by Calculated Risk on 10/15/2014 10:33:00 AM

Wednesday, October 15, 2014

NY Fed: Empire State Manufacturing Survey indicates "business activity grew modestly" in October

Earlier from the NY Fed: Empire State Manufacturing Survey

The October 2014 Empire State Manufacturing Survey indicates that business activity grew modestly for New York manufacturers. The headline general business conditions index fell twenty-one points to 6.2, signaling that the pace of growth slowed significantly from last month. The new orders index dropped nineteen points to -1.7, indicating a slight decline in orders, and the shipments index fell twenty-six points to 1.1, indicating that shipments were flat. The employment index rose seven points to 10.2, pointing to an increase in employment levels, while the average workweek index fell to a level just below zero, suggesting that hours worked held steady ...This is the first of the regional surveys for October. The general business conditions index was well below the consensus forecast of a reading of 20.0, and indicates significantly slower expansion (above zero suggests expansion).

Most of the indexes assessing the future outlook were down from last month. Nevertheless, they remained fairly high by historical standards, and conveyed an expectation that activity would continue to grow in the months ahead. The index for future general business conditions fell five points to 41.7.

emphasis added

Retail Sales decreased 0.3% in September

by Calculated Risk on 10/15/2014 08:59:00 AM

On a monthly basis, retail sales decreased 0.3% from August to September (seasonally adjusted), and sales were up 4.3% from September 2013. Sales in August were unrevised at a 0.6% increase.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $442.7 billion, a decrease of 0.3 percent from the previous month, but 4.3 percent (±0.9%) above September 2013. ... The July to August 2014 percent change was unrevised from 0.6% (±0.2%).

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were down 0.2%.

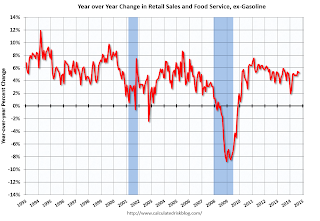

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.2% on a YoY basis (4.3% for all retail sales).

Retail sales ex-gasoline increased by 5.2% on a YoY basis (4.3% for all retail sales).The decrease in September was above consensus expectations of a 0.1% decrease.

This was a weak report.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 10/15/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 10, 2014. ...Note: This mortgage rate is for the week ending Oct 10th; rates have fallen this week.

The Refinance Index increased 11 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 0.3 percent compared with the previous week and was 4 percent lower than the same week one year ago. ...

...

“Growing concerns about weak economic growth in Europe caused a flight to quality into US assets last week, leading to sharp drops in interest rates. Mortgage rates for most loan products fell to their lowest level since June 2013,” said Mike Fratantoni, MBA’s Chief Economist. “Refinance application volume reached the highest level since June 2014 as a result, with conventional refinance volume at its highest since February 2014.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.20 percent, the lowest since June 2013, from 4.30 percent, with points decreasing to 0.17 from 0.19 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 72% from the levels in May 2013.

Refinance activity is very low this year and 2014 will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 4% from a year ago.

Tuesday, October 14, 2014

Wednesday: Retail Sales, PPI, NY Fed Mfg Survey, Beige Book and More

by Calculated Risk on 10/14/2014 08:51:00 PM

An amazing story from Bob Koslow as the Daytona Beach News Journal: In Ocean Hammock, dream house, ocean view, wrong lot (ht Walt)

Six months after building a large custom house with an ocean view, Missouri residents Mark and Brenda Voss learned of a big problem – it’s on the wrong lot.Oops!

Their three-story vacation rental house with an estimated construction value of $680,000 actually sits on the lot next to the one they own in the gated Ocean Hammock resort community.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for September will be released. The consensus is for retail sales to decrease 0.1% in September, and to increase 0.3% ex-autos.

• Also at 8:30 AM, the Producer Price Index for September from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for October. The consensus is for a reading of 20.0, down from 27.5 in September (above zero is expansion).

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.4% increase in inventories.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Mortgage News Daily: Mortgage Rates below 4%, Lowest since June 2013

by Calculated Risk on 10/14/2014 07:11:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hit High 3's

Mortgage rates continued living the dream today, falling decisively past last week's lows to claim another instance of "best rates since June 2013." Today's move was exceptional compared to last week's (or just about any other move lower of 2014 for that matter). After heading into the weekend in relatively conservative territory, the bond markets that underlie mortgages were greeted with massive movement in broader financial markets over the 3-day weekend.Here is a table from Mortgage News Daily:

Some of that movement took place late on Friday--too late for rate sheets to experience much benefit--but most of it occurred in global bond markets during Asian and European trading overnight. Motivation varies depending who you ask, but the concept of "global growth concerns" is the common thread running through most of the reasons offered for the drop in rates.

Last week's best moments saw the most prevalently-quoted conforming 30yr fixed rates hover between 4.0 and 4.125% for top tier borrowers. Today's rates all but eliminated 4.125% from that list. In fact, 3.875% would now be more common than 4.125% (assuming a flawless loan file, 75% or lower Loan-to-Value, and a competitive lender). Rates haven't been any lower since the first half of June 2013.