by Calculated Risk on 1/09/2015 08:30:00 AM

Friday, January 09, 2015

December Employment Report: 252,000 Jobs, 5.6% Unemployment Rate

From the BLS:

Total nonfarm payroll employment rose by 252,000 in December, and the unemployment rate declined to 5.6 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, construction, food services and drinking places, health care, and manufacturing.

...

The change in total nonfarm payroll employment for October was revised from +243,000 to +261,000, and the change for November was revised from +321,000 to +353,000. With these revisions, employment gains in October and November were 50,000 higher than previously reported.

Click on graph for larger image.

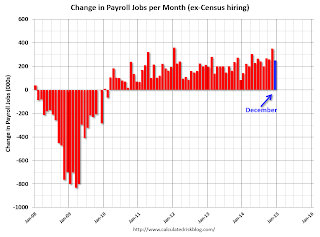

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Eleven consecutive months over 200 thousand.

Employment is now up 2.952 million year-over-year.

Here is a table of the annual change in total nonfarm, private and public sector payrolls jobs since 1997. For total employment, 2014 was the best year since 1999.

For private employment, 2014 was the best year since 1997.

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,408 | 3,213 | 195 |

| 1998 | 3,003 | 2,734 | 313 |

| 1999 | 3,177 | 2,716 | 461 |

| 2000 | 1,946 | 1,682 | 264 |

| 2001 | -1,735 | -2,286 | 551 |

| 2002 | -508 | -741 | 233 |

| 2003 | 105 | 147 | -42 |

| 2004 | 2,033 | 1,886 | 147 |

| 2005 | 2,506 | 2,320 | 186 |

| 2006 | 2,085 | 1,876 | 209 |

| 2007 | 1,140 | 852 | 288 |

| 2008 | -3,576 | -3,756 | 180 |

| 2009 | -5,087 | -5,013 | -74 |

| 2010 | 1,058 | 1,277 | -219 |

| 2011 | 2,083 | 2,400 | -317 |

| 2012 | 2,236 | 2,294 | -58 |

| 2013 | 2,331 | 2,365 | -34 |

| 2014 | 2,952 | 2,861 | 91 |

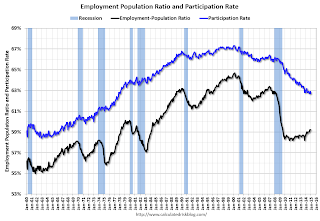

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate declined in December to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.2% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate declined in December to 5,6%.

This was above expectations of 245,000, and with the upward revisions to prior months, this was another strong report.

I'll have much more later ...

Thursday, January 08, 2015

Friday: Jobs

by Calculated Risk on 1/08/2015 07:49:00 PM

First an important point from Tim Duy: Volatile Week Ahead of Employment Report

I tend agree that the net impact [from the decline in oil prices] will be positive, but note that the negative impacts will be fairly concentrated and easy for the media to sensationalize, while the positive impacts will be fairly dispersed. We all know what is going to happen to rig counts, high-yield energy debt, and the economies of North Dakota and at least parts of Texas. "Kablooey," I think, is the technical term. Easy media fodder. Much more difficult to see the positive impact spread across the real incomes of millions of households, with particularly solid gains at the lower ends of the income distribution. This will be most likely revealed in the aggregate data and be much less newsworthy.We are already seeing stories about layoffs in oil related industries (and suppliers). However, since the US is a large net importer of oil, the overall impact of lower oil prices should be positive for the US economy. The negative stories are newsworthy, but it is worth remembering - as Tim Duy notes - that the positive stories will be hidden in the aggregate data.

emphasis added

Here was an employment preview I posted earlier: Preview: Employment Report for December

Friday:

• At 8:30 AM ET, the Employment Report for December. The consensus is for an increase of 240,000 non-farm payroll jobs added in December, down from the 321,000 non-farm payroll jobs added in November. The consensus is for the unemployment rate to decline to 5.7% in December from 5.8% the previous month.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 0.3% increase in inventories.

