by Calculated Risk on 12/03/2014 08:15:00 AM

Wednesday, December 03, 2014

ADP: Private Employment increased 208,000 in November

– Private sector employment increased by 208,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 226,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Steady as she goes in the job market. Monthly job gains remain consistently over 200,000. At this pace the unemployment rate will drop by half a percentage point per annum. The tightening in the job market will soon prompt acceleration in wage growth.”

The BLS report for November will be released on Friday.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 12/03/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 28, 2014. This week’s results included an adjustment for the Thanksgiving holiday. ...

The Refinance Index decreased 13 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.08 percent, the lowest level since May 2013, from 4.15 percent, with points increasing to 0.28 from 0.25 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

Even with a decline in mortgage rates, refinance activity is very low this year and 2014 will be the lowest since year 2000. As I've noted before - rates would have to decline significantly for there to be a large refinance boom.

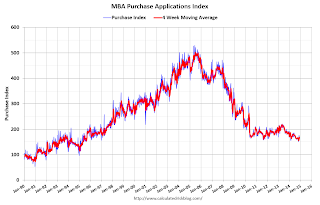

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 4% from a year ago.

Tuesday, December 02, 2014

Wednesday: ISM Non-Mfg Index, ADP Employment, Beige Book

by Calculated Risk on 12/02/2014 07:09:00 PM

Looking ahead to Friday, if net non-farm job growth (November plus revisions) is 222 thousand or more, than 2014 will be the best year for employment since the '90s.

For the private sector, the magic number is 176 thousand to pass 2011 and be the best year since the '90s (seems very likely).

Right now the consensus is for 235 thousand non-farm payroll jobs according to MarketWatch.

Get ready to party like it's 1999!

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 226,000 payroll jobs added in November, down from 230,000 in October.

• At 10:00 AM, the ISM non-Manufacturing Index for November. The consensus is for a reading of 57.7, up from 57.1 in October. Note: Above 50 indicates expansion.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

U.S. Light Vehicle Sales increase to 17.1 million annual rate in November

by Calculated Risk on 12/02/2014 02:44:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 17.08 million SAAR in November. That is up 5.5% from November 2013, and up 4.5% from the 16.35 million annual sales rate last month.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for November (red, light vehicle sales of 17.08 million SAAR from WardsAuto).

This was above the consensus forecast of 16.5 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This was another strong month for vehicle sales - the second month with 17 million SAAR this year - and the seventh consecutive month with a sales rate over 16 million.

Update: More 2015 Housing Forecasts

by Calculated Risk on 12/02/2014 12:39:00 PM

A few more updates ...

Update 12/5/2014 more from Zillow: 2015: A Big Year for Buyers

Update 12/2/2014 added CoreLogic.

Update 11/26/2014 for Merrill Lynch (minor downward revisions) and Fannie Mae (Noveber update, no changes)

Update 11/24/2014: I've added Metrostudy's forecast.

Update: I've added the MBA and Goldman Sachs forecasts. Also Wells Fargo updated their forecast (slight changes).

Towards the end of each year I collect some housing forecasts for the following year, and it looks like most analysts are optimistic for 2015.

Here is a summary of forecasts for 2014. In 2014, new home sales will be around 440 thousand, and total housing starts will be close to 1 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high).

In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Note: Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays were the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2015.

From Fannie Mae: Housing Forecast: November 2014

From NAHB: Single-Family Production Poised to Take Off in 2015

I don't have Moody's Analytics' forecast, but Mark Zandi, chief economist at Moody's Analytics said today "that single-family starts could be closing in on 1 million units by the end of 2015 and multifamily production could go as high as 500,000 units." That seems too high.

I haven't worked up a forecast yet for 2015.

| Housing Forecasts for 2015 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Chapman U | 1,056 | 2.4% | ||

| CoreLogic | 498 | 743 | 1,124 | 5.2%5 |

| Fannie Mae | 523 | 783 | 1,170 | 4.9%2 |

| Goldman Sachs | 521 | 1,166 | 3.1% | |

| Merrill Lynch | 530 | 1,175 | 3.7% | |

| Metrostudy | 515 | 730 | 1,100 | 3.9%4 |

| MBA | 503 | 728 | 1,108 | 3.0%2 |

| NAHB | 547 | 802 | 1,158 | |

| NAR | 620 | 1,300 | 4%3 | |

| Wells Fargo | 530 | 770 | 1,160 | 3.3% |

| Zillow | 501 | 1,113 | 2.5%4 | |

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Home price 4Zillow Home Value Index, Oct 2014 to Oct 2015 5CoreLogic HPI | ||||