by Calculated Risk on 2/14/2015 08:07:00 AM

Saturday, February 14, 2015

Unofficial Problem Bank list declines to 386 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 14, 2015.

Changes and comments from surferdude808:

A failure today reduced the Unofficial Problem Bank List to 386 institutions with assets of $121.2 billion. A year ago, the list held 586 institutions with assets of $195 billion.

The FDIC shuttered the doors of Capitol City Bank & Trust Company, Atlanta, GA ($276 million) making it the 89th bank headquartered in Georgia to fail since the on-set of the Great Recession. Astonishingly, the FDIC estimates the failure cost at $88.9 million or nearly 33 percent of the bank's assets.

Historically, commercial bank failure are usually around 12¢ on the dollar. Even with a well above average cost percentage, Capitol City Bank & Trust only ranks as the 54th most expensive failure, in cost percentage terms, of the 89 Georgia closures. Moreover, its cost is under the Georgia average failure cost of 34.7 percent of failed bank assets.

Next week, we anticipate the OCC will release an update on its latest enforcement action activities..

Friday, February 13, 2015

Bank Failure #3 in 2015: Capitol City Bank & Trust Company, Atlanta, Georgia

by Calculated Risk on 2/13/2015 06:55:00 PM

Another bank failure in Georgia ...

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of Capitol City Bank & Trust Company, Atlanta, Georgia

As of December 31, 2014, Capitol City Bank & Trust Company had approximately $272.3 million in total assets and $262.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $88.9 million. ... Capitol City Bank & Trust Company is the third FDIC-insured institution in the nation to fail this year, and the first in Georgia. The last FDIC-insured institution closed in the state was Eastside Commercial Bank, Conyers, on July 18, 2014.At least we know it is Friday.

By Request: Repeat U.S. Population by Age and Distribution, 1900 through 2060

by Calculated Risk on 2/13/2015 02:34:00 PM

Repeat: Here are animations of the U.S population by age and distribution, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

Also - by request - I've slowed the animation down to 2 seconds per slide (and included a slower distribution animation below).

Note: For distribution, here are the same graphs using a slider (the user can look at individual slides).

There are many interesting points - the Depression baby bust, the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more. What jumps out at me are the improvements in health care. And also that the largest cohorts will all soon be under 40. Heck, in the last frame (2060), any remaining Boomers will be in those small (but growing) 95 to 99, and 100+ cohorts.

Animation updates every two seconds.

Notes: Population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

The second graph is by distribution (updates every 2 seconds).

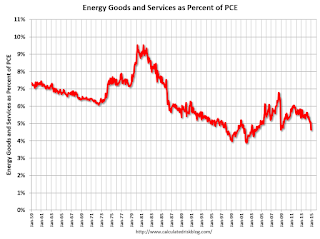

Energy expenditures as a percentage of consumer spending

by Calculated Risk on 2/13/2015 11:14:00 AM

Here is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through December 2014.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

With the recent decline in energy prices, this ratio has declined sharply. Hopefully energy prices are resuming their long term down trend as a percent of PCE.

Preliminary February Consumer Sentiment decreases to 93.6

by Calculated Risk on 2/13/2015 10:04:00 AM