by Calculated Risk on 10/14/2014 09:21:00 AM

Tuesday, October 14, 2014

NFIB: Small Business Optimism Index Declines in September

From the National Federation of Independent Business (NFIB): Small Business Optimism Index Declines in September

September’s optimism index gave up 0.8 points, falling to 95.3. At 95.3, the Index is now 5 points below the pre-recession average (from 1973 to 2007). ...Hiring plans decreased to 9 (still solid).

NFIB owners increased employment by an average of 0.24 workers per firm in September (seasonally adjusted), the 12th positive month in a row and the largest gain this year.

emphasis added

And in a positive sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 14, down from 17 last year - and "taxes" at 21 and "regulations" are the top problems at 22 (taxes are usually reported as the top problem during good times).

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 95.3 in September from 96.1 in August.

Note: There is high percentage of real estate related businesses in the "small business" survey - and this has held down over all optimism.

Monday, October 13, 2014

DataQuick on SoCal: September Home Sales up 1% Year-over-year, Distressed Sales and Investor Buying Declines Further

by Calculated Risk on 10/13/2014 08:05:00 PM

From DataQuick: Southland Home Sales Edge Higher; Price Growth Slows

Southern California home sales hit a five-year high for a September, rising slightly above a year earlier for the first time in 12 months amid gains for mid- to high-end deals. ... A total of 19,348 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 2.9 percent from 18,796 sales in August, and up 1.2 percent from 19,112 sales in September 2013, according to CoreLogic DataQuick data. ...Even with distressed sales and investor buying declining, overall sales were still up year-over-year.

On average, sales have fallen 9.4 percent between August and September since 1988, when CoreLogic DataQuick statistics begin. Last month marked the first time sales have risen on a year-over-year basis since September last year, when sales rose 7.0 percent from September 2012.

...

Foreclosure resales – homes foreclosed on in the prior 12 months – represented 4.7 percent of the Southland resale market last month. That was down from a revised 5.0 percent the prior month and down from 6.4 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 6.0 percent of Southland resales last month. That was up insignificantly from 5.9 percent the prior month and down from 10.9 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 23.3 percent of the Southland homes sold last month. That was the lowest absentee share since October 2010, when 22.1 percent of homes sold to absentee buyers. Last month’s figure was down from 23.8 percent the prior month and down from 27.0 percent a year earlier. ...

emphasis added

The NAR is scheduled to release existing home sales for September on Tuesday, October 21st - and it appears sales will be up from August on a seasonally adjusted annual rate (SAAR) basis.

From 5 Years Ago: The History of the World wouldn't be complete without ...

by Calculated Risk on 10/13/2014 05:01:00 PM

I posted this cartoon 5 years ago ... it seems like yesterday.

From Larry Gonick's The Cartoon History of the Modern World, Part 2, on page 248 ... (ht TDM)

Posted with permission from Larry Gonick. Thanks!

For more on Tanta, see the menu bar above ...

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 10/13/2014 02:15:00 PM

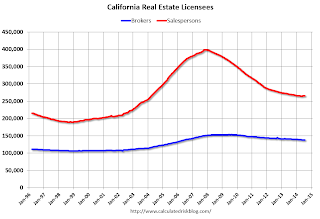

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

The graph shows the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 33.5% from the peak, and may be flattening out (still down 1.5% year-over-year). The number of salesperson's licenses has fallen to March 2004 levels.

Brokers' licenses are only off 9.9% from the peak and have only fallen to mid-2006 levels, but are still slowly declining (down 1.7% year-over-year).

So far there is no sign of a pickup in real estate agents!

"Disinflation, Here We Come"

by Calculated Risk on 10/13/2014 11:24:00 AM

From Evan Soltas: Disinflation, Here We Come

Spot prices for oil have dropped 20 percent in the last three months, from $110 to $90 a barrel. If they remain at these levels, inflation in the United States will slow quite a bit, and quickly at that. My estimate is that headline PCE inflation will fall to just under 1 percent within the next three months of data.This is why it is important to look at core measures of inflation (core CPI and PCE that remove energy), and other measures of underlying inflation such as the Cleveland Fed's median CPI and trimmed-mean CPI.

...

Recall that PCE inflation is 1.5 percent year-over-year. So, one surprise from energy markets, and we could be below one percent. At a time when we are supposed to be a couple months away from a rate hike, this could complicate the exit plan.

And from Tim Duy: The Methodical Fed

Just a few months ago the specter of inflation dominated Wall Street. Now the tables have turned and low inflation is again the worry du jour as a deflationary wave propagates from the rest of the world - think Europe, China, oil prices. How quickly sentiment changes.One thing is clear, Fed Chair Janet was correct in June when she said

And given how quickly sentiment changes, I am loath to make any predictions on the implications for Fed policy. ...

Bottom Line: Fed policy might sound dovish this week, but take note the the underlying tone has been methodically hawkish for a long, long time. And markets have responded accordingly, including anticipating a return to the zero bound when the next recession hits. Nor should this be unexpected. Monetary policymakers have yet to set clear objectives that includes a high probability that the zero bound is left behind for good.

"I think recent readings on CPI index have been a bit on the high side but I think the data we're seeing is noisy. Broadly speaking inflation is evolving in line with the committee's expectations."