by Calculated Risk on 12/23/2014 12:53:00 PM

Tuesday, December 23, 2014

Comments on New Home Sales

Earlier: New Home Sales at 438,000 Annual Rate in November

The new home sales report for November was below expectations at 438 thousand on a seasonally adjusted annual rate basis (SAAR). Also, sales for the two of the previous months were revised down.

Sales in 2014 are significantly below expectations, however, based on the low level of sales, more lots coming available, and demographics, I expect sales to increase over the next several years.

It is important to remember that demographics is a slow moving - but unstoppable - force!

It was over four years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive. One major reason for that optimism was demographics - a large cohort was moving into the renting age group.

Now demographics are slowly becoming more favorable for home buying.

This graph shows the longer term trend for several key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: 1990 to 2013 is actual, 2014 to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts - and new home sales - to continue to increase in coming years.

The Census Bureau reported that new home sales this year, through November, were 399,000, that is up 0.2% from the same period of 2013. Right now it looks like sales will be mostly unchanged this year compared to last year.

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will continue to decline and be offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Personal Income increased 0.4% in November, Spending increased 0.6%

by Calculated Risk on 12/23/2014 10:21:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $54.4 billion, or 0.4 percent ... in November, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $67.9 billion, or 0.6 percent.The following graph shows real Personal Consumption Expenditures (PCE) through November 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.7 percent in November, compared with an increase of 0.2 percent in October. ... The price index for PCE decreased 0.2 percent in November, in contrast to an increase of less than 0.1 percent in October. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared within an increase of 0.2 percent. ... The November price index for PCE increased 1.2 percent from November a year ago. The November PCE price index, excluding food and energy, increased 1.4 percent from November a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 4.3% annual rate in Q4 2014 (using the mid-month method, PCE was increasing 4.5%). It looks like Q4 will be a strong quarter for PCE growth - revise up those Q4 GDP forecasts!

New Home Sales at 438,000 Annual Rate in November

by Calculated Risk on 12/23/2014 10:00:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 438 thousand.

October sales were revised down from 458 thousand to 445 thousand, and September sales were unchanged at 455 thousand.

"Sales of new single-family houses in November 2014 were at a seasonally adjusted annual rate of 438,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.6 percent below the revised October rate of 445,000 and is 1.6 percent below the November 2013 estimate of 445,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in November to 5.8 months from 5.7 months in October.

The months of supply increased in November to 5.8 months from 5.7 months in October. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of November was 213,000. This represents a supply of 5.8 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

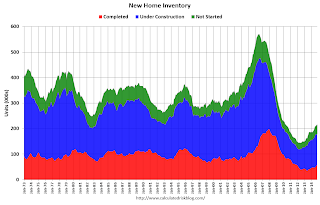

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2014 (red column), 31 thousand new homes were sold (NSA). Last year 32 thousand homes were sold in Novembe.

The high for November was 86 thousand in 2005, and the low for November was 20 thousand in 2010.

This was below expectations of 460,000 sales in November, and there were downward revisions to sales in August and October. Another weak report.

I'll have more later today.

Q3 GDP Revised Up to 5.0%

by Calculated Risk on 12/23/2014 08:34:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2014 (Third Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 5.0 percent in the third quarter of 2014, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.6 percent.Here is a Comparison of Third and Second Estimates. PCE was revised up from 2.2% to 3.2%, and private investment was revised up. A very strong report.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 3.9 percent. With the third estimate for the third quarter, both personal consumption expenditures (PCE) and nonresidential fixed investment increased more than previously estimated

Monday, December 22, 2014

Tuesday: New Home Sales, Personal Income and Outlays, GDP, and much more

by Calculated Risk on 12/22/2014 07:56:00 PM

First, from Tim Duy: Fed Watch: Looking Backward to See the Future

[In 20004] Patient" lasted for two meetings before being replaced by "measured." This is fairly consistent with my expectations. My baseline scenario is that the Fed drops "considerable" entirely in January, retains "patient" in March, drops "patient" in April, and raise rates in June.Tuesday:

...

Bottom Line: Assuming the data holds, maybe history will repeat itself.

• At 8:30 AM ET, Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.9% increase in durable goods orders.

• Also at 8:30 AM, Gross Domestic Product, 3rd quarter 2014 (third estimate). The consensus is that real GDP increased 4.3% annualized in Q3, revised up from the second estimate of 3.9%.

• At 9:00 AM, FHFA House Price Index for October 2014. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.2% increase.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 93.0, down from the preliminary reading of 93.8, and up from the November reading of 88.8.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for an increase in sales to 460 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 458 thousand in October.

• Also at 10:00 AM, Personal Income and Outlays for November. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for December.