by Calculated Risk on 2/13/2015 10:04:00 AM

Friday, February 13, 2015

Preliminary February Consumer Sentiment decreases to 93.6

Thursday, February 12, 2015

Report: Foreclosures Increase in January, "Clearing the deck"

by Calculated Risk on 2/12/2015 07:14:00 PM

Note: Data from other sources suggest most of the loans on these properties were originated almost a decade ago. Still "clearing the deck" after the storm.

From RealtyTrac: U.S. Foreclosure Activity Increases 5 Percent in January Driven By 15-Month High in Bank Repossessions

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for January 2015, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 119,888 U.S. properties in January, an increase of 5 percent from the previous month but still down 4 percent from a year ago.Friday:

The 5 percent monthly increase was driven primarily by a 55 percent monthly jump in bank repossessions (REOs) to a 15-month high. A total of 37,292 U.S. properties were repossessed by lenders in January, up 23 percent from a year ago to the highest monthly total since October 2013.

...

“Due to our ponderous judicial system, most of the options have been exhausted, and the judges are now expediting the process,” said Mike Pappas, CEO and president of the Keyes Company, covering the South Florida market. “The banks recognize the opportunity in this improving market and are aggressively trying to remove these properties from their balance sheets. It is encouraging, after seven years, to see the end near on this dramatic cycle.”

...

“Our agents’ REO and distress business has wound considerably down over the last two years,” said Mark Hughes, Chief Operating Officer at First Team Real Estate, covering the Southern California market. “Despite a bit of an extension to this wind-down process due to delayed actions created by the Homeowner Bill of Rights in 2013, we are preparing that this is really a final push to clear the decks of the a still disproportionate amount of distressed homes and finally bring the market back to a more stability.”

emphasis added

• At 10:00 AM ET, University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 98.5, up from 98.1 in January.

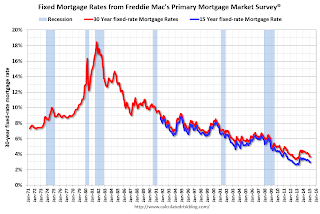

Freddie Mac: 30 Year Mortgage Rates increase to 3.69% in Latest Weekly Survey

by Calculated Risk on 2/12/2015 02:10:00 PM

From Freddie Mac today: Mortgage Rates Move Higher on Strong Jobs Report

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher amid a strong employment report. Regardless, fixed-rate mortgages rates still remain near their May 23, 2013 lows. ...

30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending February 12, 2015, up from last week when it averaged 3.59 percent. A year ago at this time, the 30-year FRM averaged 4.28 percent.

15-year FRM this week averaged 2.99 percent with an average 0.6 point, up from last week when it averaged 2.92 percent. A year ago at this time, the 15-year FRM averaged 3.33 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (34 bps) from the all time low of 3.35% in late 2012, but down from 4.28% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Hotels: Solid Start to 2015

by Calculated Risk on 2/12/2015 11:12:00 AM

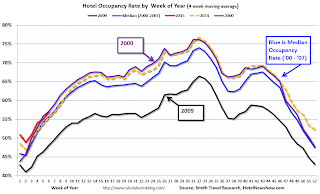

From HotelNewsNow.com: US hotel results for week ending 7 February

The U.S. hotel industry recorded positive results in the three key performance metrics during the week of 1-7 February 2015, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 1.9 percent to 57.5 percent. Average daily rate increased 3.5 percent to finish the week at US$113.55. Revenue per available room for the week was up 5.5 percent to finish at US$65.32.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the slow period of the year, but business travel will pick up soon.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above 2014.

So far 2015 is at about the same level as 2000 (best year for hotels) - and 2015 will probably be the best year ever for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

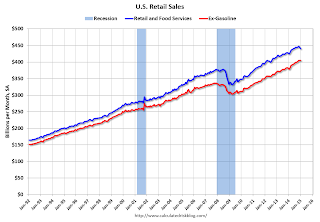

Retail Sales decreased 0.8% in January

by Calculated Risk on 2/12/2015 08:40:00 AM

On a monthly basis, retail sales decreased 0.8% from December to January (seasonally adjusted), and sales were up 3.3% from January 2014. Sales in December were unrevised at a 0.9% decrease.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $439.8 billion, a decrease of 0.8 percent from the previous month, but up 3.3 percent above January 2014. ... The November to December 2014 percent change was unrevised from -0.9 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline increased slightly.

Retail sales ex-autos decreased 0.9%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 6.9% on a YoY basis (3.3% for all retail sales).

Retail and Food service sales ex-gasoline increased by 6.9% on a YoY basis (3.3% for all retail sales).The decrease in January was below consensus expectations of a 0.5% decrease. Sales for both November and December were revised up slightly.

Although weaker than expected, after removing the impact of lower gasoline prices, this was an OK report.