by Calculated Risk on 12/10/2014 11:46:00 AM

Wednesday, December 10, 2014

Quarterly Services Survey suggests upward revision to Q3 GDP close to 4.4%

From Reuters: U.S. services data point to upward revision to third-quarter GDP

Economists said the data suggested third-quarter consumer spending could be raised by at least two-tenths of a percentage point from a 2.2 percent annual rate when the government publishes its third estimate later this month.From the WSJ: U.S. Economic Growth Could Get Boost From Services Spending

That combined with data on wholesale inventories and construction spending could see third-quarter GDP revised up to a 4.4 percent annual pace from the 3.9 percent rate reported last month.

J.P. Morgan Chase said Wednesday it expected the QSS will lead to stronger estimates for spending, raising the GDP growth rate to 4.4% from an earlier prediction of 4.3%. Barclays raised its GDP prediction for the third quarter to 4.2% from 4.1%.Here is the Q3 Quarterly Services Press Release

The U.S. Census Bureau announced today that the estimate of U.S. information sector revenue for the third calendar quarter of 2014, adjusted for seasonal variation but not for price changes, was $336.5 billion, an increase of 1.0 percent (± 0.8%) from the second quarter of 2014 and up 5.0 percent (± 0.8%) from the third quarter of 2013.

FNC: Residential Property Values increased 5.7% year-over-year in October

by Calculated Risk on 12/10/2014 09:31:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their October index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values decreased 0.1% from September to October (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) decreased between 0.1% and 0.3% in October. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was lower in October than in September, with the 100-MSA composite up 5.7% compared to October 2013. In general, for FNC, the YoY increase has been slowing since peaking in February at 9.0%.

The index is still down 19.6% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through October 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

All of the price indexes have been showing a slowdown in price increases.

The October Case-Shiller index will be released on Tuesday, December 30th, and I expect Case-Shiller to show a further slowdown in YoY price increases.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 12/10/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 5, 2014. ...

The Refinance Index increased 13 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.11 percent from 4.08 percent, with points remaining unchanged from 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

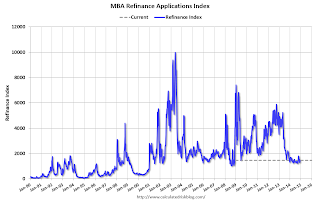

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 72% from the levels in May 2013.

Even with the general decline in mortgage rates, refinance activity is very low this year and 2014 will be the lowest since year 2000. As I've noted before - rates would have to decline significantly for there to be a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 4% from a year ago.

Tuesday, December 09, 2014

Wednesday: Q3 Quarterly Services Report

by Calculated Risk on 12/09/2014 06:44:00 PM

From the WSJ: Drop in Inflation Gauge May Complicate Outlook for Interest Rates

An inflation gauge closely watched by Federal Reserve officials has fallen to the lowest level since the financial crisis, potentially complicating the interest-rate outlook as investors brace for a likely Fed rate increase as soon as mid-2015.With the unemployment rate still elevated, inflation below target, and inflation expectations falling, I expect the Fed will be patient.

The five-year forward five-year inflation breakeven rate hit 2.0185% this month, the lowest since Dec. 31, 2008, according to the latest data provided by Rabobank.

Wednesday:

• At 7:00 AM ET, Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Q3 Quarterly Services Report from the Census Bureau.

• At 2:00 PM, the Monthly Treasury Budget Statement for November.

Las Vegas Real Estate in November: YoY Non-contingent Inventory up 20%, Distressed Sales and Cash Buying down YoY

by Calculated Risk on 12/09/2014 03:31:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices bounce back, while housing sales and supply slip

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in November was 2,483, down from 2,861 in October and down from 2,694 one year ago. At the current pace, [GLVAR President Heidi] Kasama said Southern Nevada has about a four-month supply of available properties. REALTORS® consider a six-month supply to be a balanced market.There are several key trends that we've been following:

...

GLVAR said 31.9 percent of all local properties sold in November were purchased with cash. That’s down from 35.1 percent in October and well short of the February 2013 peak of 59.5 percent, suggesting that fewer investors have been buying homes in Southern Nevada.

...

For roughly two years, GLVAR has reported fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in November, when 9.6 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 10.6 percent in October. Another 8.7 percent of all November sales were bank-owned properties, down from 8.9 percent in October.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in November was 13,421, down 7.0 percent from 14,430 in October and down 5.8 percent from one year ago. GLVAR tracked a total of 3,529 condos and townhomes listed for sale on its MLS in November, down 3.4 percent from 3,653 in October and down 2.6 percent from November 2013.

By the end of November, GLVAR reported 8,195 single-family homes listed without any sort of offer. That’s down 7.7 percent from 8,880 such homes listed in October, but up 20.0 percent from one year ago. For condos and townhomes, the 2,458 properties listed without offers in November represented a 3.5 percent decrease from 2,548 such properties listed in October, but a 12.1 percent increase from one year ago.

emphasis added

1) Overall sales were down 7.8% year-over-year.

2) However conventional (equity, not distressed) sales were up about 5% year-over-year. In November 2013, only 72.0% of all sales were conventional equity. This year, in November 2014, 81.7% were equity sales. Note: In November 2012, only 48.1% were equity!

3) The percent of cash sales has declined year-over-year from 43.7% in November 2013 to 31.9% in November 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 20.0% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing (an important change in many areas).

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |