by Calculated Risk on 2/06/2015 11:00:00 AM

Friday, February 06, 2015

Employment Report Comments and Graphs

Earlier: January Employment Report: 257,000 Jobs, 5.7% Unemployment Rate

This was a very solid employment report with 257,000 jobs added, and job gains for November and December were revised up significantly.

There was even a little good news on wage growth, from the BLS: "In January, average hourly earnings for all employees on private nonfarm payrolls increased by 12 cents to $24.75, following a decrease of 5 cents in December. Over the year, average hourly earnings have risen by 2.2 percent."

Hopefully wages will be a positive 2015 story!

A few more numbers: Total employment increased 257,000 from December to January and is now 2.5 million above the previous peak. Total employment is up 11.2 million from the employment recession low.

Private payroll employment increased 267,000 from December to January, and private employment is now 3.0 million above the previous peak. Private employment is up 11.8 million from the recession low.

In January, the year-over-year change was 3.21 million jobs. This was the highest year-over-year gain since the '90s.

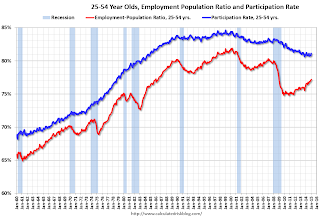

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in January to 81.1%, and the 25 to 54 employment population ratio increased to 77.2%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth has been running close to 2% since 2010 and might be picking up a little.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged in January at 6.8 million.The number of persons working part time for economic reasons increased slightly in January to 6.810 million from 6.790 million in December. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that increased to 11.3% in January from 11.2% in December.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.800 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 2.785 in December. This is trending down, but is still very high.

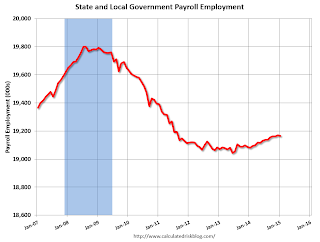

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In January 2014, state and local governments lost 4,000 jobs. State and local government employment is now up 123,000 from the bottom, but still 635,000 below the peak.

State and local employment is now generally increasing. And Federal government layoffs have slowed, but are ongoing (Federal payrolls decreased by 6 thousand in January).

Overall this was a very solid employment report.

January Employment Report: 257,000 Jobs, 5.7% Unemployment Rate

by Calculated Risk on 2/06/2015 08:48:00 AM

From the BLS:

Total nonfarm payroll employment rose by 257,000 in January, and the unemployment rate was little changed at 5.7 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in retail trade, construction, health care, financial activities, and manufacturing.

...

The change in total nonfarm payroll employment for November was revised from +353,000 to +423,000, and the change for December was revised from +252,000 to +329,000. With these revisions, employment gains in November and December were 147,000 higher than previously reported. Monthly revisions result from additional reports received from businesses since the last published estimates and the monthly recalculation of seasonal factors. The annual benchmark process also contributed to these revisions.

...

[Benchmark revision] The total nonfarm employment level for March 2014 was revised upward by 91,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 257 thousand in January (private payrolls increased 267 thousand).

Payrolls for November and December were revised up by a combined 147 thousand, putting November over 400 thousand!

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In January, the year-over-year change was 3.21 million jobs.

This was the highest year-over-year gain since the '90s.

And improved earnings: "In January, average hourly earnings for all employees on private nonfarm payrolls increased by 12 cents to $24.75, following a decrease of 5 cents in December. Over the year, average hourly earnings have risen by 2.2 percent."

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate increased in January to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was increased to 59.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

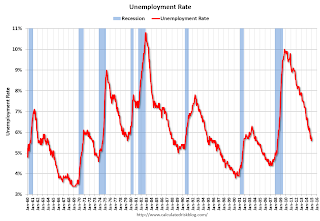

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in January to 5.7%.

This was above expectations of 230,000, and with the upward revisions to prior months, this was another strong report.

