by Calculated Risk on 11/27/2014 11:16:00 AM

Thursday, November 27, 2014

Word of the Year

Each year since 2003, Merriam-Webster has listed the Words of the Year mostly based on the frequency that each word was looked up that year.

Some years the "words of the year" have been relevant to Calculated Risk, as an example, in 2004 the word of the year was "blog" (CR was started in January 2005 partly because I was wondering what a "blog" was). In 2008, the word of the year was "bailout", and in 2010 the word was "austerity".

For fun, here are a few suggestions for "word of the year" related to the blog since 2004 (I'm sure others will have better suggestions):

2004: Blog (Merriam-Webster)

2005: Bubble. This was the peak year for the housing bubble (activity peaked in 2005, although prices peaked in early 2006). Writing about the housing bubble was the main topic on the blog in 2005.

2006: Bust. This was when the housing bust started.

2007: Subprime or Recession. It was 2007 that "subprime" started to be used by the general public. An alternative would be "recession" since the Great Recession started in December 2007, and a key topic on the blog all year was when the recession would start. Other words could be: delinquency, Alt-A, and NINJA (No income, jobs or asset loans).

2008: Bailout (Merriam-Webster). Three alternatives could be "Financial Crisis", "TARP" and "foreclosure".

2009: Stimulus. An alternative could be "deflation".

2010: Austerity (Merriam-Webster). Unfortunately austerity could be the "word of the year" for several years.

2011: Default. This was the year Congress threatened to default on paying the bills.

2012: Short Sale. This was probably the year that short sales peaked. This was the year house prices bottomed (but I couldn't think of a "word")

2013: Shutdown. In 2013, Congress shut down the government.

2014: Employment. In May 2014, employment surpassed the pre-recession peak, and 2014 will be the best year for employment since the '90s.

2015: Wages (Just being hopeful - maybe 2015 will be the year that real wages start to increase)

Happy Thanksgiving to all!

Wednesday, November 26, 2014

Fannie Mae: Mortgage Serious Delinquency rate declined in October, Lowest since October 2008

by Calculated Risk on 11/26/2014 08:21:00 PM

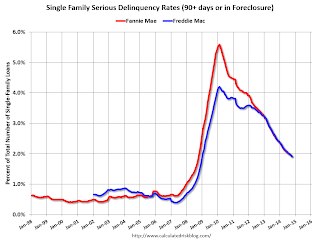

Fannie Mae reported yesterday that the Single-Family Serious Delinquency rate declined in October to 1.92% from 1.96% in September. The serious delinquency rate is down from 2.48% in October 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier this week, Freddie Mac reported that the Single-Family serious delinquency rate declined in October to 1.91% from 1.96% in September. Freddie's rate is down from 2.48% in September 2013, and is at the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.56 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in 2016 - although the rate of decline has slowed recently.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be close to normal in late 2016.

Zillow: Case-Shiller House Price Index year-over-year change expected to slow further in October

by Calculated Risk on 11/26/2014 03:47:00 PM

The Case-Shiller house price indexes for September were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Oct. 2014 Case-Shiller Prediction: Expect the Slowdown to Continue

The September S&P/Case-Shiller (SPCS) data out [yesterday] showed more slowing in the housing market, with annual growth in the 20-city index falling 0.7 percentage points from August’s pace to 4.9 percent in September. This is the first time annual appreciation for the 20-city index has been below 5 percent since October 2012. The national index was up 4.8 percent on an annual basis in September.So the Case-Shiller index will probably show a lower year-over-year gain in October than in September (4.9% year-over-year for the Composite 20 in September, 4.8% year-over-year for the National Index).

Our current forecast for October SPCS data indicates further slowing, with the annual increase in the 20-City Composite Home Price Index falling to 4.3 percent.

The non-seasonally adjusted (NSA) 20-City index was flat from August to September, and we expect it to decrease 0.4 percent in October. We also expect a monthly decline for the 10-City Composite Index, which is projected to fall 0.4 percent from September to October (NSA).

All forecasts are shown in the table below. These forecasts are based on the September SPCS data release and the October 2014 Zillow Home Value Index (ZHVI), released Nov. 20. Officially, the SPCS Composite Home Price Indices for October will not be released until Tuesday, Dec. 30.

| Zillow October 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | October 2013 | 180.29 | 178.20 | 165.90 | 164.01 |

| Case-Shiller (last month) | September 2014 | 188.68 | 184.84 | 173.72 | 170.19 |

| Zillow Forecast | YoY | 4.2% | 4.2% | 4.3% | 4.3% |

| MoM | -0.4% | 0.2% | -0.4% | 0.2% | |

| Zillow Forecasts1 | 187.9 | 185.4 | 173.0 | 170.8 | |

| Current Post Bubble Low | 146.45 | 149.87 | 134.07 | 137.05 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 28.3% | 23.7% | 29.1% | 24.6% | |

| Bubble Peak | 226.29 | 226.87 | 206.52 | 206.61 | |

| Date of Bubble Peak | Jun-06 | Apr-06 | Jul-06 | Apr-06 | |

| Below Bubble Peak | 17.0% | 18.3% | 16.2% | 17.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Comments on October New Home Sales

by Calculated Risk on 11/26/2014 12:24:00 PM

The new home sales report for October was below expectations at 458 thousand on a seasonally adjusted annual rate basis (SAAR).

Also, sales for the previous three months (July, August and September), were revised down.

Sales this year are significantly below expectations, however, based on the low level of sales, more lots coming available, and demographics, it seems likely sales will continue to increase over the next several years.

Earlier: New Home Sales at 458,000 Annual Rate in October

The Census Bureau reported that new home sales this year, through October, were 371,000, Not seasonally adjusted (NSA). That is up 1% from 367,000 during the same period of 2013 (NSA). Not much of a gain from last year. Right now it looks like sales will barely be up this year.

Sales were up 1.8% year-over-year in October.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will be small in Q4, but I expect sales to be up for the quarter and for the year.

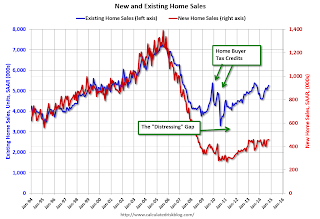

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will continue to decline and be somewhat offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 458,000 Annual Rate in October

by Calculated Risk on 11/26/2014 10:00:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 458 thousand.

September sales were revised down from 467 thousand to 455 thousand, and August sales were revised down from 466 thousand to 453 thousand.

"Sales of new single-family houses in October 2014 were at a seasonally adjusted annual rate of 458,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.7 percent above the revised September rate of 455,000 and is 1.8 percent above the October 2013 estimate of 450,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in October to 5.6 months from 5.5 months in September.

The months of supply increased in October to 5.6 months from 5.5 months in September. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of October was 212,000. This represents a supply of 5.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2014 (red column), 37 thousand new homes were sold (NSA). Last year 36 thousand homes were sold in October. This was the best October since 2007.

The high for October was 105 thousand in 2005, and the low for October was 23 thousand in 2010.

This was below expectations of 470,000 sales in October, and there were downward revisions to sales in July, August and September.

I'll have more later today.