by Calculated Risk on 10/07/2014 01:22:00 PM

Tuesday, October 07, 2014

Goldman: The Housing Recovery Resumes

A few excerpts from a research note by Goldman Sachs economist David Mericle Housing: The Recovery Resumes

Overall, the message from the broad housing data flow is consistent with the national accounts data. Real residential investment grew at an 8.8% rate in Q2 and is tracking at nearly 15% in Q3. But how confident can we be that the recent turnaround will be sustained?On mortgage credit, an interesting article from Trey Garrison at HousingWire: Is mortgage credit loosening or not?

We continue to see substantial upside for the housing sector in the long run. This view is driven by the large gap between the current annual run rate of housing starts, which have averaged about 1 million over the last three months, and our housing analysts' projection of a long-run equilibrium demand for new homes of about 1.5-1.6 million per year, estimated as the sum of trend household formation and demolition of existing homes.

The question in the near term is how quickly and reliably that gap will close. Two factors are essential for the outlook:

1. Housing affordability. The first key factor is potential homeowners' ability to finance a mortgage. ... The index worsened last year as mortgage rates rose, but continues to point to a modestly higher level of affordability than usual. In addition, the recent data are encouraging ...

2. Mortgage credit availability. The second key factor is mortgage lending standards ... tight mortgage lending standards have been an obstacle to the housing sector's recovery, a concern frequently highlighted by Fed Chair Janet Yellen. But lending standards have shown some gradual easing in recent years, and the sudden easing in standards on prime mortgages reported in the Fed's Q3 Senior Loan Officer Opinion Survey is an encouraging sign.

The Federal Reserve Board's Quarterly Senior Loan Officer Survey of credit conditions indicates that mortgage credit loosened in Q2 2014.CR Note: Eventually mortgage credit will loosen, and that will be a positive for housing.

BofA Merrill Lynch Global Research score trends of actual purchase mortgages closed on a monthly basis, and they find the opposite is true: aggregate FICO scores for purchase mortgages continue to move higher.

“We think the explanation of the difference is that while FICO trends are lower in all financing channels (such as conventional or government), the highest quality channels are increasing share of mortgages closed, hence the aggregate score is rising,” BAML analysts say.

BLS: Jobs Openings at 4.8 million in August, Up 23% Year-over-year

by Calculated Risk on 10/07/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.8 million job openings on the last business day of August, up from 4.6 million in July, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits was little changed in August at 2.5 million.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in August to 4.835 million from 4.605 million in July.

The number of job openings (yellow) are up 23% year-over-year compared to August 2013 and the highest since January 2001.

Quits are up 5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the seventh consecutive month - and the highest since January 2001 - and that quits are increasing year-over-year.

CoreLogic: House Prices up 6.4% Year-over-year in August

by Calculated Risk on 10/07/2014 08:49:00 AM

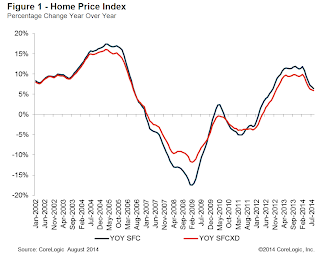

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 6.4 Percent Year Over Year in August 2014

Home prices nationwide, including distressed sales, increased 6.4 percent in August 2014 compared to August 2013. This change represents 30 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 0.3 percent in August 2014 compared to July 2014.

...

Excluding distressed sales, home prices nationally increased 5.9 percent in August 2014 compared to August 2013 and 0.3 percent month over month compared to July 2014. Also excluding distressed sales, 49 states and the District of Columbia showed year-over-year home price appreciation in August, with Mississippi being the only state to experience a year-over-year decline. ...

“The pace of year-over-year appreciation continues to slow down as real estate markets find more balance. Home price appreciation reached a peak of almost 12 percent year-over-year in October 2013 and has since subsided to the current pace of 6 percent,” said Mark Fleming, chief economist at CoreLogic. “Continued moderation of home price appreciation is a welcomed sign of more balanced real estate markets and less pressure on affordability for potential home buyers in the near future.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.3% in August, and is up 6.4% over the last year.

This index is not seasonally adjusted, and the index will probably turn negative month-to-month in September.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increases continue to slow.

This index was up 8.2% YoY in May, 7.2% in June, 6.8% in July, and now 6.4% in August.

Monday, October 06, 2014

Tuesday: Job Openings

by Calculated Risk on 10/06/2014 08:42:00 PM

An international economic overview from Bonddad: International Week in Review: The Sky Is Not Falling, But the Calculus Has Changed. Excerpt:

At times like this, gloom and doom commentary begins to take center stage as “sky is falling” headlines become click bait for various websites. Unfortunately for the bearish crowd a careful analysis indicates we are not near a major, cataclysmic market or economic event. However, it is clear that the underlying calculus regarding macro-economic analysis has changed, caused by a combination of increased geopolitical conflict, potentially higher interest rates in the US and UK and the ripple effects from this development, and growing economic concern regarding the EU, Japan and, to a lesser extent Australia.Tuesday:

• At 10:00 AM ET, the Job Openings and Labor Turnover Survey for August from the BLS. Jobs openings decreased slightly in July to 4.673 million from 4.675 million in June.

• At 3:00 PM, Consumer Credit for August from the Federal Reserve. The consensus is for credit to increase $20.5 billion.

Fun: News IQ Quiz

by Calculated Risk on 10/06/2014 04:45:00 PM

My view is most people are busy with other aspects of their lives, but these results are still pretty disappointing ...

From Jim Puzzanghera at the LA Times: Less than 1 in 4 Americans in survey know Janet Yellen is Fed chair

Janet L. Yellen made history this year when she became the first woman to lead the Federal Reserve, but most Americans apparently didn't notice.You can take the quiz here. All of the questions are pretty easy for those who follow the news.

Just 24% correctly identified her as the central bank's chair in results of a nationwide poll released Monday.

Nearly half of the respondents -- 48% -- in the Pew Research Center's News IQ survey said they didn't know who was the Fed's current chair after being read a list that included Yellen and three other names.

But I wonder how many people could find the countries mentioned on a map?