by Calculated Risk on 2/16/2015 10:37:00 AM

Monday, February 16, 2015

Year 4: It Never Rains in California

Parts of the east coast are suffering with record snow fall, but in California, the drought continues ... last week in SoCal was like summer with temperature in the 80s!

This is the fourth year in a row with little rain or snow in the mountains (the statewide snowpack is about 27% of normal for this date). California is the largest agricultural state, and an ongoing drought could have an impact on food prices - and on the economy.

This graphic shows the National Weather Service 7 day precipitation forecast for the U.S.

California will be dry for at least another week - and the East Coast is getting too much precipitation.

Sunday, February 15, 2015

March 1st Deadline for Greece Deal

by Calculated Risk on 2/15/2015 08:06:00 PM

From the WSJ: Deadline for Greek Bailout Agreement Looms

Any changes to the content or expiration date of Greece’s existing €240 billion ($273 billion) bailout have to be decided by Friday, to give national parliaments in Germany, Finland and the Netherlands enough time to approve them before the end of the month. Without such a deal, Greece will be on its own on March 1, cut loose from the rescue loans from the eurozone and the International Monetary Fund that have sustained it for almost five years.Although Greece mostly lived up to the terms of the bailout, the promised growth never materialized (see tables below). As Greek Prime Minister recently said: "We are not negotiating the bailout; it was cancelled by its own failure.”

The only choices are to allow Greece to run a smaller primary surplus or for Greece to leave the Eurozone and default on all their debt. The first choice seems likely, but not without some drama.

Note: Greece would have left the Eurozone in 2010 if the actual numbers below had been the plan. No politician would have signed up for that economic devastation!

| Greece: Annual GDP, Forecast and Actual1 | ||

|---|---|---|

| Year | Promised | Actual |

| 2009 | -2 | -4.4 |

| 2010 | -4 | -5.4 |

| 2011 | -2.6 | -8.9 |

| 2012 | 1.1 | -6.6 |

| 2013 | 2.1 | -3.9 |

| 2014 | 2.1 | |

| 2015 | 2.7 | |

| 1IMF Forecasts and Eurostat Actual | ||

| Greece: Annual Unemployment Rate, Forecast and Actual1 | ||

|---|---|---|

| Year | Promised | Actual |

| 2009 | 9.4 | 9.6 |

| 2010 | 11.8 | 12.7 |

| 2011 | 14.6 | 17.9 |

| 2012 | 14.8 | 24.5 |

| 2013 | 14.3 | 27.5 |

| 2014 | 14.1 | 26.82 |

| 2015 | 13.4 | |

| 1IMF Forecasts and Eurostat Actual 22014 is Q1, Q2, Q3 average | ||

Update: The Inland Empire Bust and Recovery

by Calculated Risk on 2/15/2015 11:31:00 AM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire is now recovering.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, but still elevated at 7.2% (down from 15.0% in 2010). And construction employment is up only slightly from the lows (as a percent of total employment).

Overall the outlook for the Inland Empire is much better today.

Saturday, February 14, 2015

Schedule for Week of February 15, 2015

by Calculated Risk on 2/14/2015 01:15:00 PM

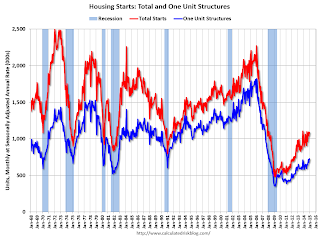

The key economic report this week is January housing starts on Wednesday.

For manufacturing, the January Industrial Production and Capacity Utilization report, and the February NY Fed (Empire State), and Philly Fed surveys, will be released this week.

For prices, PPI will be released on Wednesday.

All US markets are closed in observance of the Presidents' Day holiday.

8:30 AM: NY Fed Empire State Manufacturing Survey for February. The consensus is for a reading of 9.0, down from 10.0 last month (above zero is expansion).

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 58, up from 57 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. Total housing starts were at 1.089 million (SAAR) in December. Single family starts were at 679 thousand SAAR in December.

The consensus is for total housing starts to decrease to 1.070 million (SAAR) in January.

8:30 AM: The Producer Price Index for January from the BLS. The consensus is for a 0.4% decrease in prices, and a 0.1% increase in core PPI.

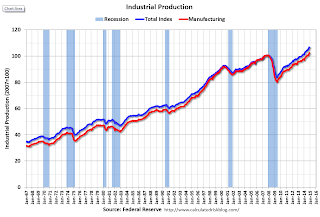

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.9%.

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for Meeting of January 27-28, 2015

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 290 thousand from 304 thousand.

10:00 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 8.5, up from 6.3 last month (above zero indicates expansion).

No economic releases scheduled.

Unofficial Problem Bank list declines to 386 Institutions

by Calculated Risk on 2/14/2015 08:07:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 14, 2015.

Changes and comments from surferdude808:

A failure today reduced the Unofficial Problem Bank List to 386 institutions with assets of $121.2 billion. A year ago, the list held 586 institutions with assets of $195 billion.

The FDIC shuttered the doors of Capitol City Bank & Trust Company, Atlanta, GA ($276 million) making it the 89th bank headquartered in Georgia to fail since the on-set of the Great Recession. Astonishingly, the FDIC estimates the failure cost at $88.9 million or nearly 33 percent of the bank's assets.

Historically, commercial bank failure are usually around 12¢ on the dollar. Even with a well above average cost percentage, Capitol City Bank & Trust only ranks as the 54th most expensive failure, in cost percentage terms, of the 89 Georgia closures. Moreover, its cost is under the Georgia average failure cost of 34.7 percent of failed bank assets.

Next week, we anticipate the OCC will release an update on its latest enforcement action activities..