by Calculated Risk on 2/12/2015 02:10:00 PM

Thursday, February 12, 2015

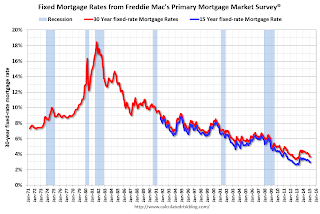

Freddie Mac: 30 Year Mortgage Rates increase to 3.69% in Latest Weekly Survey

From Freddie Mac today: Mortgage Rates Move Higher on Strong Jobs Report

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher amid a strong employment report. Regardless, fixed-rate mortgages rates still remain near their May 23, 2013 lows. ...

30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending February 12, 2015, up from last week when it averaged 3.59 percent. A year ago at this time, the 30-year FRM averaged 4.28 percent.

15-year FRM this week averaged 2.99 percent with an average 0.6 point, up from last week when it averaged 2.92 percent. A year ago at this time, the 15-year FRM averaged 3.33 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (34 bps) from the all time low of 3.35% in late 2012, but down from 4.28% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Hotels: Solid Start to 2015

by Calculated Risk on 2/12/2015 11:12:00 AM

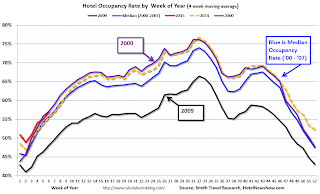

From HotelNewsNow.com: US hotel results for week ending 7 February

The U.S. hotel industry recorded positive results in the three key performance metrics during the week of 1-7 February 2015, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 1.9 percent to 57.5 percent. Average daily rate increased 3.5 percent to finish the week at US$113.55. Revenue per available room for the week was up 5.5 percent to finish at US$65.32.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the slow period of the year, but business travel will pick up soon.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above 2014.

So far 2015 is at about the same level as 2000 (best year for hotels) - and 2015 will probably be the best year ever for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Retail Sales decreased 0.8% in January

by Calculated Risk on 2/12/2015 08:40:00 AM

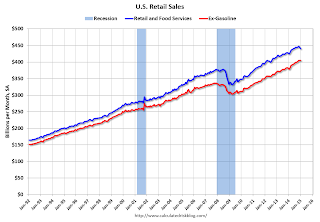

On a monthly basis, retail sales decreased 0.8% from December to January (seasonally adjusted), and sales were up 3.3% from January 2014. Sales in December were unrevised at a 0.9% decrease.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $439.8 billion, a decrease of 0.8 percent from the previous month, but up 3.3 percent above January 2014. ... The November to December 2014 percent change was unrevised from -0.9 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline increased slightly.

Retail sales ex-autos decreased 0.9%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 6.9% on a YoY basis (3.3% for all retail sales).

Retail and Food service sales ex-gasoline increased by 6.9% on a YoY basis (3.3% for all retail sales).The decrease in January was below consensus expectations of a 0.5% decrease. Sales for both November and December were revised up slightly.

Although weaker than expected, after removing the impact of lower gasoline prices, this was an OK report.

Weekly Initial Unemployment Claims increased to 304,000

by Calculated Risk on 2/12/2015 08:30:00 AM

The DOL reported:

In the week ending February 7, the advance figure for seasonally adjusted initial claims was 304,000, an increase of 25,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 278,000 to 279,000. The 4-week moving average was 289,750, a decrease of 3,250 from the previous week's revised average. The previous week's average was revised up by 250 from 292,750 to 293,000.The previous week was revised up to 279,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 289,750.

This was above the consensus forecast of 285,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, February 11, 2015

Thursday: Retail Sales, Unemployment Claims

by Calculated Risk on 2/11/2015 06:55:00 PM

From Reuters: Euro zone, Greece fail to agree way forward following meeting

We explored a number of issues, one of which was the current program," Jeroen Dijsselbloem, who chaired the meeting, told a news conference in the early hours on Thursday in Brussels.Quote of the day:

"We discussed the possibility of an extension. For some that is clear that is preferred option but we haven't come to that conclusion as yet. We will need a little more time."

“We are not negotiating the bailout; it was cancelled by its own failure.” Greek Prime Minister Alexis TsiprasEarlier I posted some of the details of the failed agreement: Did Austerity in Greece Deliver?

Greece delivered on a primary surplus, but the details on unemployment and GDP show the "program" was the wrong policy. Time to change the policy!

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 278 thousand.

• Also at 8:30 AM, Retail sales for January will be released. The consensus is for retail sales to decrease 0.5% in January, and to decrease 0.5% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.2% increase in inventories.