Clarification: Current FHA-insured borrowers WILL need to Refinance to obtain lower MIP

by Calculated Risk on 1/08/2015 04:33:00 PM

Just to be clear, current FHA-insured borrowers will need to refinance to obtain the 0.85% annual Mortgage Insurance Premium (MIP).

New borrowers will obtain the lower MIP automatically.

HUD will send out a letter very soon clarifying what this means for borrowers currently in the process of obtaining an FHA-insured loan.

HUD estimates that approximately 100,000 to 200,000 FHA-insured borrowers will refinance in the next year.

FHA Insured Loans: HUD Corrects wording on lower Mortgage Insurance Premium (MIP)

by Calculated Risk on 1/08/2015 03:04:00 PM

Update2: Clarification: Current FHA-insured borrowers WILL need to Refinance to obtain lower MIP

I was thinking there would be a refinance boom for FHA loans. The HUD press release read:

"FHA’s new annual premium prices will take effect for all new FHA-insured mortgages endorsed toward the end of January 2015. FHA will publish a mortgagee letter detailing its new pricing structure shortly."That sounded like people would need to refinance to obtain the lower MIP.

emphasis added

This would be a significant number of borrowers because the annual MIP was increased to 1.15% in April 2011, to 1.25% in April 2012, and to 1.35% in April 2013 (for borrowers with less than 5% down). Looking at the mortgage rates available at those times, it appeared a large number of FHA insured borrowers would consider refinancing now.

However HUD just corrected their press release to read:

"FHA’s new annual premium prices are expected to take effect towards the end of the month. FHA will publish a mortgagee letter detailing its new pricing structure shortly."The "new FHA-insured" was removed. Update: Or this change could mean that loans currently in the process will receive the old MIP, and loans originated after January will receive the new MIP. It is difficult to lower the MIP for current borrowers ...

So I'm expecting an FHA refi boom.

Trulia: "What Falling Oil Prices Mean for Home Prices"

by Calculated Risk on 1/08/2015 01:37:00 PM

From Trulia chief economist Jed Kolko: What Falling Oil Prices Mean for Home Prices

Nationwide, asking prices on for-sale homes were up 0.5% month-over-month in December, seasonally adjusted — a slowdown after larger increases in September, October, and November. Year-over-year, asking prices rose 7.7%, down from the 9.5% year-over-year increase in December 2013. Asking prices increased year-over-year in 97 of the 100 largest U.S. metros.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and although year-over-year price increases had been slowing, the year-over-year change increased in November.

Four of the five markets where asking prices rose most year-over-year are in the South, including Atlanta, Cape Coral-Fort Myers, North Port-Sarasota-Bradenton, and Deltona-Daytona Beach-Ormond Beach. Of the top 10, four are in the Midwest, including Cincinnati, Detroit, Lake-Kenosha Counties, and Indianapolis. Among markets with the largest asking price increases, Houston stands out for having a large local oil industry, accounting for 5.6% of jobs there.

Only Bakersfield and Baton Rouge have an even higher employment share in oil-related industries than Houston. Oklahoma City, Tulsa, New Orleans, and Fort Worth round out the seven large metros where oil-related industries account for at least 2% of employment. It’s not until you look at smaller metros that you find oil-related industries representing a larger employment share. In Williston, ND, and Midland, TX, they account for almost 30% of local jobs. [see graph of percent oil jobs at article]

This history offers three lessons for today’s housing market. First, any negative impact of falling oil prices on home prices should be concentrated in oil-producing markets in Texas, Oklahoma, Louisiana, and other places with large oil-related industries. Second, in these markets, oil prices won’t tank home prices immediately. Rather, falling oil prices in the second half of 2014 might not have their biggest impact on home prices until late 2015 or in 2016. Third, falling oil prices will probably help local economies and home prices in markets that lack oil-related industries.

...

Nationwide, rents rose 6.1% year-over-year in December. The least affordable rental markets are Miami, Los Angeles, and New York, where median rent for a two-bedroom unit eats up more than half of the local average wage.

emphasis added

The month-to-month increase suggests further house price increases over the next few months on a seasonally adjusted basis.

There is much more in the article, especially on the impact of falling oil prices on housing.