by Calculated Risk on 12/02/2014 10:03:00 AM

Tuesday, December 02, 2014

Construction Spending increased 1.1% in October

The Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2014 was estimated at a seasonally adjusted annual rate of $971.0 billion, 1.1 percent above the revised September estimate of $960.3 billion.Both private and public spending increased in October:

Spending on private construction was at a seasonally adjusted annual rate of $692.4 billion, 0.6 percent above the revised September estimate of $688.0 billion. Residential construction was at a seasonally adjusted annual rate of $353.8 billion in October, 1.3 percent above the revised September estimate of $349.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $338.6 billion in October, 0.1 percent below the revised September estimate of $338.9 billion. ...Note: Non-residential for offices and hotels is increasing, but spending for oil and gas is declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In October, the estimated seasonally adjusted annual rate of public construction spending was $278.6 billion, 2.3 percent above the revised September estimate of $272.3 billion.

emphasis added

As an example, construction spending for lodging is up 16% year-over-year, whereas spending for power (includes oil and gas) construction is declining since peaking in May.

Click on graph for larger image.

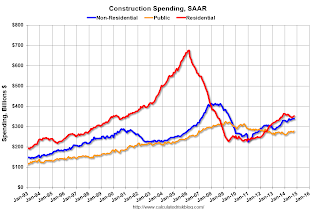

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 48% below the peak in early 2006 - but up 55% from the post-bubble low.

Non-residential spending is 18% below the peak in January 2008, and up about 50% from the recent low.

Public construction spending is now 14% below the peak in March 2009 and about 7% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 2%. Non-residential spending is up 6% year-over-year. Public spending is up 2% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup (except oil and gas), and public spending has probably hit bottom after several years of austerity.

This was a strong report - well above the consensus forecast of a 0.5% increase - and there were also upward revisions to spending in August and September.

CoreLogic: House Prices up 6.1% Year-over-year in October

by Calculated Risk on 12/02/2014 09:00:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports More Than Half of States At or Within 10 Percent of Pre-Crisis Home Price Peak

Home prices nationwide, including distressed sales, increased 6.1 percent in October 2014 compared to October 2013. This change represents 32 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, rose by 0.5 percent in October 2014 compared to September 2014.

...

Excluding distressed sales, home prices nationally increased 5.6 percent in October 2014 compared to October 2013 and 0.6 percent month over month compared to September 2014. Also excluding distressed sales, 49 states and the District of Columbia showed year-over-year home price appreciation in October, with Mississippi being the only state to experience a year-over-year decline (-1.2 percent). Distressed sales include short sales and real estate owned (REO) transactions. ...

“Home price growth is moderating as we head into the late fall and is currently running at half the pace it was in the spring of 2014,” said Sam Khater, deputy chief economist at CoreLogic. “However, there are still pockets of strength, especially in several Texas markets, as well as Seattle, Denver and other markets with strong economic fundamentals.”

emphasis added

Click on graph for larger image.

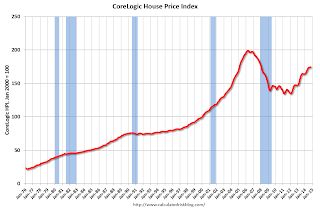

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.5% in October, and is up 6.1% over the last year.

This index is not seasonally adjusted, and this month-to-month increase was fairly strong during the seasonally weak period.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty two consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty two consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increases had been slowing, but picked up a little in October.

Monday, December 01, 2014

Tuesday: Auto Sales, Construction Spending

by Calculated Risk on 12/01/2014 09:09:00 PM

Oh no! From the WSJ: Dodgy Home Appraisals Are Making a Comeback

An estimated one in seven appraisals conducted from 2011 through early 2014 inflated home values by 20% or more, according to data provided to The Wall Street Journal by Digital Risk Analytics, a subsidiary of Digital Risk LLC. The mortgage-analysis and consulting firm based in Maitland, Fla., was hired by some of the 20 largest lenders to review their loan files.During the bubble, the appraiser always seemed to "hit the number" - no matter how crazy. I haven't seen anything like that in my area.

The firm reviewed more than 200,000 mortgages, parsing the homes’ appraised values and other information, including the properties’ sizes and similar homes sold in the areas at the times. The review was conducted using the firm’s software and staff appraisers.

Bankers, appraisers and federal officials in interviews said inflated appraisals are becoming more widespread as the recovery in the housing market cools.

Tuesday:

• All day, Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).

• At 10:00 AM ET, Construction Spending for October. The consensus is for a 0.5% increase in construction spending.

Restaurant Performance Index increased in October

by Calculated Risk on 12/01/2014 04:57:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index Registered Gain in October

Driven by stronger sales and traffic and a more optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) posted a solid gain in October. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.8 in October, up 1.8 percent from its September level. In addition, the RPI stood above 100 for the 20th consecutive month, which signifies expansion in the index of key industry indicators.

“The positive same-store sales and customer traffic results suggest that restaurants are the beneficiaries of falling gas prices, which were down $0.88 since the end of June,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Elevated food costs continue to top the list of challenges reported by restaurant operators, but overall they remain generally optimistic that business conditions will improve in the months ahead.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.8 in October, up from 101.0 in September. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is a strong reading - and as Riehle noted - it appears restaurants are benefiting from lower gasoline prices.

Housing: Demographics for Renting and Buying

by Calculated Risk on 12/01/2014 01:36:00 PM

It was over four years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive. (note: the beginning of this post is from an earlier post on apartment supply and demand).

The drivers were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

The demographics are still favorable for apartments, since a large cohort is still moving into the 20 to 34 year old age group (a key age group for renters). Also, in 2015, based on Census Bureau projections, the two largest 5 year cohorts will be 20 to 24 years old, and 25 to 29 years old (the largest cohorts will no longer be the "boomers"). Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in the 20 to 34 year age group has been increasing. This is actual data from the Census Bureau for 1985 through 2010, and current projections from the Census Bureau from 2015 through 2035.

The circled area shows the recent and projected increase for this group.

From 2020 to 2030, the population for this key rental age group is expected to remain mostly unchanged.

This favorable demographic is a key reason I've been positive on the apartment sector for the last several years - and I expect new apartment construction to stay strong for several more years.

This graph is from 1990 to 2060 (all data from BLS: 1990 to 2013 is actual, 2014 to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.