by Calculated Risk on 1/21/2015 07:00:00 AM

Wednesday, January 21, 2015

MBA: "Mortgage Applications Increase in Latest MBA Weekly Survey"

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 14.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 16, 2015. ...

The Refinance Index increased 22 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier.

...

“Mortgage application volume increased last week to its highest level since June 2013, led by a 22 percent increase in refinance application volume. This increase was largely due to mortgage rates dropping to their lowest level since May 2013. However, the recent reduction in FHA mortgage insurance premiums also played a role: FHA refinance applications increased 57 percent last week. Even with this increase, refinances made up only 48 percent of FHA volume, compared to 73 percent for VA, and 77 percent for conventional loans,” said Mike Fratantoni, MBA’s Chief Economist.

“Conventional purchase applications were down about 3 percent for the week on a seasonally adjusted basis, but up 5 percent relative to last year at this time. FHA purchase applications were down 1 percent for the week on a seasonally adjusted basis.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.80 percent, the lowest level since May 2013, from 3.89 percent, with points increasing to 0.29 from 0.23 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It looks like 2015 will see more refinance activity than in 2014, especially from FHA loans!

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the purchase index is up 5% from a year ago.

Tuesday, January 20, 2015

Wednesday: Housing Starts

by Calculated Risk on 1/20/2015 07:38:00 PM

From Mortgage News Daily: Mortgage Rates Mixed to Begin Volatile Week

Mortgage rates were truly mixed today, with some lenders improving while others moved higher. More than a few were unchanged or close to it. All this despite the fact that broader interest rate benchmarks like 10yr US Treasuries were unequivocally in stronger territory.Wednesday:

...

The net effect of this mixed underperformance is that the most prevalent conforming, 30yr fixed rate quote remains 3.625%.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for December. Total housing starts were at 1.028 million (SAAR) in November. Single family starts were at 677 thousand SAAR in November. The consensus is for total housing starts to increase to 1.040 million (SAAR) in December.

• During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

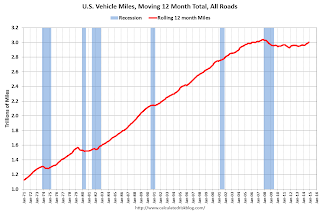

DOT: Vehicle Miles Driven increased 1.1% year-over-year in November, Nearing All Time High

by Calculated Risk on 1/20/2015 02:57:00 PM

With lower gasoline prices, vehicle miles driven might reach a new peak in 2015.

The Department of Transportation (DOT) reported:

◦Travel on all roads and streets changed by 1.1% (2.5 billion vehicle miles) for November 2014 as compared with November 2013.The following graph shows the rolling 12 month total vehicle miles driven.

◦Travel for the month is estimated to be 241.0 billion vehicle miles.

◦Cumulative Travel for 2014 changed by 1.4% (38.2 billion vehicle miles).

The rolling 12 month total is slowly moving up, after moving sideways for a few years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 84 months - 7 years - and still counting. Currently miles driven (rolling 12 months) are about 1.2% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In November 2014, gasoline averaged of $3.00 per gallon according to the EIA. That was down from November 2013 when prices averaged $3.32 per gallon.

In November 2014, gasoline averaged of $3.00 per gallon according to the EIA. That was down from November 2013 when prices averaged $3.32 per gallon. Prices will really be down year-over-year in December and January!.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 7 years is probably also due to the lingering effects of the great recession (lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

Even with all these factors, it is now possible that a new peak in miles driven could happen in 2015.

ATA Trucking Index unchanged in December, Up Solidly Year-over-year

by Calculated Risk on 1/20/2015 12:15:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Unchanged in December, Up 3.5% for 2014

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index was unchanged in December, following a jump of 3.5% during the previous month. In December, the index equaled 136.8 (2000=100), which tied November as the all-time high.

Compared with December 2013, the SA index increased 5.2%, which was the largest year-over-year gain in 2014. For the entire year, tonnage was up 3.5%. ...

“Economic data was mixed in December, with retail sales down 0.9% and factory output up 0.3%, so tonnage was in-between those two readings, which are two large drivers of truck freight,” said ATA Chief Economist Bob Costello. “Overall, 2014 was a good year for truck tonnage with significant gains throughout the year after falling 4.5% in January alone.”

Costello said that in December, tonnage was 10.2% above January.

“Freight volumes look good going into 2015,” Costello said. “Expect an acceleration in consumer spending and factory output to offset the weakness in hydraulic fracking this year.”

Trucking serves as a barometer of the U.S. economy, representing 69.1% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.7 billion tons of freight in 2013. Motor carriers collected $681.7 billion, or 81.2% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 5.2% year-over-year and finished the year strong.

NAHB: Builder Confidence decreased to 57 in January

by Calculated Risk on 1/20/2015 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 57 in January, down from an upwardly revised 58 in December (revised up from 57). Any number above 50 indicates that more builders view sales conditions as good than poor.

From Reuters: U.S. homebuilder sentiment edges lower in January -NAHB

The NAHB/Wells Fargo Housing Market index fell to 57 from a revised 58 in December, the group said in a statement. ... The index has not been below 50 since June 2014.

"After seven months above the key 50 benchmark, builder sentiment is reflecting the gradual improvement that is occurring in many markets throughout the nation," said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del.

The single-family home sales component was flat at 62. The gauge of single-family sales expectations for the next six months fell to 60 from 64, while the index of prospective buyer traffic fell to 44 from 46.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 58.