by Calculated Risk on 3/06/2015 09:45:00 AM

Friday, March 06, 2015

Employment Report Comments and Graphs

Earlier: February Employment Report: 295,000 Jobs, 5.5% Unemployment Rate

This was a very solid employment report with 295,000 jobs added, although job gains for January were revised down 18,000.

Unfortunately there was little good news on wage growth, from the BLS: "In February, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $24.78. Over the year, average hourly earnings have risen by 2.0 percent."

However I expect real wages to increase this year.

A few more numbers: Total employment increased 295,000 from January to February and is now 2.8 million above the previous peak. Total employment is up 11.5 million from the employment recession low.

Private payroll employment increased 288,000 from January to February, and private employment is now 3.2 million above the previous peak. Private employment is up 12.0 million from the recession low.

In February, the year-over-year change was 3.3 million jobs. This was the highest year-over-year gain since March '00.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in February to 81.0%, and the 25 to 54 employment population ratio increased to 77.3%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth has been running close to 2% since 2010 and will probably pick up a little this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in February at 6.6 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in February to 6.635 million from 6.810 million in January. This is the lowest level since September 2008. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.0% in February from 11.3% in January. This is the lowest level for U-6 since September 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.709 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.800 in January. This is trending down, but is still very high.

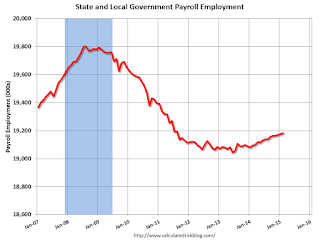

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In February 2015, state and local governments added 7,000 jobs. State and local government employment is now up 138,000 from the bottom, but still 620,000 below the peak.

State and local employment is now generally increasing. And Federal government layoffs have slowed (Federal payrolls were unchanged in February).

Overall this was a very solid employment report.

February Employment Report: 295,000 Jobs, 5.5% Unemployment Rate

by Calculated Risk on 3/06/2015 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 295,000 in February, and the unemployment rate edged down to 5.5 percent, the U.S. Bureau of Labor Statistics reported today.

...

After revision, the change in total nonfarm payroll employment for December remained at +329,000, and the change for January was revised from +257,000 to +239,000. With these revisions, employment gains in December and January were 18,000 lower than previously reported. Over the past 3 months, job gains have averaged 288,000 per month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 295 thousand in February (private payrolls increased 288 thousand).

Payrolls for December and January were revised down by a combined 18 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 3.3 million jobs.

This was the highest year-over-year gain since end of the '90s.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate decreased in February to 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in February to 5.5%.

This was above expectations of 230,000, and this was another solid report.

I'll have much more later ...

Thursday, March 05, 2015

Friday: Jobs, Trade Deficit

by Calculated Risk on 3/05/2015 06:51:00 PM

Congratulations to my friend, housing economist Tom Lawler, for winning another "Crystal Ball" award (Tom's home price forecasts were the most accurate of their more than 100 expert panelists.). This is Tom's third "Crystal Ball"!

Friday:

• At 8:30 AM ET, the Employment Report for February. The consensus is for an increase of 230,000 non-farm payroll jobs added in February, down from the 257,000 non-farm payroll jobs added in January. The consensus is for the unemployment rate to decline to 5.6% in February from 5.7% in January.

• Also at 8:30 AM, the Trade Balance report for January from the Census Bureau. The consensus is for the U.S. trade deficit to be at $41.8 billion in January from $46.6 billion in December.

• At 3:00 PM, Consumer Credit for January from the Federal Reserve. The consensus is for credit to increase $15.0 billion.

Hints of real Wage Increases

by Calculated Risk on 3/05/2015 03:04:00 PM

A few thoughts ... it seems this might be the year that we see an increase in real wages. Here are a few signs:

1) The official data suggests we are getting closer to full employment. The unemployment rate (U-3) has fallen to 5.7%, and "quits" are up significantly (voluntary separations). The number of people working part time for economic reasons is still high, but declining (these workers are included in the alternate measure of underemployment, U-6, that has fallen to 11.3% from a high of 17.1%).

2) Several companies have announced increases for their lowest paid employees, including Wal-Mart (to $9 per hour in April, and $10 per hour next year) and T.J. Maxx.

3) More labor issues. There was the West Coast port slowdown (now resolved, with a huge backup of ships waiting to unload), and the ongoing refinery strikes. From the WSJ: U.S. Refiners, Striking Workers Digging In for Protracted Battle

U.S. refiners and striking union workers are digging in for a protracted battle that could last through the spring.

...

Weeks of negotiations the union and refinery owners fell apart in early February. Since then, 6,500 USW workers have walked out of more than a dozen plants. ...

The last nationwide refinery strike was in 1980 and lasted for three months. This year, energy companies have signaled that they are willing for the work stoppage to drag on even longer. The two sides are trying to hammer out a new three-year contract that would be used as a pattern for union employment, wage increases and benefits at refineries and petrochemical plants around the U.S.

Click on graph for larger image.

Click on graph for larger image.Union membership has declined significantly over the last 35 years (less power for labor), but these slowdowns and strikes still suggest some negotiating power for labor (we didn't see many strikes in 2008 when the economy was collapsing).

Last year I wrote that the economic word of the year for 2015 might be "wages", "Just being hopeful", I wrote, "maybe 2015 will be the year that real wages start to increase". All of the above suggests some increase in real wages this year.

Goldman February Payrolls Preview

by Calculated Risk on 3/05/2015 12:10:00 PM

Yesterday I posted a employment preview for February. Here are some excerpts from Goldman Sachs economist David Mericle:

We expect nonfarm payroll job growth of 220k in February, below the consensus forecast of 235k. Labor market indicators were mixed in February, and we expect that the effect of four major snowstorms in the month leading into the February survey week will also weigh on payroll growth. We expect a one-tenth decline in the unemployment rate to 5.6%, reversing the increase seen last month. On average hourly earnings, our baseline expectation is for a 0.2% increase, but we see some upside risk from possible statistical distortions related to the severe snowstorms.

emphasis added