by Calculated Risk on 9/12/2014 09:55:00 AM

Friday, September 12, 2014

Preliminary September Consumer Sentiment increases to 84.6

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for September was at 84.6, up from 82.5 in August.

This was above the consensus forecast of 83.1. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Retail Sales increased 0.6% in August

by Calculated Risk on 9/12/2014 08:41:00 AM

On a monthly basis, retail sales increased 0.6% from July to August (seasonally adjusted), and sales were up 5.0% from August 2013. Sales in July were revised up to a 0.3% increase from unchanged. Sales in June were also revised up.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $444.4 billion, an increase of 0.6 percent from the previous month, and 5.0 percent (±0.9%) above August 2013. ... The June to July 2014 percent change was revised from virtually unchanged to 0.3 percent.

Click on graph for larger image.

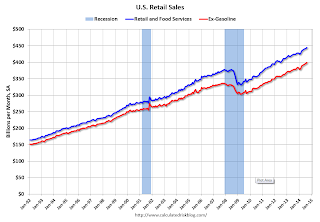

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were up 0.3%.

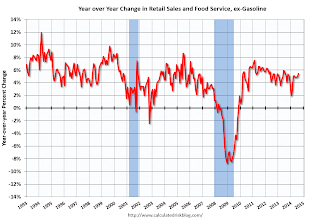

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.5% on a YoY basis (5.0% for all retail sales).

Retail sales ex-gasoline increased by 5.5% on a YoY basis (5.0% for all retail sales).The increase in August was above consensus expectations of a 0.4% increase.

Including the upward revisions to June and July, this was a strong report.

Thursday, September 11, 2014

Friday: Retail Sales

by Calculated Risk on 9/11/2014 07:43:00 PM

First, from Merrill Lynch:

We have revised up our forecast for 3Q GDP growth to 3.5% from 3.0% and 2Q tracking has moved up to 4.8%, from 4.0%.Some of this is a bounce back from the -2.1% decline in Q1 GDP (on a seasonally adjusted annual rate basis, SAAR).

Friday:

• At 8:30 AM ET, Retail sales for August will be released. The consensus is for retail sales to increase 0.4% in August, and to increase 0.3% ex-autos.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 83.1, up from 82.5 in August.

• Also at 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.5% increase in inventories.

DataQuick: Home Sales slow in SoCal and Bay Area

by Calculated Risk on 9/11/2014 04:32:00 PM

From DataQuick: Southland Home Sales Sputter; Median Sale Price Hits 80-Month High

A total of 18,796 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 7.7 percent from 20,369 sales in July, and down 18.5 percent from 23,057 sales in August 2013, according to CoreLogic DataQuick data. ...From DataQuick: Bay Area Home Sales Slow in August; Prices Increases Ease Back

...

Foreclosure resales – homes foreclosed on in the prior 12 months – represented 5.0 percent of the Southland resale market last month. That was down from 5.2 percent the prior month and down from 7.0 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 5.9 percent of Southland resales last month. That was up slightly from 5.8 percent the prior month and down from 11.5 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 23.5 percent of the Southland homes sold last month. That tied the July level as the lowest absentee share since December 2010, when 23.4 percent of homes sold to absentee buyers. Last month’s figure was down from 26.7 percent a year earlier. The peak was 32.4 percent in January 2013, while the monthly average since 2000, when the CoreLogic DataQuick absentee data begin, is about 19 percent.

emphasis added

A total of 7,578 new and resale houses and condos sold in the nine-county Bay Area last month. That was down 10.6 percent from 8,474 in July and down 12.0 percent from 8,616 in August last year, according to CoreLogic DataQuick data. ...A few key year-over-year trends: 1) declining distressed sales (about half as many this year as in August 2013), 2) generally declining investor buying, and 3) declining total sales. For August, it looks like non-distressed sales were also down significantly.

...

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 2.9 percent of resales, up from 2.7 percent the month before, and down from 4.3 percent a year ago. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.8 percent, CoreLogic DataQuick reported.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 3.8 percent of Bay Area resales last month. That was down from an estimated 4.0 percent in July and down from 7.6 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 18.4 percent of all Bay Area homes. That was down from a revised 18.9 percent the prior month, and down from 20.3 percent a year earlier.

emphasis added

Hotels: Occupancy up 4.5%, RevPAR up 10.6% Year-over-Year

by Calculated Risk on 9/11/2014 01:55:00 PM

From HotelNewsNow.com: STR: US results for week ending 6 September

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 31 August through 6 September 2014, according to data from STR.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rate rose 4.5 percent to 59.0 percent. Average daily rate increased 5.9 percent to finish the week at US$108.87. Revenue per available room for the week was up 10.6 percent to finish at US$64.20.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

There is always a dip in occupancy after the summer (less leisure travel), and business travel should pick up soon.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at about the level as for the same week in 2000 (the previous high).

Right now it looks like 2014 will be the best year since 2000 for hotels. Since it takes some time to plan and build hotels, I expect 2015 will be a record year for hotel occupancy. Note: Smith Travel analysts say that supply growth will pickup next year, but remain relatively slow, "hotel supply growth in the United States is forecast to be 1% this year and 1.3% in 2015".

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com