by Calculated Risk on 1/07/2015 02:00:00 PM

Wednesday, January 07, 2015

FOMC Minutes: "Participants would want to be reasonably confident that inflation will move back toward 2 percent over time"

Participants expressed more concern about low inflation and the FOMC might wait on rate hikes until they are "reasonably confident that inflation will move back toward 2 percent over time".

From the Fed: Minutes of the Federal Open Market Committee, December 16-17, 2014. Excerpts:

Participants generally anticipated that inflation was likely to decline further in the near term, reflecting the reduction in oil prices and the effects of the rise in the foreign exchange value of the dollar on import prices. Most participants saw these influences as temporary and thus continued to expect inflation to move back gradually to the Committee's 2 percent longer-run objective as the labor market improved further in an environment of well-anchored inflation expectations. Survey-based measures of longer-term inflation expectations remained stable, although market-based measures of inflation compensation over the next five years, as well as over the five-year period beginning five years ahead, moved down further over the intermeeting period. Participants discussed various explanations for the decline in market-based measures, including a fall in expected future inflation, reductions in inflation risk premiums, and higher liquidity and other premiums that might be influencing the prices of Treasury Inflation-Protected Securities and inflation derivatives. Model-based decompositions of inflation compensation seemed to support the message from surveys that longer-term inflation expectations had remained stable, although it was observed that these results were sensitive to the assumptions underlying the particular models used. It was noted that even if the declines in inflation compensation reflected lower inflation risk premiums rather than a reduction in expected inflation, policymakers might still want to take them into account because such changes could reflect increased concerns on the part of investors about adverse outcomes in which low inflation was accompanied by weak economic activity. In the end, participants generally agreed that it would take more time and analysis to draw definitive conclusions regarding the recent behavior of inflation compensation.

...

With regard to inflation, a number of participants saw a risk that it could run persistently below their 2 percent objective, with some expressing concern that such an outcome could undermine the credibility of the Committee's commitment to that objective.

...

With lower energy prices and the stronger dollar likely to keep inflation below target for some time, it was noted that the Committee might begin normalization at a time when core inflation was near current levels, although in that circumstance participants would want to be reasonably confident that inflation will move back toward 2 percent over time. emphasis added

Reis: Strip Mall Vacancy Rate declined in Q4, Regional Mall Vacancy Rate Increased

by Calculated Risk on 1/07/2015 11:06:00 AM

Reis reported that the vacancy rate for regional malls was increased to 8.0% in Q4 2014 from 7.9% in Q3. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate decreased to 10.2% in Q4, from 10.1% in Q3. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] The retail market recovery marched forward during the fourth quarter, but remained at a snail's pace. Net absorption once again exceeded the scant levels of construction in the market which pushed the vacancy rate for neighborhood and community centers down by 10 basis points to 10.2%. Asking and effective rent growth both accelerated slightly versus last quarter but the quarterly growth rates are so weak that any difference is marginal and insignificant. Vacancy remains far too elevated for rents to grow at a much faster pace than we have observed in recent quarters.

[Regional] During the fourth quarter, regional mall vacancy increased by 10 basis points to 8.0%. This is the first quarterly increase in the mall vacancy rate since the third quarter of 2011. For 2014, the mall vacancy rate was also up 10 basis points. Although the mall recovery cycle is fairly mature at this juncture, the primary culprit for the increase in the vacancy rate was the closing of a number of Sears stores during the fourth quarter. However, the market recovery had been losing steam before this with the national vacancy rate flat for most of 2014. While there is no new construction in the mall subsector, demand should increase along with the recovery in the economy and labor markets in 2014. Therefore, we do not believe that this quarter is a reversal in fortune for the mall sector. However, any improvement in demand will come from average‐caliber malls. Vacancy at high‐end malls has just about vanished, giving their landlords strong pricing power, but little ability to increase NOI due to occupancy change. Vacancy at average malls remains relatively high and still has significant room to compress over the next few years.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

Trade Deficit declines in November to $39.0 Billion

by Calculated Risk on 1/07/2015 08:54:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $39.0 billion in November, down $3.2 billion from $42.2 billion in October, revised. November exports were $196.4 billion, $2.0 billion less than October exports. November imports were $235.4 billion, $5.2 billion less than October imports.The trade deficit was smaller than the consensus forecast of $42.0 billion.

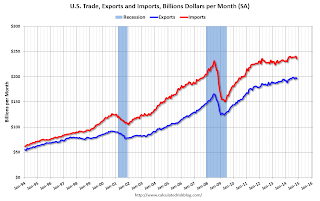

The first graph shows the monthly U.S. exports and imports in dollars through November 2014.

Click on graph for larger image.

Click on graph for larger image.Both imports and exports decreased in November.

Exports are 18% above the pre-recession peak and up 1% compared to November 2013; imports are 2% above the pre-recession peak, and up about 2% compared to November 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through November.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $82.95 in November, down from $88.47 in October, and down from $94.69 in November 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

Note: There is a lag due to shipping and long term contracts, but oil prices will really decline over the next several months - and the oil deficit will get much smaller.

The trade deficit with China increased to $29.9 billion in November, from $27.0 billion in November 2013. The deficit with China is a large portion of the overall deficit.

ADP: Private Employment increased 241,000 in December

by Calculated Risk on 1/07/2015 08:15:00 AM

Private sector employment increased by 241,000 jobs from November to December according to the December ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 223,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 46,000 jobs in December, up from 40,000 jobs gained in November. The construction industry added 23,000 jobs, up from last month’s gain of 20,000. Meanwhile, manufacturing added 26,000 jobs in December, well above November’s 16,000 and the second highest monthly total of 2014 in that sector.

Service-providing employment rose by 194,000 jobs in December, up from 187,000 in November. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market continues to power forward. Businesses across all industries and sizes are adding to payrolls. At the current pace of job growth, the economy will be back to full employment by this time next year.”

The BLS report for December will be released on Friday and the consensus is for 240,000 non-farm payroll jobs added in December.

MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey

by Calculated Risk on 1/07/2015 07:01:00 AM

From the MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 9.1 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 2, 2015. The most recent week’s results include an adjustment to account for the New Year’s Day holiday, while the previous week’s results were adjusted for the Christmas holiday....

The Refinance Index decreased 12 percent from two weeks ago. The seasonally adjusted Purchase Index decreased 5 percent from two weeks earlier ... The Purchase Index was 8 percent lower than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.01 percent from 4.04 percent, with points decreasing to 0.28 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

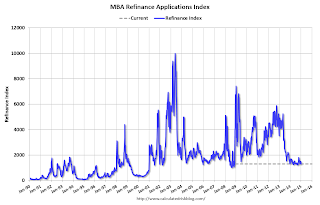

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

2014 was probably the lowest year for refinance activity since year 2000 (haven't seen final stats yet). Even with the sharp decline in rates this week, mortgage rates would have to decline further for there to be a large refinance boom - so I expect refinance activity to be low again in 2015.

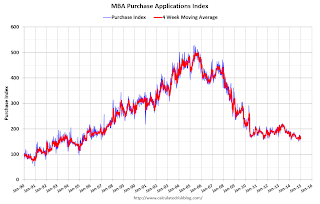

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down 8% from a year ago.