by Calculated Risk on 12/03/2014 07:00:00 AM

Wednesday, December 03, 2014

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 28, 2014. This week’s results included an adjustment for the Thanksgiving holiday. ...

The Refinance Index decreased 13 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.08 percent, the lowest level since May 2013, from 4.15 percent, with points increasing to 0.28 from 0.25 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

Even with a decline in mortgage rates, refinance activity is very low this year and 2014 will be the lowest since year 2000. As I've noted before - rates would have to decline significantly for there to be a large refinance boom.

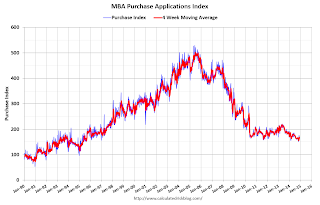

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 4% from a year ago.

Tuesday, December 02, 2014

Wednesday: ISM Non-Mfg Index, ADP Employment, Beige Book

by Calculated Risk on 12/02/2014 07:09:00 PM

Looking ahead to Friday, if net non-farm job growth (November plus revisions) is 222 thousand or more, than 2014 will be the best year for employment since the '90s.

For the private sector, the magic number is 176 thousand to pass 2011 and be the best year since the '90s (seems very likely).

Right now the consensus is for 235 thousand non-farm payroll jobs according to MarketWatch.

Get ready to party like it's 1999!

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 226,000 payroll jobs added in November, down from 230,000 in October.

• At 10:00 AM, the ISM non-Manufacturing Index for November. The consensus is for a reading of 57.7, up from 57.1 in October. Note: Above 50 indicates expansion.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

U.S. Light Vehicle Sales increase to 17.1 million annual rate in November

by Calculated Risk on 12/02/2014 02:44:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 17.08 million SAAR in November. That is up 5.5% from November 2013, and up 4.5% from the 16.35 million annual sales rate last month.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for November (red, light vehicle sales of 17.08 million SAAR from WardsAuto).

This was above the consensus forecast of 16.5 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This was another strong month for vehicle sales - the second month with 17 million SAAR this year - and the seventh consecutive month with a sales rate over 16 million.

Update: More 2015 Housing Forecasts

by Calculated Risk on 12/02/2014 12:39:00 PM

A few more updates ...

Update 12/5/2014 more from Zillow: 2015: A Big Year for Buyers

Update 12/2/2014 added CoreLogic.

Update 11/26/2014 for Merrill Lynch (minor downward revisions) and Fannie Mae (Noveber update, no changes)

Update 11/24/2014: I've added Metrostudy's forecast.

Update: I've added the MBA and Goldman Sachs forecasts. Also Wells Fargo updated their forecast (slight changes).

Towards the end of each year I collect some housing forecasts for the following year, and it looks like most analysts are optimistic for 2015.

Here is a summary of forecasts for 2014. In 2014, new home sales will be around 440 thousand, and total housing starts will be close to 1 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high).

In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Note: Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays were the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2015.

From Fannie Mae: Housing Forecast: November 2014

From NAHB: Single-Family Production Poised to Take Off in 2015

I don't have Moody's Analytics' forecast, but Mark Zandi, chief economist at Moody's Analytics said today "that single-family starts could be closing in on 1 million units by the end of 2015 and multifamily production could go as high as 500,000 units." That seems too high.

I haven't worked up a forecast yet for 2015.

| Housing Forecasts for 2015 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Chapman U | 1,056 | 2.4% | ||

| CoreLogic | 498 | 743 | 1,124 | 5.2%5 |

| Fannie Mae | 523 | 783 | 1,170 | 4.9%2 |

| Goldman Sachs | 521 | 1,166 | 3.1% | |

| Merrill Lynch | 530 | 1,175 | 3.7% | |

| Metrostudy | 515 | 730 | 1,100 | 3.9%4 |

| MBA | 503 | 728 | 1,108 | 3.0%2 |

| NAHB | 547 | 802 | 1,158 | |

| NAR | 620 | 1,300 | 4%3 | |

| Wells Fargo | 530 | 770 | 1,160 | 3.3% |

| Zillow | 501 | 1,113 | 2.5%4 | |

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Home price 4Zillow Home Value Index, Oct 2014 to Oct 2015 5CoreLogic HPI | ||||

Construction Spending increased 1.1% in October

by Calculated Risk on 12/02/2014 10:03:00 AM

The Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2014 was estimated at a seasonally adjusted annual rate of $971.0 billion, 1.1 percent above the revised September estimate of $960.3 billion.Both private and public spending increased in October:

Spending on private construction was at a seasonally adjusted annual rate of $692.4 billion, 0.6 percent above the revised September estimate of $688.0 billion. Residential construction was at a seasonally adjusted annual rate of $353.8 billion in October, 1.3 percent above the revised September estimate of $349.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $338.6 billion in October, 0.1 percent below the revised September estimate of $338.9 billion. ...Note: Non-residential for offices and hotels is increasing, but spending for oil and gas is declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In October, the estimated seasonally adjusted annual rate of public construction spending was $278.6 billion, 2.3 percent above the revised September estimate of $272.3 billion.

emphasis added

As an example, construction spending for lodging is up 16% year-over-year, whereas spending for power (includes oil and gas) construction is declining since peaking in May.

Click on graph for larger image.

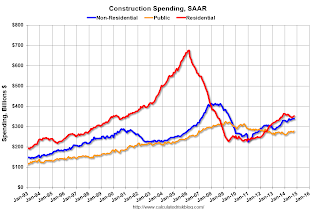

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 48% below the peak in early 2006 - but up 55% from the post-bubble low.

Non-residential spending is 18% below the peak in January 2008, and up about 50% from the recent low.

Public construction spending is now 14% below the peak in March 2009 and about 7% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 2%. Non-residential spending is up 6% year-over-year. Public spending is up 2% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup (except oil and gas), and public spending has probably hit bottom after several years of austerity.

This was a strong report - well above the consensus forecast of a 0.5% increase - and there were also upward revisions to spending in August and September.