by Calculated Risk on 12/24/2014 07:01:00 AM

Wednesday, December 24, 2014

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 19, 2014. ...

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.02 percent, the lowest level since May 2013, from 4.06 percent, with points increasing to 0.26 from 0.21 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

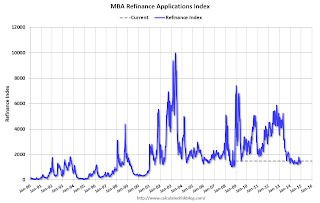

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 72% from the levels in May 2013.

Even with the general decline in mortgage rates, refinance activity is very low this year and 2014 will be the lowest since year 2000. Rates would have to decline significantly for there to be a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down 1% from a year ago.

Tuesday, December 23, 2014

Wednesday: Unemployment Claims

by Calculated Risk on 12/23/2014 08:41:00 PM

From the WSJ: U.S. Economy Posts Strongest Growth in More Than a Decade

U.S. gross domestic product, the fullest measure of economic output, was shown in the Commerce Department’s third estimate to have expanded at a 5% pace in the third quarter—up from the second quarter’s growth rate of 4.6% and the strongest pace since the third quarter of 2003.And Q4 will be decent, although it appears some investment will slow - especially for petroleum and natural gas - but the consumer will be solid. A nice end to a good economic year!

The growth was buoyed by consumer spending on health care and restaurant meals, business investment in equipment and new software, and a rise in exports.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 289 thousand.

• The NYSE and the NASDAQ will close at 1:00 PM ET.

Review: Ten Economic Questions for 2014

by Calculated Risk on 12/23/2014 04:02:00 PM

At the end of each year, I post ten questions for the upcoming year. Here are the Ten Economic Questions for 2014. I follow up with a brief post on each question, and the goal is to provide an overview of what I expect for the coming year (I don't have a crystal ball, but I think it helps to outline what I think will happen - and then try to understand why I was wrong).

I've been lucky in the years with turning points (calling the recession in 2007 or the bottom for house price in early 2012 are two examples).

Here is a 2014 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2014: Downside Risks

Happily, looking forward, it seems the downside risks have diminished significantly. China remains a key risk ... There are always potential geopolitical risks (war with Iran, North Korea, or turmoil in some oil producing country). Right now those risks appear small, although it is always hard to tell. ...There are international risks - China remains a downside risk. Russia too. Europe (and the Euro) are still a mess, and the situations in the Ukraine and Iraq are serious, but overall it appears that downside risks to the U.S. economy were less in 2014 than in 2013.

When I look around, I see few obvious downside risks for the U.S. economy in 2014. No need to borrow trouble - diminished downside risks are a reason for cheer.

9) Question #9 for 2014: How much will housing inventory increase in 2014?

Right now my guess is active inventory will increase 10% to 15% in 2014 (inventory will decline seasonally in December and January, but I expect to see inventory up 10% to 15% year-over-year toward the end of 2014). This will put active inventory close to 6 months supply this summer. If correct, this will slow house price increases in 2014.The NAR reported inventory was up 2.0% year-over-year in November. However Zillow is showing inventory up 12% year-over-year. Note: I used to follow "Housing Tracker" weekly, but the site had some data problems and they discontinued the series. The "10% to 15%" increase this year was too high based on the NAR reports.

8) Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

Bottom line: I expect lending standards to loosen a bit in 2014 from the tight level of the last few years. It will be difficult to measure, but I'll be watching what Mel Watt says, what private lenders say, comments from mortgage brokers, and MEW.I think we are seeing a little loosening with Fannie and Freddie clarifying Reps and Warrants, and in some circumstances, lower downpayment requirements. Mortgage equity withdrawal is still net negative (but a smaller negative).

7) Question #7 for 2014: What will happen with house prices in 2014?

In 2014, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. This suggests more house price increases in 2014, but probably at a slow pace.We only have Case-Shiller data through September, and price increases have slowed as expected. Zillow expects the October Case-Shiller National index to show a 4.8% year-over-year gain. My prediction was based on the Composite 20 which would be a little higher (Case-Shiller started releasing the national index monthly this year). My prediction was pretty close, and if anything, house prices slowed more than I expected.

As Khater noted, some of the "bounce back" in certain areas is probably over, also suggesting slower price increases going forward. And investor buying appears to have slowed. A positive for the market will probably be a little looser mortgage credit.

All of these factors suggest further prices increases in 2014, but at a slower rate than in 2013. There tends to be some momentum for house prices, and I expect we will see prices up mid-to-high single digits (percentage) in 2014 as measured by Case-Shiller.

6) Question #6 for 2014: How much will Residential Investment increase?

