by Calculated Risk on 10/11/2014 08:15:00 AM

Saturday, October 11, 2014

Schedule for Week of October 12th

The key economic reports this week are September retail sales on Wednesday, and September housing starts on Friday.

For manufacturing, the September Industrial Production and Capacity Utilization report, and the October NY Fed (Empire State) and Philly Fed manufacturing surveys, will be released this week.

For prices, PPI will be released on Wednesday.

The is a federal/bank holiday. The Bond market will be closed in observance of the Columbus Day holiday. The stock market will be open for trading.

7:30 AM ET: NFIB Small Business Optimism Index for September.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for September will be released.

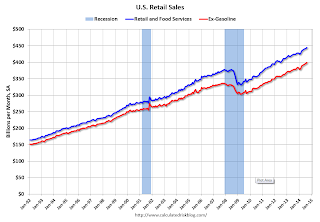

8:30 AM ET: Retail sales for September will be released.This graph shows retail sales since 1992 through August 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).On a monthly basis, retail sales increased 0.6% from July to August (seasonally adjusted), and sales were up 5.0% from August 2013.

The consensus is for retail sales to decrease 0.1% in September, and to increase 0.3% ex-autos.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

8:30 AM: NY Fed Empire Manufacturing Survey for October. The consensus is for a reading of 20.0, down from 27.5 in September (above zero is expansion).

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.4% increase in inventories.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 287 thousand.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.0%.

10:00 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of 20.0, down from 22.5 last month (above zero indicates expansion).

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 59, unchanged from 59 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. Total housing starts were at 956 thousand (SAAR) in August. Single family starts were at 643 thousand SAAR in August.

The consensus is for total housing starts to increase to 1.010 million (SAAR) in September.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 84.2, down from 84.6 in September.

Friday, October 10, 2014

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in September

by Calculated Risk on 10/10/2014 04:02:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for a few selected cities in September.

Lawler also noted: "While I do not yet have enough local realtor/MLS reports to produce a reliable estimate for national existing home sales last month, my very early read is that NAR-based existing home sales ran at a seasonally adjusted annual rate of about 5.14 million in September, up 1.8% from August."

On distressed: Total "distressed" share is down in these markets due to a decline in short sales.

Short sales are down significantly in these areas.

Foreclosures are up slightly in several of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Sep-14 | Sep-13 | Sep-14 | Sep-13 | Sep-14 | Sep-13 | Sep-14 | Sep-13 | |

| Las Vegas | 10.4% | 23.0% | 8.8% | 7.0% | 19.2% | 30.0% | 34.3% | 47.2% |

| Reno** | 7.0% | 20.0% | 7.0% | 5.0% | 14.0% | 25.0% | ||

| Phoenix | 25.7% | 33.4% | ||||||

| Sacramento | 5.3% | 12.1% | 6.5% | 3.9% | 11.8% | 16.0% | 19.4% | 23.6% |

| Mid-Atlantic | 5.5% | 7.7% | 9.7% | 8.2% | 15.2% | 15.9% | 19.1% | 18.4% |

| Tucson | 26.7% | 29.8% | ||||||

| Toledo | 31.4% | 38.1% | ||||||

| Des Moines | 16.8% | 19.2% | ||||||

| Georgia*** | 27.4% | N/A | ||||||

| Omaha | 19.9% | 19.1% | ||||||

| Memphis* | 11.7% | 16.5% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Moody's Zandi: "Have We Underestimated U.S. Wage Growth?"

by Calculated Risk on 10/10/2014 02:47:00 PM

My view is that there is still significant slack in the labor market. Evidence of slack includes the elevated unemployment rate at 5.9%, the elevated level of U-6 at 11.8% (an alternative measure of labor underutilization), the large number of people working part time for economic reasons (included in U-6), and the low level of wage growth.

Some new research from Moody's Mark Zandi suggests wage growth might be picking up: Have We Underestimated U.S. Wage Growth? A few excerpts:

[W]hat if wage growth is accelerating already, and the BLS wage measures have yet to pick this up? This is the message in new data from ADP, based on payroll processing records for more than 24 million employees, or about one-fifth of all U.S. workers.

Moody’s Analytics helped ADP separate the changes in hourly wages paid to those staying in their jobs, labeled job holders, from wages paid to those who change jobs, new entrants to the workforce, and those leaving it. The data track changes quarterly from the second quarter of 2011 to the third quarter of 2014, long enough allow for seasonal adjustments. The data can also be broken down by industry, region, company size, worker age and gender, tenure on the job, pay scale, and part- vs. full-time.

