by Calculated Risk on 11/12/2014 09:38:00 AM

Wednesday, November 12, 2014

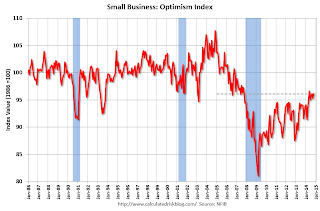

NFIB: Small Business Optimism Index Increases in October

From the National Federation of Independent Business (NFIB): More owners plan to make capital expenditures, expect sales to increase

The NFIB Small Business Optimism Index crept back to its August level of 96.1 with a gain of 0.8 points led by a modest increase in the net percent of owners who plan to increase capital spending and more who expect higher sales in the next 3 months. ...And in another positive sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 12, down from 17 last year - and "taxes" at 21 and "regulations" are the top problems at 22 (taxes are usually reported as the top problem during good times).

Job creation plans improved a point to a seasonally adjusted net 10 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 96.1 in October from 95.3 in September.

Note: There is high percentage of real estate related businesses in the "small business" survey - and this has held down over all optimism.

MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

by Calculated Risk on 11/12/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 7, 2014. ...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.19 percent from 4.17 percent, with points increasing to 0.26 from 0.22 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 71% from the levels in May 2013.

Even with the recent slight small increase in activity - as people who purchased in the last year or so refinance - refinance activity is very low this year and 2014 will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 11% from a year ago.

Tuesday, November 11, 2014

Wednesday: Small Business Optimism

by Calculated Risk on 11/11/2014 06:29:00 PM

From the LA Times: West Coast port slowdown raises fears of dockworker strike or lockout

A six-year agreement covering nearly 20,000 dockworkers at 29 West Coast ports expired July 1. The sides have been negotiating since May. In 2002, amid talks for a previous contract, employers accused the union of go-slow tactics, then locked out dockworkers for 10 days, shutting down ports along the West Coast.Most of the holiday related goods have already arrived, but a shutdown could have a short term impact on the economy.

Some businesses are worried that ports could be shut down again. ... During a shutdown ... some workers — including 20,000 dockworkers — would sit idle and not collect a paycheck.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 7:30 AM, the NFIB Small Business Optimism Index for October.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.2% increase in inventories.

Lawler on D.R. Horton: Net Orders Jump as Increased Incentives Continued; Expects Big Increase in Unit Sales, Flat Home Prices Next Year

by Calculated Risk on 11/11/2014 01:41:00 PM

From housing economist Tom Lawler: D.R. Horton: Net Orders Jump as Increased Incentives Continued; Expects Big Increase in Unit Sales, Flat Home Prices Next Year

D.R. Horton reported that net home orders in the quarter ended September 30, 2014 totaled 7,135, up 38.3% from the comparable quarter of 2013. Net orders per community were up about 25% from a year ago. ... Home deliveries totaled 8,612 last quarter, up 25.4% from the comparable quarter of 2013, at an average sales price of $279,099, up 6.3% from a year ago. The company’s order backlog at the end of September was 9,888, up 20.5% from last September, at an average order price of $289,118, up 7.3% from a year ago.

On the net order front, orders were up the most in the company’s “East” division (YOY up 93%), which included orders from the housing inventory acquired from Crown Communities and where there are a “disproportionate” number of Express home communities (the relatively new product line for entry-level buyers, as most Express communities are in the Carolinas and Texas).

With respect to the YOY increase in the average price of homes closed last quarter (6.3%), company officials said that the average size of home closed last quarter was up 4% from a year earlier, while the average sales price per square foot was up just a little.

Company officials said that incentives last quarter were little changed from the previous quarter, implying that they were up significantly from a year ago. In order to increase the pace of absorptions, Horton increased significantly its sales incentive starting this spring, to what officials called “more normal long-term levels” from the “much lower than normal” levels of the past few years.

Horton said that at the end of September it owned or controlled 183,500 lots, up 1.4% from a year earlier but up 62.8% from September 2011. From the latter part of 2011 through the first half of 2013 Horton acquired a huge land/lot position, which “positioned” the company well for a housing recovery but which also has “pushed” the company to drive more home sales with more aggressive pricing than most of its competitors.

While a company official characterized overall housing demand as “relatively stable,” the company’s “broad geographic footprint and diversified product offerings across our three brands,” combined with its “sizable inventories of homes and finished lots” and more aggressive pricing, enabled Horton to achieve the highest market share in the company’s history.

For the fiscal year ending September 30, 2014 Horton home closings totaled 28,670 at an average sales price of about $272,200. The company said that in FY 2015 it “expects” home closings to be 34,500 to 37,500 (an increase of 20-30%), at an average sales price that is expected to be “little changed” from FY 2014.

CR Note: Below is a table of annual fiscal year sales (via Lawler). The increase in 2010 was related to the ill-conceived housing tax credit. Note that D.R. Horton increased sales 19% this fiscal year, even though total new home sales were only up a little.

Two key points: Incentives are up significantly (back to "normal" according to Horton) and prices are mostly flat.

| Horton: Homes Closed during Fiscal Year Ending September 30 | ||

|---|---|---|

| Fiscal Year | Sales | YoY % Change |

| 2001 | 21,371 | --- |

| 2002 | 29,761 | 39.3% |

| 2003 | 35,934 | 20.7% |

| 2004 | 43,567 | 21.2% |

| 2005 | 51,172 | 17.5% |

| 2006 | 53,099 | 3.8% |

| 2007 | 41,370 | -22.1% |

| 2008 | 26,396 | -36.2% |

| 2009 | 16,703 | -36.7% |

| 2010 | 20,875 | 25.0% |

| 2011 | 16,695 | -20.0% |

| 2012 | 18,890 | 13.1% |

| 2013 | 24,155 | 27.9% |

| 2014 | 28,670 | 18.7% |

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 11/11/2014 11:12:00 AM

By request, a few more employment graphs that I haven't posted in a few months ...

Here are the previous posts on the employment report:

• October Employment Report: 214,000 Jobs, 5.8% Unemployment Rate

• Comments: Solid Employment Report, Seasonal Retail Hiring at Record Level

• Employment: Party Like It's 1999!

• Update: Prime Working-Age Population Growing Again

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is just below 1.9% of the labor force - the lowest since January 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 663 thousand.

The BLS diffusion index for total private employment was at 62.3 in October, up from 60.4 in September.

The BLS diffusion index for total private employment was at 62.3 in October, up from 60.4 in September.For manufacturing, the diffusion index increased to 58.6, up from 53.1 in September.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was widespread in October.