by Calculated Risk on 2/13/2015 06:55:00 PM

Friday, February 13, 2015

Bank Failure #3 in 2015: Capitol City Bank & Trust Company, Atlanta, Georgia

Another bank failure in Georgia ...

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of Capitol City Bank & Trust Company, Atlanta, Georgia

As of December 31, 2014, Capitol City Bank & Trust Company had approximately $272.3 million in total assets and $262.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $88.9 million. ... Capitol City Bank & Trust Company is the third FDIC-insured institution in the nation to fail this year, and the first in Georgia. The last FDIC-insured institution closed in the state was Eastside Commercial Bank, Conyers, on July 18, 2014.At least we know it is Friday.

By Request: Repeat U.S. Population by Age and Distribution, 1900 through 2060

by Calculated Risk on 2/13/2015 02:34:00 PM

Repeat: Here are animations of the U.S population by age and distribution, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

Also - by request - I've slowed the animation down to 2 seconds per slide (and included a slower distribution animation below).

Note: For distribution, here are the same graphs using a slider (the user can look at individual slides).

There are many interesting points - the Depression baby bust, the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more. What jumps out at me are the improvements in health care. And also that the largest cohorts will all soon be under 40. Heck, in the last frame (2060), any remaining Boomers will be in those small (but growing) 95 to 99, and 100+ cohorts.

Animation updates every two seconds.

Notes: Population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

The second graph is by distribution (updates every 2 seconds).

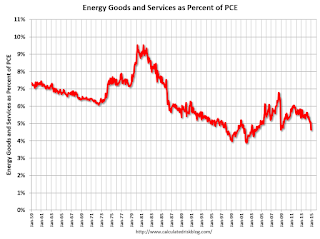

Energy expenditures as a percentage of consumer spending

by Calculated Risk on 2/13/2015 11:14:00 AM

Here is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through December 2014.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

With the recent decline in energy prices, this ratio has declined sharply. Hopefully energy prices are resuming their long term down trend as a percent of PCE.

Preliminary February Consumer Sentiment decreases to 93.6

by Calculated Risk on 2/13/2015 10:04:00 AM

Thursday, February 12, 2015

Report: Foreclosures Increase in January, "Clearing the deck"

by Calculated Risk on 2/12/2015 07:14:00 PM

Note: Data from other sources suggest most of the loans on these properties were originated almost a decade ago. Still "clearing the deck" after the storm.

From RealtyTrac: U.S. Foreclosure Activity Increases 5 Percent in January Driven By 15-Month High in Bank Repossessions

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for January 2015, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 119,888 U.S. properties in January, an increase of 5 percent from the previous month but still down 4 percent from a year ago.Friday:

The 5 percent monthly increase was driven primarily by a 55 percent monthly jump in bank repossessions (REOs) to a 15-month high. A total of 37,292 U.S. properties were repossessed by lenders in January, up 23 percent from a year ago to the highest monthly total since October 2013.

...

“Due to our ponderous judicial system, most of the options have been exhausted, and the judges are now expediting the process,” said Mike Pappas, CEO and president of the Keyes Company, covering the South Florida market. “The banks recognize the opportunity in this improving market and are aggressively trying to remove these properties from their balance sheets. It is encouraging, after seven years, to see the end near on this dramatic cycle.”

...

“Our agents’ REO and distress business has wound considerably down over the last two years,” said Mark Hughes, Chief Operating Officer at First Team Real Estate, covering the Southern California market. “Despite a bit of an extension to this wind-down process due to delayed actions created by the Homeowner Bill of Rights in 2013, we are preparing that this is really a final push to clear the decks of the a still disproportionate amount of distressed homes and finally bring the market back to a more stability.”

emphasis added

• At 10:00 AM ET, University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 98.5, up from 98.1 in January.