by Calculated Risk on 1/12/2015 10:28:00 AM

Monday, January 12, 2015

FNC: Residential Property Values increased 5.2% year-over-year in November

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their November index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values decreased slightly from October to November (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) also decreased slightly in November. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was lower in November than in October, with the 100-MSA composite up 5.2% compared to November 2013. In general, for FNC, the YoY increase has been slowing since peaking in March at 9.0%.

The index is still down 19.7% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through November 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the price indexes have been showing a slowdown in price increases.

The November Case-Shiller index will be released on Tuesday, January 27th, and I expect Case-Shiller to show a further slowdown in YoY price increases.

Black Knight Mortgage Monitor: Delinquencies "Spike" in November

by Calculated Risk on 1/12/2015 08:11:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for November today. According to BKFS, 6.08% of mortgages were delinquent in November, up from 5.44% in October. BKFS reported that 1.63% of mortgages were in the foreclosure process, down from 2.50% in November 2013.

This gives a total of 7.71% delinquent or in foreclosure. It breaks down as:

• 1,925,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,163,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 829,000 loans in foreclosure process.

For a total of 3,917,000 loans delinquent or in foreclosure in November. This is down from 4,497,000 in November 2013.

Black Knight had several comments on the "spike" in delinquencies in November:

• November’s spike in delinquencies was the largest month-over month increase (for any month) since November 2008If this was just seasonal (and calendar related), then delinquencies should decline solidly in December.

• Much of the increase seems to have been calendar-driven; two federal holidays (Veterans Day and Thanksgiving) and the last two days of the month being a weekend resulted in just 18 possible payment processing days

• The five largest M/M delinquency rate increases over the last 7 years have all occurred in months ending on a Sunday

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the number of loans rolling to a more delinquent status. There was a big spike from current to 30 days delinquent, and that should reverse if seasonal.

From Black Knight:

• Increased roll-rates were seen across all early stage delinquency categories (i.e., loans rolling from current status to 30-days delinquent, 30 to 60 days delinquent, etc.)There is much more in the mortgage monitor.

• November saw the highest one month count of loans rolling from current to 30-days delinquent since June 2013

• While early stage delinquent categories saw increased roll-rates, rolls from delinquent to foreclosure status were still down

Sunday, January 11, 2015

Sunday Night Futures

by Calculated Risk on 1/11/2015 08:40:00 PM

Professor Hamilton estimates almost half the decline in oil prices are due to demand factors: Demand factors in the collapse of oil prices

[O]f the $55 drop in the price of oil since the start of July, about $24, or 44%, seems attributable to broader demand factors rather than anything specific happening to the oil market. That’s almost the same percentage as when I performed the calculation using data that we had available a month ago.Its important to remember that both the supply and demand curves for oil are very steep, so small changes in either supply or demand can cause large changes in price.

So what’s been happening on the supply side of oil markets is important. But so is what’s been happening on the demand side.

Monday:

• At 10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of January 11, 2015

• Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 4 and DOW futures are down 25 (fair value).

Oil prices were down over the last week with WTI futures at $47.69 per barrel and Brent at $49.58 per barrel. A year ago, WTI was at $93, and Brent was at $107 - so prices are down 49% and 54% year-over-year respectively.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.13 per gallon (down about $1.13 per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

WSJ: Banks Stress Test for Grexit

by Calculated Risk on 1/11/2015 10:41:00 AM

The European policy makers have dragged their feet (especially the Germans), and Grexit is back in the news.

From the WSJ: Banks Ready Contingency Plans in Case of Greek Eurozone Exit

Banks and other financial institutions in Europe are stress-testing their internal systems and dusting off two-year-old contingency plans for the possibility Greece could leave the region’s monetary union after a key election later this month.And from Business Insider: Here's What A 'Grexit' Would Cost Europe

Among the firms running through drills are Citigroup Inc., Goldman Sachs Group Inc. and brokerage ICAP PLC, according to people familiar with the matter.

The firms’ plans include detailed checks on counterparties that could be significantly affected by a Greek exit, looking at credit exposures and testing how they would provide cross-border funding to local operations.

A snap election in Greece on January 25 could bring to power the far-left Syriza party, which wants to abandon the austerity policy imposed by the EU and IMF as part of the country's 240-billion-euro ($282 billion) international bailout.

The market selloff was triggered by media reports indicating that if a new government in Athens reversed course, Germany was ready to let Greece leave the European club of common currency users.

Most analysts doubt it would come to that, but if it did Athens would be hard pressed to repay its bailout loans and would likely default.

Saturday, January 10, 2015

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 1/10/2015 06:13:00 PM

By request, here is an update on an earlier post through the December employment report.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -841 |

| GW Bush 2 | 379 |

| Obama 1 | 1,998 |

| Obama 2 | 5,0071 |

| 123 months into 2nd term: 10,449 pace. | |

1Currently Obama's 2nd term is on pace to be the 2nd best ever - only trailing Clinton's 1st term.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Twenty three months into Mr. Obama's second term, there are now 7,005,000 more private sector jobs than when he initially took office.

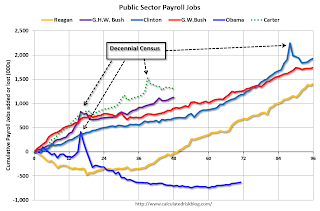

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 634,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -713 |

| Obama 2 | 791 |

| 122 months into 2nd term, 165 pace | |

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

For the public sector, the cutbacks are clearly over at the state and local levels, and it appears cutbacks at the Federal level have slowed. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.