by Calculated Risk on 12/03/2014 02:00:00 PM

Wednesday, December 03, 2014

Fed's Beige Book: Economic Activity "continued to expand"

Fed's Beige Book "Prepared at the Federal Reserve Bank of Chicago and based on information collected on or before November 24, 2014."

Reports from the twelve Federal Reserve Districts suggest that national economic activity continued to expand in October and November. A number of Districts also noted that contacts remained optimistic about the outlook for future economic activity. Consumer spending continued to advance in most Districts, and reports on tourism were mostly positive. Employment gains were widespread across Districts, and Districts reporting on business spending generally noted some improvement. Demand for nonfinancial services generally increased. Manufacturing activity strengthened in most Districts. Construction and real estate activity expanded overall, but at a pace that varied by sector and by District.And on real estate:

Construction and real estate activity expanded overall in October and November, but saw a fair amount of variation across sectors and regions. Residential construction increased on balance across the Districts and multifamily construction remained stronger than single-family construction in a number of Districts. Reports on residential real estate activity were mixed. About half of the Districts reported an increase in home sales. Many Districts indicated that sales in the multifamily sector were stronger than sales in the single-family sector. Home prices were little changed in most Districts, although prices increased in the Richmond, Atlanta, Dallas, and San Francisco Districts. Nonresidential construction rose in most Districts. Construction of office space was relatively strong in some large urban areas, such as New York City and Philadelphia. Industrial construction was particularly strong in the Cleveland, Chicago, and Dallas Districts. Commercial real estate activity also increased in many Districts, with declining vacancies and rising rents for office space; especially strong activity was noted in the central business districts of some large urban areas. Vacancies for commercial and industrial space also dropped in several Districts.Residential real estate is "mixed', however nonresidential is picking up. Overall fairly positive.

emphasis added

ISM Non-Manufacturing Index increased to 59.3% in November

by Calculated Risk on 12/03/2014 10:00:00 AM

The November ISM Non-manufacturing index was at 59.3%, up from 57.1% in October. The employment index decreased in November to 56.7%, down from 59.6% in October. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: November 2014 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 58th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 59.3 percent in November, 2.2 percentage points higher than the October reading of 57.1 percent. This represents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased to 64.4 percent, which is 4.4 percentage points higher than the October reading of 60 percent, reflecting growth for the 64th consecutive month at a faster rate. The New Orders Index registered 61.4 percent, 2.3 percentage points higher than the reading of 59.1 percent registered in October. The Employment Index decreased 2.9 percentage points to 56.7 percent from the October reading of 59.6 percent and indicates growth for the ninth consecutive month. The Prices Index increased 2.3 percentage points from the October reading of 52.1 percent to 54.4 percent, indicating prices increased at a faster rate in November when compared to October. According to the NMI®, 14 non-manufacturing industries reported growth in November. Comments from the majority of respondents indicate that business conditions are on track for continued growth. The respondents have also stated that there is some strain on capacity due to the month-over-month increase in activity."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 57.7% and suggests faster expansion in November than in October. A solid report.

ADP: Private Employment increased 208,000 in November

by Calculated Risk on 12/03/2014 08:15:00 AM

– Private sector employment increased by 208,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 226,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Steady as she goes in the job market. Monthly job gains remain consistently over 200,000. At this pace the unemployment rate will drop by half a percentage point per annum. The tightening in the job market will soon prompt acceleration in wage growth.”

The BLS report for November will be released on Friday.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 12/03/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 28, 2014. This week’s results included an adjustment for the Thanksgiving holiday. ...

The Refinance Index decreased 13 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.08 percent, the lowest level since May 2013, from 4.15 percent, with points increasing to 0.28 from 0.25 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

Even with a decline in mortgage rates, refinance activity is very low this year and 2014 will be the lowest since year 2000. As I've noted before - rates would have to decline significantly for there to be a large refinance boom.

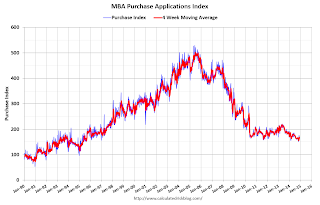

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 4% from a year ago.

Tuesday, December 02, 2014

Wednesday: ISM Non-Mfg Index, ADP Employment, Beige Book

by Calculated Risk on 12/02/2014 07:09:00 PM

Looking ahead to Friday, if net non-farm job growth (November plus revisions) is 222 thousand or more, than 2014 will be the best year for employment since the '90s.

For the private sector, the magic number is 176 thousand to pass 2011 and be the best year since the '90s (seems very likely).

Right now the consensus is for 235 thousand non-farm payroll jobs according to MarketWatch.

Get ready to party like it's 1999!

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 226,000 payroll jobs added in November, down from 230,000 in October.

• At 10:00 AM, the ISM non-Manufacturing Index for November. The consensus is for a reading of 57.7, up from 57.1 in October. Note: Above 50 indicates expansion.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.