by Calculated Risk on 1/07/2015 07:25:00 PM

Wednesday, January 07, 2015

Thursday: Unemployment Claims

Interesting from Jon Hilsenrath And Brian Blackstone at the WSJ: Fed Backs More Overseas Stimulus

Fed officials rarely comment on the decisions taken by foreign central banks and have generally played down risks to domestic growth emanating from abroad. Yet minutes of the Fed’s Dec. 16-17 policy meeting included several references to the urgency U.S. officials and market participants are placing on new policy actions to counteract slow growth outside the U.S.Thursday:

...

The minutes showed Fed officials “regarded the international situation as an important source of downside risks to domestic real activity and employment.” They added that the risks were particularly serious “if foreign policy responses were insufficient.”

In another place in the Fed minutes, officials warned that financial markets had been “importantly influenced by concerns about prospects for foreign economic growth and by associated expectations of monetary policy actions in Europe and Japan.”

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 300 thousand from 298 thousand.

• Early, Trulia Price Rent Monitors for December. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 3:00 PM, Consumer Credit for November from the Federal Reserve. The consensus is for credit to increase $15.0 billion.

Preview: Employment Report for December

by Calculated Risk on 1/07/2015 03:51:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus, according to Bloomberg, is for an increase of 245,000 non-farm payroll jobs in December (with a range of estimates between 202,000 and 305,000), and for the unemployment rate to decline to 5.7%.

The BLS reported 321,000 jobs added in November.

Here is a summary of recent data:

• The ADP employment report showed an increase of 241,000 private sector payroll jobs in November. This was above expectations of 223,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly above expectations.

• The ISM manufacturing employment index increased in December to 56.8%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs increased about 18,000 in December. The ADP report indicated a 26,000 increase for manufacturing jobs in December.

The ISM non-manufacturing employment index decreased in December to 56.0%. A historical correlation (linear) between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 234,000 in December.

Combined, the ISM indexes suggests employment gains of 252,000. This suggests growth slightly above expectations.

• Initial weekly unemployment claims averaged close to 291,000 in December, down from 299,000 in November. For the BLS reference week (includes the 12th of the month), initial claims were at 289,000; this was down from 292,000 during the reference week in November.

Generally this suggests about the same low level of layoffs in December as for the previous three months (employment gains averaged 278,000 per month for September, October and November).

• The final December Reuters / University of Michigan consumer sentiment index increased to 93.6 from the November reading of 88.8. This was the highest level in nearly eight years. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like sharply lower gasoline prices.

• On small business hiring: The small business index from Intuit showed a 30,000 increase in small business employment in December, the same strong level as in November.

• Trim Tabs reported that the U.S. economy added between 210,000 to 240,000 jobs in December. This is down sharply from their 306,000 estimate last month (that was pretty close). "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 141 million U.S. workers subject to withholding" December is more challenging for TrimTabs due to year end bonuses - so they provided a range this month.

• Conclusion: Below is a table showing several employment indicators and the initial BLS report (the first column is the revised employment). Two key points:

1) Unfortunately none of the indicators below is very good at predicting the initial BLS employment report.

2) In general it looks like this should be another 200+ month (based on ADP, ISM, unemployment claims, and small business hiring).

There is always some randomness to the employment report. The consensus forecast is pretty strong, but I'll take the over again (above 245,000).

| Employment Indicators (000s) | ||||||

|---|---|---|---|---|---|---|

| BLS Revised | BLS Initial | ADP Initial | ISM | Weekly Claims Reference Week1 | Intuit Small Business | |

| Jan | 144 | 113 | 175 | 236 | 329 | 10 |

| Feb | 222 | 175 | 139 | -6 | 334 | 0 |

| Mar | 203 | 192 | 191 | 153 | 323 | 0 |

| Apr | 304 | 288 | 220 | NA | 320 | 25 |

| May | 229 | 217 | 179 | 130 | 327 | 35 |

| Jun | 267 | 288 | 281 | NA | 314 | 20 |

| Jul | 243 | 209 | 218 | NA | 303 | 15 |

| Aug | 203 | 142 | 204 | 285 | 299 | 0 |

| Sep | 271 | 248 | 213 | NA | 281 | 10 |

| Oct | 243 | 214 | 230 | 340 | 284 | 15 |

| Nov | 321 | 208 | 260 | 292 | 30 | |

| Dec | Friday | 241 | 252 | 289 | 30 | |

| 1Lower is better for Unemployment Claims | ||||||

FOMC Minutes: "Participants would want to be reasonably confident that inflation will move back toward 2 percent over time"

by Calculated Risk on 1/07/2015 02:00:00 PM

Participants expressed more concern about low inflation and the FOMC might wait on rate hikes until they are "reasonably confident that inflation will move back toward 2 percent over time".

