 2015, 81.0% were standard equity sales. Note: In February 2013 (two years ago), only 51.9% were equity! A significant change.

3) The percent of cash sales has declined year-over-year from 46.8% in February 2014 to 37.4% in February 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 15.8% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing - but still ongoing.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

BLS: Jobs Openings at 5.0 million in January, Up 28% Year-over-year

by Calculated Risk on 3/10/2015 10:10:00 AM

From the BLS: Job Openings and Labor Turnover Summary

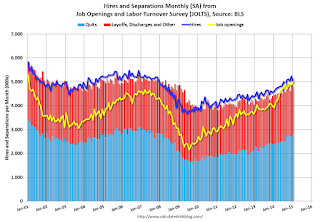

There were 5.0 million job openings on the last business day of January, little changed from 4.9 million in December, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.8 million quits in January, little changed from December.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in January to 4.998 million from 4.877 million in December.

The number of job openings (yellow) are up 28% year-over-year compared to January 2014.

Quits are up 17% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another very positive report. It is a good sign that job openings are at 5 million, and that quits are increasing significantly year-over-year.

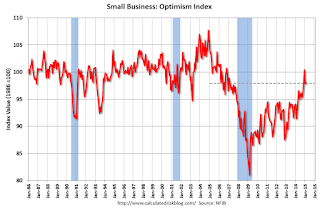

NFIB: Small Business Optimism Index Increased slightly in February

by Calculated Risk on 3/10/2015 09:04:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Rises Despite Falling Sales Trends

The NFIB Small Business Optimism Survey for February rose 0.1 points to 98.0 a solid result despite some unfavorable conditions.

“In spite of slow economic activity and awful weather in a lot of the country, small business owners are finding reasons to hire and spend which is great news. Of the ten components, owners reporting hard-to-fill job openings was the largest gain increasing three points to a 29 percent which is a nine year high.

“Large firms have been powering the economic recovery since the Great Recession, but that may be shifting to the small business sector. February’s data suggests there are fundamental domestic economic currents leading business owners to add workers and these should bubble up in the official statistics and support stronger growth in domestic output.” ...

...

Fourteen percent cited the availability of qualified labor as their top business problem, the highest since September 2007. The job openings figure is one of the highest in 40 years and this suggests that labor markets are tightening and that there will be more pressure on compensation in the coming months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 98.0 in February from 97.9 in January.