I'll have much more later ...

Thursday, February 05, 2015

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 2/05/2015 08:39:00 PM

Here was an employment preview I posted earlier: Preview for January Employment Report: Taking the Under

Friday:

• At 8:30 AM ET, the Employment Report for January. The consensus is for an increase of 230,000 non-farm payroll jobs added in January, down from the 252,000 non-farm payroll jobs added in December. The consensus is for the unemployment rate to be unchanged at 5.6% in January from 5.6% the previous month.

Notes: The annual benchmark revision will be released with the January report. The preliminary estimate was an additional 7,000 jobs as of March 2014.

Also, the new population controls will be used in the Current Population Survey (CPS) estimation process. It is important to note that "household survey data for January 2015 will not be directly comparable with data for December 2014 or earlier periods".

• At 3:00 PM, Consumer Credit for December from the Federal Reserve. The consensus is for credit to increase $15.0 billion.

Duy: Fed Updates

by Calculated Risk on 2/05/2015 05:17:00 PM

Tim Duy provides a number of thoughts, and I'd like to highlight one: Fed Updates

3.) Fed ready to lower NAIRU? I have argued in the past that if the Fed is faced with ongoing slow wage growth, they would need to reassess their estimates of NAIRU. Cardiff Garcia reminded me:There is much more in Duy's post.

@TheStalwart @TimDuy Whether/extent to which Fed reverts nat-rate estimates to pre-2010 range is one of 2015's big Qs pic.twitter.com/CKieHx2zRCWhile David Wessel adds today:

— Cardiff Garcia (@CardiffGarcia) February 4, 2015

JPMorgan run the Fed's statistical model of the economy and says the NAIRU (which was 5.6%+ through 2013 data) is now down to 5%.Jim O'Sullivan from High Frequency Economics says not yet:

— David Wessel (@davidmwessel) February 5, 2015

"Hard-to-fill" @NFIB jobs series up to 26 in Jan (+1). Corroborates unempl decline, with no sign of lower #NAIRU pic.twitter.com/DVYGyGV4e6A reduction in the Fed's estimate of the natural rate of unemployment would likely mean a delayed and more gradual path of policy tightening, should of course the Fed ever get the chance to pull off the zero bound. Keep an eye on this issue!

— Jim O'Sullivan (@osullivanEcon) February 5, 2015

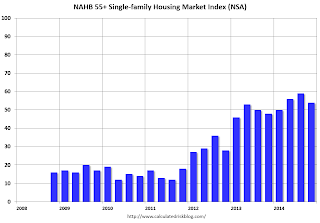

NAHB: Builder Confidence improves Year-over-year for the 55+ Housing Market in Q4

by Calculated Risk on 2/05/2015 02:20:00 PM

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low. Note that this index is Not Seasonally Adjusted (NSA) and usually dips in Q4 compared to Q3 (just seasonal).

From the NAHB: Builder Confidence in the 55+ Housing Market Ends Fourth Quarter on a Record High

The fourth quarter results of the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today show that builders are feeling quite positive about the market. All segments of the market—single-family homes, condominiums and multifamily rental—registered increases compared to the same quarter a year ago. The single-family index increased six points to a level of 54, which is the highest fourth-quarter reading since the inception of the index in 2008 and the 13th consecutive quarter of year over year improvements.

...

All components of the 55+ single-family HMI posted increases from a year ago: present sales increased five points to 58, expected sales for the next six months rose two points to 64 and traffic of prospective buyers increased six points to 39.

“The strength of the 55+ segment of the housing industry has been fueled in part by rising home values,” said NAHB Chief Economist David Crowe. “Older home owners are finding it easier to sell their existing homes at a favorable price, allowing them to rent or buy a new home in a 55+ community.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q4 2014. The index increased in Q4 to 54 from 48 in Q4 2013. This indicates that more builders view conditions as good than as poor.

There are two key drivers in addition to the improved economy: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.