New home sales will still be competing with distressed sales (short sales and foreclosures) in some judicial foreclosure states in 2014. However, unlike last year when I reported that some builders were land constrained (not enough finished lots in the pipeline), land should be less of an issue this year. Even with the foreclosures, I expect another solid year of growth for new home sales.Through November, new home sales were flat compared to 2013, and housing starts were only up 7.8% year-over-year. Clearly I was too optimistic this year. There were a number of factors that kept RI down, but I still think fundamentals support a higher level of starts. An optimistic view is that the sluggish growth this year means more growth over the next several years!

... I expect growth for new home sales and housing starts in the 20% range in 2014 compared to 2013. That would still make 2014 the tenth weakest year on record for housing starts (behind 2008 through 2012 and few other recession lows).

5) Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

[E]ven though the Fed is data-dependent, I currently expect the Fed to reduce their asset purchases by $10 billion per month (or so) at each meeting this year and conclude QE3 at the end of the 2014.QE3 ended in October.

4) Question #4 for 2014: Will too much inflation be a concern in 2014?

[C]urrently I think inflation (year-over-year) will increase a little in 2014 as growth picks up, but too much inflation will not be a concern in 2014.Core measures of inflation did increase a little this year, and too much inflation was not a concern in 2014.

3) Question #3 for 2014: What will the unemployment rate be in December 2014?

My guess is the participation rate will stabilize or only decline slightly in 2014 (less than in 2012 and 2013) ... it appears the unemployment rate will decline to the low-to-mid 6% range by December 2014.The participation rate did stabilize - in December 2013, the participation rate was 62.8%, and in November 2014, the participation rate was ... 62.8%. However the unemployment rate was 5.8% in November and I was too pessimistic on unemployment.

2) Question #2 for 2014: How many payroll jobs will be added in 2014?

Both state and local government and construction hiring should improve further in 2014. Federal layoffs will be a negative, but most sectors should be solid. So my forecast is somewhat above the previous three years, and I expect gains of about 200,000 to 225,000 payroll jobs per month in 2014.Through November 2014, the economy has added 2,650,000 jobs, or 240,000 per month - above my projection - and the best year since 1999!

...

It is possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

1) Question #1 for 2014: How much will the economy grow in 2014?

I expect PCE to pick up again into the 3% to 4% range, and this will give a boost to GDP. This increase in consumer spending should provide an incentive for business investment. Add in the ongoing housing recovery, some increase in state and local government spending, and 2014 should be the best year of the recovery with GDP growth at or above 3%PCE was sluggish at 1.2% in Q1 (due to the bad weather), picked up in Q2 to 2.5%, and in Q3 to 3.2%. Right now, based on the November Personal Income data, it looks like PCE will be around 4.3% in Q4. Not quite what I expected, because of Q1 weakness, but a clear acceleration. GDP will be probably be around 2.4% (or higher) - pretty amazing because of the contraction in Q1. Growth clearly picked up this year, and 2014 will be close to the best year of the recovery.

Overall 2014 unfolded about as expected - I anticipated the pickup in employment and economic growth, was correct on inflation and Fed policy - however I was too optimistic on housing.

Comments on New Home Sales

by Calculated Risk on 12/23/2014 12:53:00 PM

Earlier: New Home Sales at 438,000 Annual Rate in November

The new home sales report for November was below expectations at 438 thousand on a seasonally adjusted annual rate basis (SAAR). Also, sales for the two of the previous months were revised down.

Sales in 2014 are significantly below expectations, however, based on the low level of sales, more lots coming available, and demographics, I expect sales to increase over the next several years.

It is important to remember that demographics is a slow moving - but unstoppable - force!

It was over four years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive. One major reason for that optimism was demographics - a large cohort was moving into the renting age group.

Now demographics are slowly becoming more favorable for home buying.

This graph shows the longer term trend for several key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: 1990 to 2013 is actual, 2014 to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts - and new home sales - to continue to increase in coming years.

The Census Bureau reported that new home sales this year, through November, were 399,000, that is up 0.2% from the same period of 2013. Right now it looks like sales will be mostly unchanged this year compared to last year.

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will continue to decline and be offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Personal Income increased 0.4% in November, Spending increased 0.6%

by Calculated Risk on 12/23/2014 10:21:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $54.4 billion, or 0.4 percent ... in November, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $67.9 billion, or 0.6 percent.The following graph shows real Personal Consumption Expenditures (PCE) through November 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.7 percent in November, compared with an increase of 0.2 percent in October. ... The price index for PCE decreased 0.2 percent in November, in contrast to an increase of less than 0.1 percent in October. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared within an increase of 0.2 percent. ... The November price index for PCE increased 1.2 percent from November a year ago. The November PCE price index, excluding food and energy, increased 1.4 percent from November a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 4.3% annual rate in Q4 2014 (using the mid-month method, PCE was increasing 4.5%). It looks like Q4 will be a strong quarter for PCE growth - revise up those Q4 GDP forecasts!