The hourly wage rate for job holders is the most telling. It is up 4.5% from a year ago in the third quarter, a strong and steady acceleration from its low two years ago. The acceleration in hourly wage growth occurs across the board, although it is up most for younger workers, those with one to five years on the job and at lower pay levels, and those who work at small companies. Wage gains have also picked up most in financial services and construction in the West and South.

Baby boomers who work at big companies in healthcare and in leisure and hospitality in the Northeast and Midwest have experienced the slowest acceleration in wages.

The ADP-based hourly wage data likely overstate the acceleration in wage growth in the broader labor market for several reasons. First, ADP’s client companies tend to perform better than average, particularly among smaller companies. A small firm will not use a payroll processing service unless its prospects are good.

How much this inflates the ADP data has not been estimated, but judging from the impact on employment, which we have quantified in our work estimating payroll employment (the ADP National Employment Report), it is meaningful. This may suggest that the ADP data foreshadow broader trends if conditions continue to improve.

Second, the ADP hourly wage for job holders more accurately measures workers’ base pay. This is unlike other BLS wage measures, which include other forms of compensation. The BLS average hourly earnings gauge includes pay for overtime hours and incentive pay (though not irregular bonuses). In 2011 and early 2012, overtime hours were increasing as was incentive pay. This supported growth in the BLS average hourly earnings metric, but not in the ADP measure. Indeed, ADP hourly wage growth lagged BLS hourly earnings growth during this period.

During the past two years, overtime hours and incentive pay have leveled off, weighing on the BLS hourly earnings growth gauge, but not on ADP’s base hourly wages measure. This effect should wear off soon, however, and stronger growth in base pay, which is evident in the ADP data, should appear as well in the BLS data.

The increase in personal income tax rates at the start of 2013 also affected the timing of some workers’ income. Businesses moved income into 2012 to benefit from the lower tax rate, reducing income afterward. This likely had a bigger impact on the BLS measures of labor compensation than on ADP’s base wage rates for job holders. Yet this impact too should also fade quickly.

Third, the significant increase in the number of job leavers and new entrants since early 2013 may also be weighing more heavily on BLS wage measures. In the third quarter of this year, there were approximately 400,000 more job leavers and 500,000 more new entrants than in the first quarter of 2013. Since new entrants are paid less than those at the ends of their careers (a large share of the leavers), measured wage growth has been depressed. While this also affects growth in ADP’s hourly wages for job holders, it does so later than it affects the BLS wage measure.

Implications

If the acceleration in ADP hourly wages presages an imminent acceleration in broader measures of labor compensation, the implications are substantial. Most encouragingly, it signals that workers will finally participate more equitably in the benefits of the economic recovery.

Sacramento Housing in September: Total Sales down 1% Year-over-year, Equity Sales up 5%, Active Inventory increased 51%

by Calculated Risk on 10/10/2014 12:00:00 PM

About 5 years ago I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In September 2014, 11.1% of all resales were distressed sales. This was down from 11.7% last month, and down from 16.0% in September 2013. This is the post-bubble low.

The percentage of REOs was at 6.0%, and the percentage of short sales was 5.1%.

Here are the statistics for September.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Look at all that BLUE!

Active Listing Inventory for single family homes increased 50.9% year-over-year (YoY) in September. Although this was a large YoY increase, the YoY increases have been trending down after peaking close to 100%.

Cash buyers accounted for 19.4% of all sales, down from 23.6% in September 2013, and down from 20.2% last month (frequently investors). This has been trending down, and it appears investors are becoming much less of a factor in Sacramento.

Total sales were down 0.6% from September 2013, and conventional equity sales were up 5.2% compared to the same month last year.

Summary: Distressed sales down sharply (at post bubble low), cash buyers down significantly, and inventory up significantly (but increases slowing). This is what we'd expect to see in a healing market. As I've noted before, we are seeing a similar pattern in other distressed areas.

FNC: Residential Property Values increased 7.5% year-over-year in August

by Calculated Risk on 10/10/2014 10:09:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their August index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.8% from July to August (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.9% and 1.1% in August. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was the same in August as in July, with the 100-MSA composite up 7.5% compared to August 2013. In general, for FNC, the YoY increase has been slowing since peaking in February at 9.4%.

The index is still down 18.8% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through August 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

All of the price indexes had been showing a slowdown in price increases - although the indexes increased the same or slightly more year-over-year in August compared to July.

The August Case-Shiller index will be released on Tuesday, October 28th, and I expect Case-Shiller to show a further slowdown in YoY price increases.