From the Fed: Minutes of the Federal Open Market Committee, December 16-17, 2014. Excerpts:

Participants generally anticipated that inflation was likely to decline further in the near term, reflecting the reduction in oil prices and the effects of the rise in the foreign exchange value of the dollar on import prices. Most participants saw these influences as temporary and thus continued to expect inflation to move back gradually to the Committee's 2 percent longer-run objective as the labor market improved further in an environment of well-anchored inflation expectations. Survey-based measures of longer-term inflation expectations remained stable, although market-based measures of inflation compensation over the next five years, as well as over the five-year period beginning five years ahead, moved down further over the intermeeting period. Participants discussed various explanations for the decline in market-based measures, including a fall in expected future inflation, reductions in inflation risk premiums, and higher liquidity and other premiums that might be influencing the prices of Treasury Inflation-Protected Securities and inflation derivatives. Model-based decompositions of inflation compensation seemed to support the message from surveys that longer-term inflation expectations had remained stable, although it was observed that these results were sensitive to the assumptions underlying the particular models used. It was noted that even if the declines in inflation compensation reflected lower inflation risk premiums rather than a reduction in expected inflation, policymakers might still want to take them into account because such changes could reflect increased concerns on the part of investors about adverse outcomes in which low inflation was accompanied by weak economic activity. In the end, participants generally agreed that it would take more time and analysis to draw definitive conclusions regarding the recent behavior of inflation compensation.

...

With regard to inflation, a number of participants saw a risk that it could run persistently below their 2 percent objective, with some expressing concern that such an outcome could undermine the credibility of the Committee's commitment to that objective.

...

With lower energy prices and the stronger dollar likely to keep inflation below target for some time, it was noted that the Committee might begin normalization at a time when core inflation was near current levels, although in that circumstance participants would want to be reasonably confident that inflation will move back toward 2 percent over time. emphasis added

Reis: Strip Mall Vacancy Rate declined in Q4, Regional Mall Vacancy Rate Increased

by Calculated Risk on 1/07/2015 11:06:00 AM

Reis reported that the vacancy rate for regional malls was increased to 8.0% in Q4 2014 from 7.9% in Q3. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate decreased to 10.2% in Q4, from 10.1% in Q3. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] The retail market recovery marched forward during the fourth quarter, but remained at a snail's pace. Net absorption once again exceeded the scant levels of construction in the market which pushed the vacancy rate for neighborhood and community centers down by 10 basis points to 10.2%. Asking and effective rent growth both accelerated slightly versus last quarter but the quarterly growth rates are so weak that any difference is marginal and insignificant. Vacancy remains far too elevated for rents to grow at a much faster pace than we have observed in recent quarters.

[Regional] During the fourth quarter, regional mall vacancy increased by 10 basis points to 8.0%. This is the first quarterly increase in the mall vacancy rate since the third quarter of 2011. For 2014, the mall vacancy rate was also up 10 basis points. Although the mall recovery cycle is fairly mature at this juncture, the primary culprit for the increase in the vacancy rate was the closing of a number of Sears stores during the fourth quarter. However, the market recovery had been losing steam before this with the national vacancy rate flat for most of 2014. While there is no new construction in the mall subsector, demand should increase along with the recovery in the economy and labor markets in 2014. Therefore, we do not believe that this quarter is a reversal in fortune for the mall sector. However, any improvement in demand will come from average‐caliber malls. Vacancy at high‐end malls has just about vanished, giving their landlords strong pricing power, but little ability to increase NOI due to occupancy change. Vacancy at average malls remains relatively high and still has significant room to compress over the next few years.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

Trade Deficit declines in November to $39.0 Billion

by Calculated Risk on 1/07/2015 08:54:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $39.0 billion in November, down $3.2 billion from $42.2 billion in October, revised. November exports were $196.4 billion, $2.0 billion less than October exports. November imports were $235.4 billion, $5.2 billion less than October imports.The trade deficit was smaller than the consensus forecast of $42.0 billion.

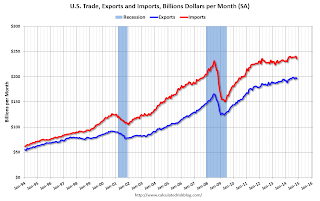

The first graph shows the monthly U.S. exports and imports in dollars through November 2014.

Click on graph for larger image.

Click on graph for larger image.Both imports and exports decreased in November.

Exports are 18% above the pre-recession peak and up 1% compared to November 2013; imports are 2% above the pre-recession peak, and up about 2% compared to November 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through November.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $82.95 in November, down from $88.47 in October, and down from $94.69 in November 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

Note: There is a lag due to shipping and long term contracts, but oil prices will really decline over the next several months - and the oil deficit will get much smaller.

The trade deficit with China increased to $29.9 billion in November, from $27.0 billion in November 2013. The deficit with China is a large portion of the overall deficit.