by Calculated Risk on 2/18/2015 02:00:00 PM

Wednesday, February 18, 2015

FOMC Minutes: "Many participants ... inclined toward keeping the federal funds rate at its effective lower bound for a longer time"

From the Fed: Minutes of the Federal Open Market Committee, January 27-28, 2015. Excerpts:

Participants discussed the tradeoffs between the risks that would be associated with departing from the effective lower bound later and those that would be associated with departing earlier. Several participants noted that a late departure could result in the stance of monetary policy becoming excessively accommodative, leading to undesirably high inflation. It was also suggested that maintaining the federal funds rate at its effective lower bound for an extended period or raising it rapidly, if that proved necessary, could adversely affect financial stability. Some participants were concerned that a decision to delay the commencement of tightening could be perceived as indicating that an overly accommodative policy is likely to prevail during the firming phase. In connection with the risks associated with an early start to policy normalization, many participants observed that a premature increase in rates might damp the apparent solid recovery in real activity and labor market conditions, undermining progress toward the Committee's objectives of maximum employment and 2 percent inflation. In addition, an earlier tightening would increase the likelihood that the Committee might be forced by adverse economic outcomes to return the federal funds rate to its effective lower bound. Some participants noted the communications challenges associated with the prospect of commencing policy tightening at a time when inflation could be running well below 2 percent, and a few expressed concern that in some circumstances the public could come to question the credibility of the Committee's 2 percent goal. Indeed, one participant recommended that, in light of the outlook for inflation, the Committee consider ways to use its tools to provide more, not less, accommodation.Also concerned about too low inflation:

Many participants indicated that their assessment of the balance of risks associated with the timing of the beginning of policy normalization had inclined them toward keeping the federal funds rate at its effective lower bound for a longer time.

emphasis added

A number of participants emphasized that they would need to see either an increase in market-based measures of inflation compensation or evidence that continued low readings on these measures did not constitute grounds for concern.

AIA: Architecture Billings Index "softens" in January

by Calculated Risk on 2/18/2015 11:31:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Softens in January

Following a nine-month stretch of positive billings, the Architecture Billings Index (ABI) showed no increase in design activity in January. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the January ABI score was 49.9, down from a mark of 52.7 in December. This score reflects a very modest decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.7, down from the reading of 59.1 the previous month.

“This easing in demand for design services is a bit of a surprise given the overall strength of the market over the past nine months,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Likely some of this can be attributed to severe weather conditions in January. We will have a better sense if there is a reason for more serious concern over the next couple of months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.9 in January, down from 52.7 in December. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This is just one month of slight contraction - the index is noisy - and this index was mostly positive in 2014, suggesting an increase in CRE investment in 2015.

Fed: Industrial Production increased 0.2% in January

by Calculated Risk on 2/18/2015 09:24:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.2 percent in January after decreasing 0.3 percent in December. The rates of change in output for September through December are all slightly lower than previously published; even so, production is estimated to have advanced at an annual rate of 4.3 percent in the fourth quarter of last year. In January, manufacturing output moved up 0.2 percent and was 5.6 percent above its year-earlier level. The index for mining decreased 1.0 percent, with the decline more than accounted for by a substantial drop in the index for oil and gas well drilling and related support activities. The output of utilities increased 2.3 percent. At 106.2 percent of its 2007 average, total industrial production in January was 4.8 percent above its level of a year earlier. Capacity utilization for the industrial sector was unchanged in January at 79.4 percent, a rate that is 0.7 percentage point below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

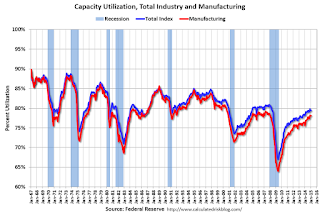

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.4% is 0.7% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.2% in January to 106.2. This is 26.8% above the recession low, and 5.4% above the pre-recession peak.

This was below expectations, and there were downward revisions to prior months.

Housing Starts decreased to 1.065 Million Annual Rate in January

by Calculated Risk on 2/18/2015 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 1,065,000. This is 2.0 percent below the revised December estimate of 1,087,000, but is 18.7 percent above the January 2014 rate of 897,000.

Single-family housing starts in January were at a rate of 678,000; this is 6.7 percent below the revised December figure of 727,000. The January rate for units in buildings with five units or more was 381,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,053,000. This is 0.7 percent below the revised December rate of 1,060,000, but is 8.1 percent above the January 2014 estimate of 974,000.

Single-family authorizations in January were at a rate of 654,000; this is 3.1 percent (±0.9%) below the revised December figure of 675,000. Authorizations of units in buildings with five units or more were at a rate of 372,000 in January.

Click on graph for larger image.

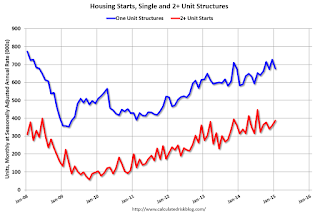

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased slightly in January. Multi-family starts are up 23% year-over-year.

Single-family starts (blue) decreased slightly in January and are up 16% year-over-year.

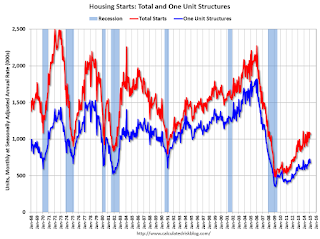

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and - after moving sideways for about two years and a half years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and - after moving sideways for about two years and a half years - housing is now recovering (but still historically low),This was close to expectations of 1.070 million starts in January, although starts in November and December were revised down. Overall this was a decent report with housing starts up almost 19% year-over-year (starts were weak in early 2014). I'll have more later ...

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 2/18/2015 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 13.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 13, 2015. ...

The Refinance Index decreased 16 percent from the previous week. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier.

...

“Mortgage rates increased to their highest level since the beginning of the year last week, and application volume dropped sharply as a result, particularly for refinances. The market index declined to its lowest level since the week ending January 2nd as purchase application activity decreased seven percent and refinance applications decreased 16 percent. Refinance volume fell particularly for larger loans, as evidenced by the decline of almost $25,000 in the average loan size for a refinance loan,” said Mike Fratantoni, MBA’s Chief Economist.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.93 percent from 3.84 percent, with points increasing to 0.35 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is up 1% from a year ago.