by Calculated Risk on 2/15/2015 11:31:00 AM

Sunday, February 15, 2015

Update: The Inland Empire Bust and Recovery

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire is now recovering.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, but still elevated at 7.2% (down from 15.0% in 2010). And construction employment is up only slightly from the lows (as a percent of total employment).

Overall the outlook for the Inland Empire is much better today.

Saturday, February 14, 2015

Schedule for Week of February 15, 2015

by Calculated Risk on 2/14/2015 01:15:00 PM

The key economic report this week is January housing starts on Wednesday.

For manufacturing, the January Industrial Production and Capacity Utilization report, and the February NY Fed (Empire State), and Philly Fed surveys, will be released this week.

For prices, PPI will be released on Wednesday.

All US markets are closed in observance of the Presidents' Day holiday.

8:30 AM: NY Fed Empire State Manufacturing Survey for February. The consensus is for a reading of 9.0, down from 10.0 last month (above zero is expansion).

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 58, up from 57 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

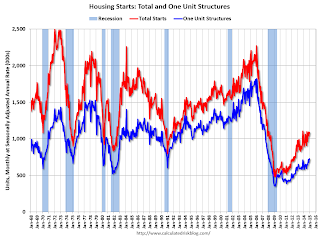

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. Total housing starts were at 1.089 million (SAAR) in December. Single family starts were at 679 thousand SAAR in December.

The consensus is for total housing starts to decrease to 1.070 million (SAAR) in January.

8:30 AM: The Producer Price Index for January from the BLS. The consensus is for a 0.4% decrease in prices, and a 0.1% increase in core PPI.

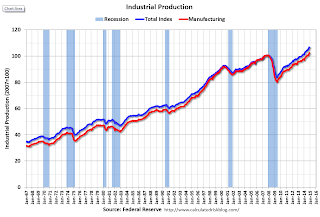

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.9%.

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for Meeting of January 27-28, 2015

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 290 thousand from 304 thousand.

10:00 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 8.5, up from 6.3 last month (above zero indicates expansion).

No economic releases scheduled.

Unofficial Problem Bank list declines to 386 Institutions

by Calculated Risk on 2/14/2015 08:07:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 14, 2015.

Changes and comments from surferdude808:

A failure today reduced the Unofficial Problem Bank List to 386 institutions with assets of $121.2 billion. A year ago, the list held 586 institutions with assets of $195 billion.

The FDIC shuttered the doors of Capitol City Bank & Trust Company, Atlanta, GA ($276 million) making it the 89th bank headquartered in Georgia to fail since the on-set of the Great Recession. Astonishingly, the FDIC estimates the failure cost at $88.9 million or nearly 33 percent of the bank's assets.

Historically, commercial bank failure are usually around 12¢ on the dollar. Even with a well above average cost percentage, Capitol City Bank & Trust only ranks as the 54th most expensive failure, in cost percentage terms, of the 89 Georgia closures. Moreover, its cost is under the Georgia average failure cost of 34.7 percent of failed bank assets.

Next week, we anticipate the OCC will release an update on its latest enforcement action activities..

Friday, February 13, 2015

Bank Failure #3 in 2015: Capitol City Bank & Trust Company, Atlanta, Georgia

by Calculated Risk on 2/13/2015 06:55:00 PM

Another bank failure in Georgia ...

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of Capitol City Bank & Trust Company, Atlanta, Georgia

As of December 31, 2014, Capitol City Bank & Trust Company had approximately $272.3 million in total assets and $262.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $88.9 million. ... Capitol City Bank & Trust Company is the third FDIC-insured institution in the nation to fail this year, and the first in Georgia. The last FDIC-insured institution closed in the state was Eastside Commercial Bank, Conyers, on July 18, 2014.At least we know it is Friday.

By Request: Repeat U.S. Population by Age and Distribution, 1900 through 2060

by Calculated Risk on 2/13/2015 02:34:00 PM

Repeat: Here are animations of the U.S population by age and distribution, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

Also - by request - I've slowed the animation down to 2 seconds per slide (and included a slower distribution animation below).

Note: For distribution, here are the same graphs using a slider (the user can look at individual slides).

There are many interesting points - the Depression baby bust, the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more. What jumps out at me are the improvements in health care. And also that the largest cohorts will all soon be under 40. Heck, in the last frame (2060), any remaining Boomers will be in those small (but growing) 95 to 99, and 100+ cohorts.

Animation updates every two seconds.

Notes: Population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

The second graph is by distribution (updates every 2 seconds).