by Calculated Risk on 9/16/2014 04:31:00 PM

Tuesday, September 16, 2014

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in August

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for several selected cities in August.

Comments from CR: Tom Lawler has been sending me this table every month for several years. I think it is very useful for looking at the trend for distressed sales and cash buyers in these areas. I sincerely appreciate Tom sharing this data with us!

On Orlando, Lawler notes: "MLS-based foreclosure sales in Orlando last month were up 30.1% from last August, while MLS-based short sales were down 64.9%."

On distressed: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Short sales are down significantly in all of these areas.

Foreclosures are down in most of these areas too, although foreclosures are up sharply in Orlando, and up a little in Las Vegas and the Mid-Atlantic.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug-14 | Aug-13 | Aug-14 | Aug-13 | Aug-14 | Aug-13 | Aug-14 | Aug-13 | |

| Las Vegas | 11.5% | 25.0% | 8.9% | 8.0% | 20.4% | 33.0% | 32.1% | 52.5% |

| Reno** | 8.0% | 21.0% | 4.0% | 5.0% | 12.0% | 26.0% | ||

| Phoenix | 3.6% | 10.3% | 6.6% | 8.9% | 10.3% | 19.3% | 25.2% | 34.1% |

| Minneapolis | 2.5% | 5.5% | 8.1% | 15.2% | 10.6% | 20.7% | ||

| Mid-Atlantic | 4.1% | 7.6% | 8.9% | 7.0% | 13.0% | 14.6% | 17.5% | 17.5% |

| Orlando | 7.1% | 17.2% | 25.8% | 16.7% | 32.9% | 33.9% | 42.1% | 46.0% |

| California * | 6.0% | 11.4% | 5.4% | 7.8% | 11.4% | 19.2% | ||

| Bay Area CA* | 3.8% | 7.6% | 2.9% | 4.3% | 6.7% | 11.9% | 21.8% | 23.7% |

| So. California* | 5.9% | 11.5% | 5.0% | 7.0% | 10.9% | 18.5% | 24.4% | 28.4% |

| Hampton Roads | 18.6% | 21.0% | ||||||

| Northeast Florida | 33.3% | 36.7% | ||||||

| Georgia*** | 26.8% | N/A | ||||||

| Toledo | 32.2% | 30.1% | ||||||

| Des Moines | 16.0% | 16.8% | ||||||

| Memphis* | 11.7% | 16.5% | ||||||

| Birmingham AL | ||||||||

| Springfield IL** | ||||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/16/2014 02:14:00 PM

From housing economist Tom Lawler:

Based on August realtor association/board/MLS reports released so far, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.12 million, down 0.6% from July’s pace and down 3.9% from last August’s seasonally adjusted pace. I also estimate that unadjusted sales last month were down about 6% from a year ago.CR Note: The NAR is scheduled to release August existing home sales on Monday, September 22nd.

Based on realtor/MLS reports as well as other reports on home listings, I project that the NAR’s estimate of the number of existing homes for sales at the end of August will be 2.35 million, down 0.8% from July but up 6.3% from last August. Finally, I project that the NAR’s estimate of the median existing SF home sales price last month will be $217,500, up 3.7% from last August.

I also expect the NAR to revise downward its median existing SF home sales price for July to $222,600 from $223,900 – or to a YOY increase of 4.5% from a YOY increase of 5.1%. In the July report the NAR showed a YOY increase in the Northeast median existing SF home sales price of 2.7%, which was well above what state and local realtor reports would suggest.

On inventory, if Lawler is correct, this would put inventory in August down about 2% compared to August 2012 - two years ago - when prices started increasing faster. Now, with rising inventory, this should mean slower price increases.

Census: Poverty Rate declined in 2013, Real Median Income increased slightly

by Calculated Risk on 9/16/2014 10:28:00 AM

From the Census Bureau: Income, Poverty and Health Insurance Coverage in the United States: 2013

The nation’s official poverty rate in 2013 was 14.5 percent, down from 15.0 percent in 2012. The 45.3 million people living at or below the poverty line in 2013, for the third consecutive year, did not represent a statistically significant change from the previous year’s estimate.

Median household income in the United States in 2013 was $51,939; the change in real terms from the 2012 median of $51,759 was not statistically significant. This is the second consecutive year that the annual change was not statistically significant, following two consecutive annual declines.

...

These findings are contained in two reports: Income and Poverty in the United States: 2013 and Health Insurance Coverage in the United States: 2013.

Click on graph for larger image.

Click on graph for larger image. From Census:

• In 2013, real median household income was 8.0 percent lower than in 2007, the year before the most recent recession (Figure 1 and Table A-1).

• Median household income was $51,939 in 2013, not statistically different in real terms from the 2012 median of $51,759 (Figure 1 and Table 1). This is the second consecutive year that the annual change was not statistically significant, following two consecutive years of annual declines in median household income.

From Census:

From Census:• In 2013, the official poverty rate was 14.5 percent, down from 15.0 percent in 2012 (Figure 4). This was the first decrease in the poverty rate since 2006.

• In 2013, there were 45.3 million people in poverty. For the third consecutive year, the number of people in poverty at the national level was not statistically different from the previous year’s estimate.

• The 2013 poverty rate was 2.0 percentage points higher than in 2007, the year before the most recent recession.

BLS: Producer Price Index unchanged in August

by Calculated Risk on 9/16/2014 09:17:00 AM

The Producer Price Index for final demand was unchanged in August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.1 percent in July and 0.4 percent in June. On an unadjusted basis, the index for final demand increased 1.8 percent for the 12 months ended in August.This was slightly lower than expectations, and was mostly due to a decline in energy products. However this is another indicator a low level of inflation.

...

The index for final demand goods moved down 0.3 percent in August, the largest decrease since a 0.7-percent drop in April 2013. Over 80 percent of the August decline is attributable to prices for final demand energy, which fell 1.5 percent. The index for final demand foods decreased 0.5 percent. Prices for final demand goods less foods and energy were unchanged.

emphasis added

Monday, September 15, 2014

LA area Port Traffic: Soft in August

by Calculated Risk on 9/15/2014 07:51:00 PM

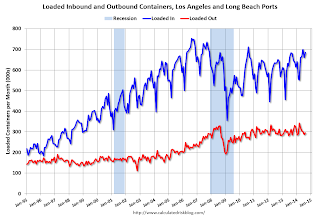

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for August since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Note: From the Port of Long Beach: Shipping surge cools after early ‘peak season’

Container cargo shipments declined by 9.1 percent in August at the Port of Long Beach, reflecting both early shipping by importers this year and the comparison to an August last year that was the Port’s busiest month since 2007. ... The downturn last month followed a surge in Long Beach from April through June 2014, when retailers shipped their products early ahead of the expiration of the longshore contract at the end of June.The contract was settled fairly quickly in July, and I expect traffic to increase over the next few months.

Last year’s August was very busy and started off the typical August through October “peak season.” That peak season may have occurred earlier this year.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was unchanged compared to the rolling 12 months ending in July. Outbound traffic was down 0.5% compared to 12 months ending in July.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). Imports were up slightly year-over-year in August, exports were down 6% year-over-year.

Overall traffic was a little soft in August, possibly due to concerns about a longer strike.