by Calculated Risk on 1/08/2015 11:38:00 AM

Thursday, January 08, 2015

Las Vegas Real Estate in December: Lowest Sales in Years, Non-contingent Inventory up 18% YoY

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices stay up through holidays

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in December was 2,734, up from 2,483 in November, but down from 2,915 one year ago. At the current sales pace, [GLVAR President Keith] Lynam said Southern Nevada continues to have less than a four-month supply of available homes. REALTORS® consider a six-month supply to be a balanced market.There are several key trends that we've been following:

For all of 2014, GLVAR reported that 36,550 total properties were sold through its MLS. Lynam noted that was the lowest number of sales in at least six years, down from 47,685 sales in 2009; 44,045 in 2010; 48,798 in 2011; 45,698 in 2012; and 41,477 in 2013.

...

GLVAR said 34.1 percent of all local properties sold in December were purchased with cash. That’s up from 31.9 percent in November, but well short of the February 2013 peak of 59.5 percent, suggesting that fewer investors have been buying homes in Southern Nevada.

...

GLVAR has been tracking a two-year trend toward fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That continued in December, when 10 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s up slightly from 9.6 percent in November. Another 8 percent of all December sales were bank-owned properties, down from 8.7 percent in November.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in December was 12,377, down 7.8 percent from 13,421 in November and down 7.0 percent from one year ago. GLVAR tracked a total of 3,282 condos and townhomes listed for sale on its MLS in December, down 7.0 percent from 3,529 in November, but up 13.1 percent from December 2013.

By the end of December, GLVAR reported 7,774 single-family homes listed without any sort of offer. That’s down 5.1 percent from 8,195 such homes listed in November, but up 18.0 percent from one year ago. For condos and townhomes, the 2,309 properties listed without offers in December represented a 6.1 percent decrease from 2,458 such properties listed in November, but a 38.8 percent increase from one year ago.

emphasis added

1) Overall sales were down 6,2% year-over-year.

2) However conventional (equity, not distressed) sales were up about 9% year-over-year. In December 2013, only 70.8% of all sales were conventional equity. In December 2014, 82.0% were standard equity sales. Note: In December 2012, only 44.7% were equity! A significant change.

3) The percent of cash sales has declined year-over-year from 44.4% in December 2013 to 34.1% in December 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 18.0% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing (an important change in many areas).

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

CoreLogic: "273,000 Residential Properties Regained Equity in Q3 2014"

by Calculated Risk on 1/08/2015 09:25:00 AM

From CoreLogic: CoreLogic Reports 273,000 Residential Properties Regained Equity in Q3 2014

CoreLogic ... today released new analysis showing nearly 273,000 U.S. homes returned to positive equity in the third quarter of 2014, bringing the total number of mortgaged residential properties with equity to approximately 44.6 million, or 90 percent of all mortgaged properties. Nationwide, borrower equity increased year over year by approximately $800 billion in Q3 2014. The CoreLogic analysis indicates that approximately 5.1 million homes, or 10.3 percent of all residential properties with a mortgage, were still in negative equity as of Q3 2014 compared to 5.4 million homes, or 10.9 percent, for Q2 2014. This compares to a negative equity share of 13.3 percent, or 6.5 million homes, in Q3 2013, representing a year-over-year decrease in the number of underwater homes by almost 1.5 million (1,433,296), or 3.0 percent.

... Of the 44.6 million residential properties with positive equity, approximately 9.4 million, or 19 percent, have less than 20-percent equity (referred to as “under-equitied”) and 1.3 million of those have less than 5-percent equity (referred to as near-negative equity). Borrowers who are “under-equitied” may have a more difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Borrowers with near-negative equity are considered at risk of moving into negative equity if home prices fall. In contrast, if home prices rose by as little as 5 percent, an additional 1 million homeowners now in negative equity would regain equity. ...

“Nationally, the negative equity share is down over three percentage points over the past year. Declines were concentrated in a handful of states, such as Nevada, Georgia, Michigan and Florida,” said Sam Khater, deputy chief economist for CoreLogic. “Forecasted house price appreciation of about five percent over the next year suggests that negative equity should be at about 8 percent a year from now, still above average, but approaching the pre-crisis level.”

emphasis added

Click on graph for larger image.

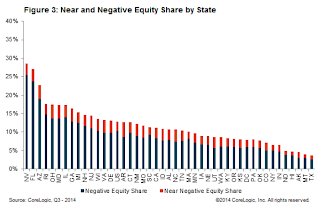

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 25.4 percent, followed by Florida (23.8 percent), Arizona (19 percent), Rhode Island (14.8 percent) and Illinois (14.1 percent). These top five states together account for 33.1 percent of negative equity in the United States."

Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago (Q3 2013) when the negative equity share in Nevada was at 32.2 percent, and at 28.8 percent in Florida.

The second graph shows the distribution of home equity in Q3 compared to Q2 2014. Close to 4% of residential properties have 25% or more negative equity, down from Q2.

