by Calculated Risk on 11/07/2014 08:30:00 AM

Friday, November 07, 2014

October Employment Report: 214,000 Jobs, 5.8% Unemployment Rate

From the BLS:

Total nonfarm payroll employment rose by 214,000 in October, and the unemployment rate edged down to 5.8 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for August was revised from +180,000 to +203,000, and the change for September was revised from +248,000 to +256,000. With these revisions, employment gains in August and September combined were 31,000 more than previously reported.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

Employment is now up 2.64 million year-over-year.

Total employment is now 1.3 million above the pre-recession peak.

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate increased in October to 62.8% from 62.7% in September. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio increased to 59.2% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

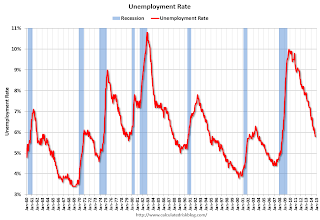

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate decreased in October to 5.8%.

This was below expectations, but with the upward revisions to prior months, this was solid report.

I'll have much more later ...

Thursday, November 06, 2014

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 11/06/2014 07:33:00 PM

Yesterday I posted a summary of the monthly October employment related data: Preview: Employment Report for October. Overall the data has been positive.

From Goldman Sachs economist Kris Dawsey:

We forecast nonfarm payroll job growth of 235k in October, in line with consensus and slightly above the three-month average of 224k. On balance, labor market indicators appear consistent with a solid underlying trend on job growth.That is an interesting comment on revisions, so here are the two-month revisions released in the last five October employment reports:

...

Back revisions have a strong tendency to be positive in the October report ... over the past five years, the average net two-month back revision has been +89k, the strongest of any month of the year. While we do not necessarily expect a revision of quite that magnitude this year (the average size of the revisions seems to have trended down a bit since 2010), we think the odds favor a substantial upward revision to August and September job growth.

...

we expect the unemployment rate to remain unchanged at 5.9% in October ... This forecast assumes a roughly stable labor force participation rate. We forecast a 0.3% month-on-month gain in average hourly earnings, reflecting some degree of "catch-up" from last month's flat reading. An October increase in line with our forecast would leave the year-on-year rate at a still-subdued 2.1%.

2009: Total +91,000 "The change in total nonfarm payroll employment for August was revised from -201,000 to -154,000, and the change for September was revised from -263,000 to -219,000."

2010: Total +110,000 "The change in total nonfarm payroll employment for August was revised from -57,000 to -1,000, and the change for September was revised from -95,000 to -41,000."

2011: Total +98,000 "The change in total nonfarm payroll employment for August was revised from +57,000 to +104,000, and the change for September was revised from +103,000 to +158,000."

2012: Total +84,000 "The change in total nonfarm payroll employment for August was revised from +142,000 to +192,000, and the change for September was revised from +114,000 to +148,000."

2013: Total +60,000 "The change in total nonfarm payroll employment for August was revised from +193,000 to +238,000, and the change for September was revised from +148,000 to +163,000."

Friday:

• At 8:30 AM, the Employment Report for October. The consensus is for an increase of 240,000 non-farm payroll jobs added in October, down from the 248,000 non-farm payroll jobs added in September. The consensus is for the unemployment rate to be unchanged at 5.9% in October. As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

• At 3:00 PM, Consumer Credit for September from the Federal Reserve. The consensus is for credit to increase $16.0 billion.

Lawler: Fannie, Freddie in Q3

by Calculated Risk on 11/06/2014 05:08:00 PM

From housing economist Tom Lawler:

Fannie Mae reported that GAAP net income in the quarter ended September 30, 2014 was $3.9 billion, while “comprehensive income” was $4.0 billion. As a result, in December Fannie Mae will make a dividend payment to the US Treasury of $4.0 billion, bringing total dividend payments to $134.5 billion, compared to $116.1 billion in previous “draws” from the Treasury. Dividend payments do not reduce the Treasury’s senior preferred stock balance.

