by Calculated Risk on 12/19/2014 02:12:00 PM

Friday, December 19, 2014

DOT: Vehicle Miles Driven increased 2.6% year-over-year in October

With lower gasoline prices, vehicle miles driven might reach a new peak in 2015.

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 2.6% (6.6 billion vehicle miles) for October 2014 as compared with October 2013.The following graph shows the rolling 12 month total vehicle miles driven.

Travel for the month is estimated to be 264.2 billion vehicle miles.

Cumulative Travel for 2014 changed by 0.9% (23.2 billion vehicle miles).

The rolling 12 month total is slowly moving up, after moving sideways for a few years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 83 months - almost 7 years - and still counting. Currently miles driven (rolling 12 months) are about 1.6% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In October 2014, gasoline averaged of $3.26 per gallon according to the EIA. That was down from October 2013 when prices averaged $3.42 per gallon.

In October 2014, gasoline averaged of $3.26 per gallon according to the EIA. That was down from October 2013 when prices averaged $3.42 per gallon. Prices will really be down year-over-year in November and December too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 7 years is probably also due to the lingering effects of the great recession (lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a little more time before we see a new peak in miles driven - but it is possible that a new peak could happen in 2015.

Kansas City Fed: Regional Manufacturing "Activity Expanded at a Moderate Pace" in December

by Calculated Risk on 12/19/2014 11:05:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded at a Moderate Pace

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to expand at a moderate pace in December, and producers’ expectations for future activity remained at solid levels.Two more regional Fed manufacturing surveys for December will be released this month (the Dallas and Richmond Fed surveys). So far the regional surveys have indicated decent growth in December and optimism about the future.

“This month’s results are similar to what we’ve seen most of the year, said Wilkerson. The main change in December, which we started to see in November, is that input price pressures have come down.”

The month-over-month composite index was 8 in December, up slightly from 7 in November and 4 in October. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The employment index jumped from 10 to 18, its highest level in nearly two years. ...

Future factory indexes were mostly stable at solid levels. The future composite index was unchanged at 22, while the future shipments, new orders, and employment indexes increased further. The future capital spending index jumped from 15 to 23, its highest level in five months. In contrast, the future production index eased from 34 to 30, and the future order backlog index also inched lower.

emphasis added

BLS: Forty-one States had Unemployment Rate Decreases in November

by Calculated Risk on 12/19/2014 10:03:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in November. Forty-one states and the District of Columbia had unemployment rate decreases from October, three states had increases, and six states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Mississippi had the highest unemployment rate among the states in November, 7.3 percent. The District of Columbia had a rate of 7.4 percent. North Dakota again had the lowest jobless rate, 2.7 percent.

Click on graph for larger image.

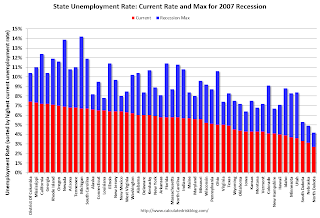

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Mississippi, at 7.3%, had the highest unemployment rate replacing Georgia with the highest unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Five states and D.C. are still at or above 7% (dark blue).

Thursday, December 18, 2014

Freddie Mac: "Mortgage Rates Find New Lows for 2014"

by Calculated Risk on 12/18/2014 07:46:00 PM

Friday:

• At 10:00 AM ET, Regional and State Employment and Unemployment (Monthly) for November 2014

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

From Freddie Mac: Mortgage Rates Find New Lows for 2014

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates falling to new lows for this year as 10-year Treasury yields closed at their lowest level since May 2013.

30-year fixed-rate mortgage (FRM) averaged 3.80 percent with an average 0.6 point for the week ending December 18, 2014, down from last week when it averaged 3.93 percent. A year ago at this time, the 30-year FRM averaged 4.47 percent.

Click on graph for larger image.

This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

Historically refinance activity picks up significantly when mortgage rates fall about 50 bps from a recent level.

Many borrowers who took out mortgages over the last 18 months can refinance now - but that is a small number of total borrowers. However, for a significant increase in refinance activity, rates would have to fall below the late 2012 lows (on a monthly basis, 30 year mortgage rates were at 3.35% in the PMMS in November and December 2012.

Based on the relationship between the 30 year mortgage rate and 10-year Treasury yields, the 10-year Treasury yield would probably have to decline to 1.5% or lower for a significant refinance boom (in the near future). With the 10-year yield currently at 2.20%, I don't expect a significant increase in refinance activity any time soon.

CoStar: Commercial Real Estate prices increased in October

by Calculated Risk on 12/18/2014 03:27:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Prices Post Steady Gains In October

CRE PRICES ROSE STEADILY IN OCTOBER, SUPPORTED BY BROAD BASE OF POSITIVE TRENDS. Most major property types continued to benefit from minimal speculative construction, a firming economic recovery and rising rental rates. Meanwhile, benchmark interest rates such as the 10-year Treasury continued to decline in October, a positive underlying trend for commercial real estate cap rates. The two broadest measures of aggregate pricing for commercial properties within the CCRSI — the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index — increased by 0.8% and 0.9%, respectively, for October 2014.

...

VALUE-WEIGHTED U.S. COMPOSITE INDEX HITS RECORD HIGH IN OCTOBER, SIGNALING STRONG DEMAND FOR LARGE, INSTITUTIONAL-GRADE PROPERTIES. After climbing 0.9% in the month of October, the value-weighted U.S. Composite Index reached a record high, thanks to steady gains in recent months. The index now stands 3.9% above its prerecession peak in 2007, reflecting strong competition among investors for large, high-end commercial properties.

EQUAL-WEIGHTED U.S. COMPOSITE INDEX MOVES WITHIN 15% OF ITS PRERECESSION HIGH. While its recovery began later, the equal-weighted U.S. Composite Index, which is influenced by smaller property sales, has made solid gains and is now back to 2005 levels, although it remains 15% below its 2007 prerecession peak. This reflects the general movement of investment capital in search of higher yields into secondary markets and property types, as pricing for commercial property has escalated in the core coastal markets.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is at a record high, but the equal weighted is still 15% below the pre-recession peak.

There are indexes by sector and region too.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak, but still elevated.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.