The second graph shows the distribution of home equity in Q3 compared to Q2 2014. Close to 4% of residential properties have 25% or more negative equity, down from Q2.In Q3 2013, there were 6.4 million properties with negative equity - now there are 5.1 million. A significant change.

Weekly Initial Unemployment Claims decreased to 294,000

by Calculated Risk on 1/08/2015 08:33:00 AM

The DOL reported:

In the week ending January 3, the advance figure for seasonally adjusted initial claims was 294,000, a decrease of 4,000 from the previous week's unrevised level of 298,000. The 4-week moving average was 290,500, a decrease of 250 from the previous week's unrevised average of 290,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased slightly to 290,500.

This was lower than the consensus forecast of 300,000, and the level suggests few layoffs.

Wednesday, January 07, 2015

Thursday: Unemployment Claims

by Calculated Risk on 1/07/2015 07:25:00 PM

Interesting from Jon Hilsenrath And Brian Blackstone at the WSJ: Fed Backs More Overseas Stimulus

Fed officials rarely comment on the decisions taken by foreign central banks and have generally played down risks to domestic growth emanating from abroad. Yet minutes of the Fed’s Dec. 16-17 policy meeting included several references to the urgency U.S. officials and market participants are placing on new policy actions to counteract slow growth outside the U.S.Thursday:

...

The minutes showed Fed officials “regarded the international situation as an important source of downside risks to domestic real activity and employment.” They added that the risks were particularly serious “if foreign policy responses were insufficient.”

In another place in the Fed minutes, officials warned that financial markets had been “importantly influenced by concerns about prospects for foreign economic growth and by associated expectations of monetary policy actions in Europe and Japan.”

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 300 thousand from 298 thousand.

• Early, Trulia Price Rent Monitors for December. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 3:00 PM, Consumer Credit for November from the Federal Reserve. The consensus is for credit to increase $15.0 billion.

Preview: Employment Report for December

by Calculated Risk on 1/07/2015 03:51:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus, according to Bloomberg, is for an increase of 245,000 non-farm payroll jobs in December (with a range of estimates between 202,000 and 305,000), and for the unemployment rate to decline to 5.7%.

The BLS reported 321,000 jobs added in November.

Here is a summary of recent data:

• The ADP employment report showed an increase of 241,000 private sector payroll jobs in November. This was above expectations of 223,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly above expectations.

• The ISM manufacturing employment index increased in December to 56.8%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs increased about 18,000 in December. The ADP report indicated a 26,000 increase for manufacturing jobs in December.

The ISM non-manufacturing employment index decreased in December to 56.0%. A historical correlation (linear) between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 234,000 in December.

Combined, the ISM indexes suggests employment gains of 252,000. This suggests growth slightly above expectations.

• Initial weekly unemployment claims averaged close to 291,000 in December, down from 299,000 in November. For the BLS reference week (includes the 12th of the month), initial claims were at 289,000; this was down from 292,000 during the reference week in November.

Generally this suggests about the same low level of layoffs in December as for the previous three months (employment gains averaged 278,000 per month for September, October and November).

• The final December Reuters / University of Michigan consumer sentiment index increased to 93.6 from the November reading of 88.8. This was the highest level in nearly eight years. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like sharply lower gasoline prices.

• On small business hiring: The small business index from Intuit showed a 30,000 increase in small business employment in December, the same strong level as in November.

• Trim Tabs reported that the U.S. economy added between 210,000 to 240,000 jobs in December. This is down sharply from their 306,000 estimate last month (that was pretty close). "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 141 million U.S. workers subject to withholding" December is more challenging for TrimTabs due to year end bonuses - so they provided a range this month.

• Conclusion: Below is a table showing several employment indicators and the initial BLS report (the first column is the revised employment). Two key points:

1) Unfortunately none of the indicators below is very good at predicting the initial BLS employment report.

2) In general it looks like this should be another 200+ month (based on ADP, ISM, unemployment claims, and small business hiring).

There is always some randomness to the employment report. The consensus forecast is pretty strong, but I'll take the over again (above 245,000).

| Employment Indicators (000s) | ||||||

|---|---|---|---|---|---|---|

| BLS Revised | BLS Initial | ADP Initial | ISM | Weekly Claims Reference Week1 | Intuit Small Business | |

| Jan | 144 | 113 | 175 | 236 | 329 | 10 |

| Feb | 222 | 175 | 139 | -6 | 334 | 0 |

| Mar | 203 | 192 | 191 | 153 | 323 | 0 |

| Apr | 304 | 288 | 220 | NA | 320 | 25 |

| May | 229 | 217 | 179 | 130 | 327 | 35 |

| Jun | 267 | 288 | 281 | NA | 314 | 20 |

| Jul | 243 | 209 | 218 | NA | 303 | 15 |

| Aug | 203 | 142 | 204 | 285 | 299 | 0 |

| Sep | 271 | 248 | 213 | NA | 281 | 10 |

| Oct | 243 | 214 | 230 | 340 | 284 | 15 |

| Nov | 321 | 208 | 260 | 292 | 30 | |

| Dec | Friday | 241 | 252 | 289 | 30 | |

| 1Lower is better for Unemployment Claims | ||||||