by Calculated Risk on 12/10/2014 07:01:00 AM

Wednesday, December 10, 2014

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 5, 2014. ...

The Refinance Index increased 13 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.11 percent from 4.08 percent, with points remaining unchanged from 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

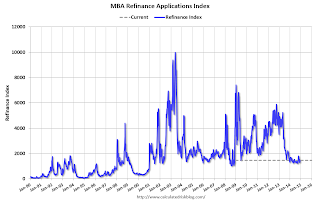

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 72% from the levels in May 2013.

Even with the general decline in mortgage rates, refinance activity is very low this year and 2014 will be the lowest since year 2000. As I've noted before - rates would have to decline significantly for there to be a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 4% from a year ago.

Tuesday, December 09, 2014

Wednesday: Q3 Quarterly Services Report

by Calculated Risk on 12/09/2014 06:44:00 PM

From the WSJ: Drop in Inflation Gauge May Complicate Outlook for Interest Rates

An inflation gauge closely watched by Federal Reserve officials has fallen to the lowest level since the financial crisis, potentially complicating the interest-rate outlook as investors brace for a likely Fed rate increase as soon as mid-2015.With the unemployment rate still elevated, inflation below target, and inflation expectations falling, I expect the Fed will be patient.

The five-year forward five-year inflation breakeven rate hit 2.0185% this month, the lowest since Dec. 31, 2008, according to the latest data provided by Rabobank.

Wednesday:

• At 7:00 AM ET, Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Q3 Quarterly Services Report from the Census Bureau.

• At 2:00 PM, the Monthly Treasury Budget Statement for November.

Las Vegas Real Estate in November: YoY Non-contingent Inventory up 20%, Distressed Sales and Cash Buying down YoY

by Calculated Risk on 12/09/2014 03:31:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices bounce back, while housing sales and supply slip

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in November was 2,483, down from 2,861 in October and down from 2,694 one year ago. At the current pace, [GLVAR President Heidi] Kasama said Southern Nevada has about a four-month supply of available properties. REALTORS® consider a six-month supply to be a balanced market.There are several key trends that we've been following:

...

GLVAR said 31.9 percent of all local properties sold in November were purchased with cash. That’s down from 35.1 percent in October and well short of the February 2013 peak of 59.5 percent, suggesting that fewer investors have been buying homes in Southern Nevada.

...

For roughly two years, GLVAR has reported fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in November, when 9.6 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 10.6 percent in October. Another 8.7 percent of all November sales were bank-owned properties, down from 8.9 percent in October.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in November was 13,421, down 7.0 percent from 14,430 in October and down 5.8 percent from one year ago. GLVAR tracked a total of 3,529 condos and townhomes listed for sale on its MLS in November, down 3.4 percent from 3,653 in October and down 2.6 percent from November 2013.

By the end of November, GLVAR reported 8,195 single-family homes listed without any sort of offer. That’s down 7.7 percent from 8,880 such homes listed in October, but up 20.0 percent from one year ago. For condos and townhomes, the 2,458 properties listed without offers in November represented a 3.5 percent decrease from 2,548 such properties listed in October, but a 12.1 percent increase from one year ago.

emphasis added

1) Overall sales were down 7.8% year-over-year.

2) However conventional (equity, not distressed) sales were up about 5% year-over-year. In November 2013, only 72.0% of all sales were conventional equity. This year, in November 2014, 81.7% were equity sales. Note: In November 2012, only 48.1% were equity!

3) The percent of cash sales has declined year-over-year from 43.7% in November 2013 to 31.9% in November 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 20.0% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing (an important change in many areas).

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

Trulia: Asking House Prices up 7.4% year-over-year in November

by Calculated Risk on 12/09/2014 12:41:00 PM

From Trulia chief economist Jed Kolko: Housing’s Millennial Mismatch

Nationwide, asking prices on for-sale homes jumped 1.5% month-over-month in November, seasonally adjusted — a surprisingly large increase. Future months will tell whether this was a blip or the beginning of a sustained climb. Year-over-year, asking prices rose 7.4%, down from the 10.3% year-over-year increase in November 2013. Asking prices rose year-over-year in 98 of the 100 largest U.S. metros — everywhere but Little Rock and New Haven.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and although year-over-year price increases had been slowing, the year-over-year change increased in November.

Four of the 10 metros where asking prices rose most year-over-year were in Florida. These Sunshine State markets have older populations, and they all have a lower share of millennials than the national average of 21% and a higher share of baby boomers than the average of 24%. In fact, only one of the 10 markets with the largest price increases in November has a higher share of millennials than the national average—and only slightly (Las Vegas, at 22%).

Rents continued to climb. Nationwide, rents rose 6.1% year-over-year in November. Still, rent gains have cooled since August in 14 of the 25 largest rental markets, including the Northern California markets of San Francisco, Oakland, and Sacramento.

emphasis added

The month-to-month increase suggests further house price increases over the next few months on a seasonally adjusted basis.

There is much more in the article.

BLS: Jobs Openings at 4.8 million in October, Up 21% Year-over-year

by Calculated Risk on 12/09/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.8 million job openings on the last business day of October, little changed from 4.7 million in September, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits was unchanged at 2.7 million in October, maintaining the prior month’s increase.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in October to 4.834 million from 4.685 million in September.

The number of job openings (yellow) are up 21% year-over-year compared to October 2013.

Quits are up 12% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is a very positive report. It is a good sign that job openings are over 4 million for the ninth consecutive month (almost to 5 million), and that quits are increasing year-over-year.