Freddie Mac reported that GAAP net income in the quarter ended September 30, 2014 was $2.0 billion, while “comprehensive income” was $2.8 billion. As a result, in December Freddie Mac will make a dividend payment to the US Treasury of $2.8 billion, bringing total dividend payments to $91.0 billion, compared to $71.3 billion in previous “draws” from the Treasury. Dividend payments do not reduce the Treasury’s senior preferred stock balance.

Fannie’s average charged Gfee on new SF acquisitions last quarter was 63.5 bp, up from 25.7 bp in 2010.

Freddie’s average charged Gfee on new SF acquisitions last quarter was 57.2 bp, up from 25 bp in 2010.

Freddie’s regulator instructed the GSEs to raise base fees several times over the last four or so years. In addition, pursuant to the Temporary Payroll Tax Cut Continuation Act of 2011, both Fannie and Freddie increased their guaranty fee on all SF residential mortgages delivered to them on of after April 1, 2012 by 10 basis points, with the incremental revenue being remitted to Treasury.

CR Note: Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased 17% year-over-year in Q3 for Fannie and Freddie combined, and combined REO inventory is at the lowest level since Q3 2009.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.

NAHB: Builder Confidence improves for the 55+ Housing Market in Q3

by Calculated Risk on 11/06/2014 02:55:00 PM

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low. Note that this index is Not Seasonally Adjusted (NSA)

From the NAHB: Builders Gain Confidence in the 55+ Housing Market

Builder confidence in the 55+ housing market was up again in the third quarter, according to the latest release of NAHB’s 55+ Housing Market Index (55+HMI). The 55+ HMI release contains separate indices for single-family homes and multifamily condominiums. Each is a weighted average of three components: present sales, expected sales, and traffic. The numbers are not seasonally adjusted, so they should only be compared year over year. On that basis, both were up in the third quarter.

The single-family 55+ HMI jumped nine points from the third quarter of 2013, to 59—the highest third-quarter reading since the inception of the index in 2008 and the 12th consecutive quarter of year over year improvements. All three components posted year-over-year increases: present sales jumped 13 points to 65, expected sales for the next six months climbed 10 points to 63 and traffic of prospective buyers rose three points to 46.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q3 2014. The index increased in Q3 to 59 from 56 in Q2, and up from 50 in Q3 2013. This indicates that more builders view conditions as good than as poor.

There are two key drivers in addition to the improved economy: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Las Vegas Real Estate in October: YoY Non-contingent Inventory up 26%, Distressed Sales and Cash Buying down YoY

by Calculated Risk on 11/06/2014 10:57:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports dip in local home prices

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in October was 2,861, down from 2,982 in September and down from 3,192 one year ago. At the current pace, [GLVAR President Heidi] Kasama said Southern Nevada has about a four-month supply of available properties. REALTORS® consider a six-month supply to be a balanced market.There are several key trends that we've been following:

...

GLVAR said 35.1 percent all local properties sold in October were purchased with cash. That’s up from 34.3 percent in September, but still well short of the February 2013 peak of 59.5 percent, suggesting that fewer investors have been buying homes in Southern Nevada.

...

For nearly two years, GLVAR has reported fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend generally continued in October, when GLVAR reported that 10.6 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s up from 10.4 percent in September. Another 8.9 percent of all October sales were bank-owned properties, up from 8.8 percent in September and matching the percentage in August.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in October was 14,430, up 4.1 percent from 13,857 in September, but down 3.9 percent from one year ago. ...

By the end of October, GLVAR reported 8,880 single-family homes listed without any sort of offer. That’s up 8.3 percent from 8,196 such homes listed in September and up 25.6 percent from one year ago. For condos and townhomes, the 2,548 properties listed without offers in October represented a 5.5 percent increase from 2,415 such properties listed in September and a 13.4 percent increase from one year ago.

emphasis added

1) Overall sales were down 10.4% year-over-year.

2) However conventional (equity, not distressed) sales were only down slightly year-over-year. In October 2013, only 73.0% of all sales were conventional equity. This year, in October 2014, 80.5% were equity sales.

3) The percent of cash sales has declined year-over-year from 44.9% in October 2013 to 35.1% in October 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 25.6% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing (an important change in many areas).

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |