by Calculated Risk on 12/05/2014 08:30:00 AM

Friday, December 05, 2014

November Employment Report: 321,000 Jobs, 5.8% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 321,000 in November, and the unemployment rate was unchanged at 5.8 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for September was revised from +256,000 to +271,000, and the change for October was revised from +214,000 to +243,000. With these revisions, employment gains in September and October combined were 44,000 more than previously reported.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

Ten consecutive months over 200 thousand.

Employment is now up 2.73 million year-over-year.

Total employment is now 1.7 million above the pre-recession peak.

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate was unchanged in November at 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.2% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

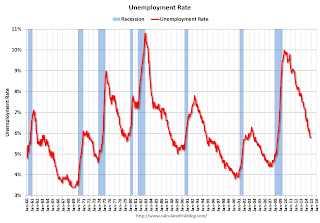

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate was unchanged in November at 5.8%.

This was well above expectations, and with the upward revisions to prior months, this was a strong report. Party like it's 1999!

I'll have much more later ...

Thursday, December 04, 2014

Friday: Employment, Trade Deficit

by Calculated Risk on 12/04/2014 06:33:00 PM

A few employment previews:

From me: Preview: Employment Report for November (reviewing the numbers for the month)

From Tim Duy on the employment report and the Fed Ahead of the November Employment Report

As I have said before, predicting the monthly nonfarm payroll change is a fool's errand, yet an errand we all undertake. I would pick 235k with an upside risk. More important is what happens to wage growth. I expect that to pick up over the next six months, but would be surprised to see any large gain this month.From Andy Kierz at Business Insider: It Could Take Months Before We Find Out Friday's Jobs Report Was Great

One big factor that could weigh on the jobs number is the recent tendency for revisions to the November payroll numbers to be quite a bit larger than for other months ... Sheperdson points out that "over the past five years, the median revision between the first estimate for November and the third, published two months later, is a hefty 71K. The median for the other 11 months of the year is just +23K."The seasonal factor for November might have been skewed by the huge job losses in 2008 and early 2009, and that might be less of a factor now. But it will take some time to know!

If that trend continues, we could see the November jobs number increase by tens of thousands in the later revisions early next year.

Friday:

• At 8:30 AM ET, the Employment Report for November. The consensus is for an increase of 230,000 non-farm payroll jobs added in November, up from the 214,000 non-farm payroll jobs added in October. The consensus is for the unemployment rate to be unchanged at 5.8% in November.

• Also at 8:30 AM, the Trade Balance report for October from the Census Bureau. The consensus is for the U.S. trade deficit to be at $41.5 billion in October from $43.0 billion in September.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.1 decrease in October orders.

• At 3:00 PM, Consumer Credit for October from the Federal Reserve. The consensus is for credit to increase $16.3 billion.

Mortgage Rates decline to 3.89%, No Significant Increase in Refinance Activity Expected

by Calculated Risk on 12/04/2014 01:27:00 PM

A few months ago, there was some discussion of a possible "refi boom" due to falling mortgage rates. I argued then that that was unlikely.

Mortgage rates have fallen further, but rates are still far above the level required for a significant increase in refinance activity.

This morning Freddie Mac reported: Mortgage Rates Lower Across the Board

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates down from the previous week. At 3.89 percent, the average 30-year fixed-rate mortgage is at its lowest level since the week of May 30, 2013.

Click on graph for larger image.

This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index dropped sharply last year when mortgage rates increased. Historically refinance activity picks up significantly when mortgage rates fall about 50 bps from a recent level.

Many borrowers who took out mortgages last year can refinance now - but that is a small number of total borrowers. For a significant increase in refinance activity, rates would have to fall below the late 2012 lows (on a monthly basis, 30 year mortgage rates were at 3.35% in the PMMS in November and December 2012.

Based on the relationship between the 30 year mortgage rate and 10-year Treasury yields, the 10-year Treasury yield would probably have to decline to 1.5% or lower for a significant refinance boom (in the near future). With the 10-year yield currently at 2.27%, I don't expect a significant increase in refinance activity any time soon.

Black Knight October Mortgage Monitor: "8% of mortgages, 4 million borrowers in negative equity"

by Calculated Risk on 12/04/2014 09:47:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for October today. According to BKFS, 5.44% of mortgages were delinquent in October, down from 5.67% in September. BKFS reported that 1.69% of mortgages were in the foreclosure process, down from 2.54% in October 2013.

This gives a total of 7.13% delinquent or in foreclosure. It breaks down as:

• 1,658,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,101,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 858,000 loans in foreclosure process.

For a total of 3,617,000 loans delinquent or in foreclosure in October. This is down from 4,427,000 in October 2013.

This table from Black Knight is a comparison of 2005 to 2014 originations by Credit Score and LTV. Black Knight notes:

Borrowers with credit scores of 740 and up make up 55 percent of 2014 refinance originations, compared to just 29 percent in 2005It is not surprising that the recent vintages of mortgage loan are the best performing ever!

On the other hand, in 2005, 21 percent of refinance originations were to credit scores below 640; today that number is just 8 percent

Today’s purchase market is even more clearly separated; 56 percent of purchase originations were to credit scores of 740 and above, while just 2 percent went to borrowers with scores below 640

This graph shows the percent of loans in negative equity grouped by CLTV.

This graph shows the percent of loans in negative equity grouped by CLTV.From Black Knight:

Over the past two and a half years, there has been a sustained and continual improvement in negative equity, from 33.5 percent of borrowers being underwater in January 2012 to less than eight percent todayThe good news is there are few borrowers with CLTV at or above 150%. The bad news is - for most of these borrowers - the only way out is foreclosure (or a short sale).

Only 1.2 percent of active mortgages have current CLTVs of 150 percent or higher, down from 9.5 percent in January of 2012 (the bottom of the market in terms of national home prices)

While the overall share of underwater mortgages continues to decline, delinquency rates are increasing among the remaining negative equity mortgages

For the severely underwater – 150 percent or higher current CLTVs – over three out of every four borrowers (77 percent) are delinquent

There is much more in the mortgage monitor.

Weekly Initial Unemployment Claims decreased to 297,000

by Calculated Risk on 12/04/2014 08:34:00 AM

The DOL reported:

In the week ending November 29, the advance figure for seasonally adjusted initial claims was 297,000, a decrease of 17,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 313,000 to 314,000. The 4-week moving average was 299,000, an increase of 4,750 from the previous week's revised average. The previous week's average was revised up by 250 from 294,000 to 294,250.The previous week was revised up to 314,000

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 299,000.

This was close to the consensus forecast of 300,000, and the level suggests few layoffs.