by Calculated Risk on 2/11/2015 10:35:00 AM

Wednesday, February 11, 2015

Opinion: Did Germany Fulfill their Promises? Did Austerity in Greece Deliver?

Back in 2010, Greece agreed to a number of austerity measures. In general, Greece met their obligations and is currently running a primary surplus.

Greece was told by the IMF, the Germans, and other that this would turn the Greek economy around. Greece clearly needed some austerity, however many of us argued austerity alone would be a disaster for Greece, and for Europe in general.

Below are the forecasts for Greece (IMF) and the actual results (Eurostat).

Clearly austerity alone failed. Sadly European officials like German Finance minister Wolfgang Schauble have not changed their views and apologized to the Greeks.

Here is an actual quote from Schauble in 2013:

"Nobody in Europe sees this contradiction between fiscal policy consolidation and growth,” Schauble said. “We have a growth-friendly process of consolidation, and we have sustainable growth, however you want to word it.”A "growth friendly process"? "Sustainable growth"? Nonsense.

Obviously there is a contradiction between "fiscal policy consolidation and growth". And not everyone is blind to the obvious - some people in Europe see the obvious contradiction (just look at the data for Europe as a whole and Greece in particular).

It is time to stop blaming Greece (they mostly did what they were told), and start blaming the Germans and others for pushing the wrong policies. And give Greece a little relief.

| Greece: Annual GDP, Forecast and Actual1 | ||

|---|---|---|

| Year | Promised | Actual |

| 2009 | -2 | -4.4 |

| 2010 | -4 | -5.4 |

| 2011 | -2.6 | -8.9 |

| 2012 | 1.1 | -6.6 |

| 2013 | 2.1 | -3.9 |

| 2014 | 2.1 | |

| 2015 | 2.7 | |

| 1IMF Forecasts and Eurostat Actual | ||

| Greece: Annual Unemployment Rate, Forecast and Actual1 | ||

|---|---|---|

| Year | Promised | Actual |

| 2009 | 9.4 | 9.6 |

| 2010 | 11.8 | 12.7 |

| 2011 | 14.6 | 17.9 |

| 2012 | 14.8 | 24.5 |

| 2013 | 14.3 | 27.5 |

| 2014 | 14.1 | 26.82 |

| 2015 | 13.4 | |

| 1IMF Forecasts and Eurostat Actual 22014 is Q1, Q2, Q3 average | ||

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 2/11/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 6, 2015. ...

The Refinance Index decreased 10 percent from the previous week. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.84 percent, the highest level since January 9, 2015, from 3.79 percent, with points increasing to 0.31 from 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It looks like 2015 will see more refinance activity than in 2014, especially from FHA loans!

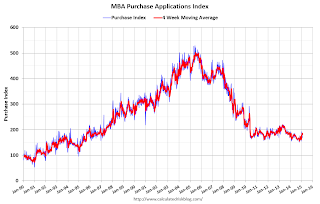

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the purchase index is up 1% from a year ago.

Tuesday, February 10, 2015

FNC: Residential Property Values increased 5.0% year-over-year in December

by Calculated Risk on 2/10/2015 05:21:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their December index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased slightly from November to December (Composite 100 index, not seasonally adjusted).

The 10 city MSA RPI declined in December, and the 20-MSA and 30-MSA RPIs increased . These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was lower in December than in November, with the 100-MSA composite up 5.0% compared to December 2013. In general, for FNC, the YoY increase has been slowing since peaking in March at 9.0%.

The index is still down 19.6% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through December 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the price indexes have been showing a slowdown in price increases.

The December Case-Shiller index will be released on Tuesday, February 24th, and I expect Case-Shiller to show a further slowdown in YoY price increases.

Las Vegas Real Estate in January: Sales Decline, Non-contingent Inventory up 13% YoY

by Calculated Risk on 2/10/2015 02:24:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices up 8 percent for year

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in January 2015 was 2,239, down from 2,734 in December 2014 and down from 2,565 one year ago. At the current sales pace, Lynam said Southern Nevada continues to have roughly a four-month supply of available homes. REALTORS® consider a six-month supply to be a balanced market.There are several key trends that we've been following:

...

GLVAR has been tracking a two-year trend of fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In January, 9.7 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 10 percent in December and 17 percent a year ago. Another 9.4 percent of January sales were bank-owned, up from 8 percent in December, but down from 11 percent last year.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in January was 12,666, up 2.3 percent from 12,377 in December, but down 6.4 percent from one year ago. GLVAR tracked a total of 3,429 condos, high-rise condos and townhomes listed for sale on its MLS in January, up 4.5 percent from 3,282 in December and up 15.1 percent from January 2014.

By the end of January, GLVAR reported 7,382 single-family homes listed without any sort of offer. That’s down 5.0 percent from 7,774 such homes listed in December, but up 12.9 percent from one year ago. For condos and townhomes, the 2,327 properties listed without offers in January represented a 0.8 percent increase from 2,309 such properties listed in December and a 35.9 percent increase from one year ago.

emphasis added

1) Overall sales were down 12.7% year-over-year.

2) However conventional (equity, not distressed) sales were only down about 2% year-over-year. In January 2014, only 72.0% of all sales were conventional equity. In January 2015, 80.9% were standard equity sales. Note: In January 2013 (two years ago), only 51.3% were equity! A significant change.

3) The percent of cash sales has declined year-over-year from 46.8% in January 2014 to 36.0% in January 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 12.9% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing (an important change in many areas).

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

Trulia: Asking House Prices up 7.5% year-over-year in January

by Calculated Risk on 2/10/2015 11:58:00 AM

From Trulia chief economist Jed Kolko: For Home Prices, The Rebound Effect Is Over. Long Live Job Growth

Nationwide, asking prices on for-sale homes climbed 0.5% month-over-month in January, seasonally adjusted — the smallest monthly gain since August. Year-over-year, asking prices rose 7.5%, down from the 9.3% year-over-year increase in January 2014. Asking prices increased year-over-year in 94 of the 100 largest U.S. metros.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and although year-over-year price increases had been slowing, the year-over-year change increased in January compared to December.

The biggest home price increases are not necessarily in markets that had more severe housing busts. But the metros where home prices are now rising fastest are, almost without exception, the ones with faster job growth. Why? A growing economy fuels housing demand. Among the 10 metros with the biggest year-over-year price increases, nine had at least 2% year-over-year job growth. ...

Nationwide, rents rose 6.5% year-over-year in January. The three large rental markets with the steepest rent increases – Denver, Oakland, and San Francisco – all have had job growth of 2% or more. In general, metros with faster job growth have larger rent increases, though some Sunbelt markets like Riverside-San Bernardino, Houston, and San Diego have had impressive job growth with more limited rent increases.

emphasis added

The month-to-month increase suggests further house price increases over the next few months on a seasonally adjusted basis.

There is much more in the article.