by Calculated Risk on 8/31/2014 12:49:00 PM

Sunday, August 31, 2014

Restaurant Performance Index declined in July

From the National Restaurant Association: Restaurant Performance Index Dipped in July

Due in part to a dampened outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) registered a modest decline in July. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.0 in July, down from a level of 101.3 in June and the second consecutive monthly decline. Despite the recent downticks, the RPI remained above 100 for the 17th consecutive month, which signifies expansion in the index of key industry indicators.

“Although restaurant operators reported positive same-store sales and customer traffic results in July, the RPI edged down as a result of a mixed outlook for the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Restaurant operators were less bullish about the direction of the overall economy, and rising wholesale food costs are once again starting to pose a significant challenge.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.0 in July, down from 101.3 in June. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. Even with the recent declines in the index, this is still a decent level.

Saturday, August 30, 2014

Schedule for Week of August 31st

by Calculated Risk on 8/30/2014 01:11:00 PM

This will be a busy week for economic data. The key report is the August employment report on Friday.

Other key reports include the ISM manufacturing index on Tuesday and August vehicle sales on Wednesday.

The ECB rate decision and press conference with ECB President Mario Draghi on Thursday will be closely watched.

All US markets will be closed in observance of the Labor Day holiday.

Early: Black Knight Mortgage Monitor report for July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for a decrease to 56.8 from 57.1 in July.

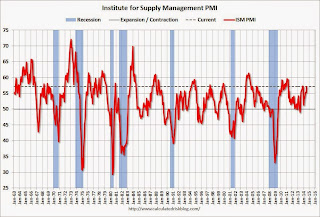

10:00 AM: ISM Manufacturing Index for August. The consensus is for a decrease to 56.8 from 57.1 in July.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in July at 57.1%. The employment index was at 58.2%, and the new orders index was at 63.4%.

10:00 AM: Construction Spending for July. The consensus is for a 0.8% increase in construction spending.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

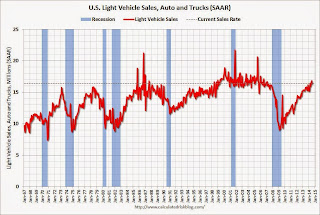

All day: Light vehicle sales for August. The consensus is for light vehicle sales to increase to 16.5 million SAAR in August from 16.4 million in July (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for August. The consensus is for light vehicle sales to increase to 16.5 million SAAR in August from 16.4 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July. The consensus is for a 10.5% increase in July orders.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

1:45 PM CET (7:45 AM ET): Press conference following the Governing Council meeting of the ECB in Frankfurt with Mario Draghi. Here is the ECB website and press conference page.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 213,000 payroll jobs added in August, down from 218,000 in July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 298 thousand.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. Imports decreased and exports increased in June.

The consensus is for the U.S. trade deficit to be at $42.7 billion in July from $41.5 billion in June.

10:00 AM: ISM non-Manufacturing Index for August. The consensus is for a reading of 57.1, down from 58.7 in July. Note: Above 50 indicates expansion.

8:30 AM: Employment Report for August. The consensus is for an increase of 210,000 non-farm payroll jobs added in August, up slightly from the 209,000 non-farm payroll jobs added in July.

The consensus is for the unemployment rate to decrease to 6.1% in August.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In July, the year-over-year change was 2.570 million jobs, and it generally appears the pace of hiring is increasing.

Right now it looks possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

Unofficial Problem Bank list declines to 439 Institutions

by Calculated Risk on 8/30/2014 08:33:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 29, 2014.

Changes and comments from surferdude808:

As expected, the FDIC released q2 industry results and provided an update on its latest enforcement action activity. The update led to six removals from the Unofficial Problem Bank List pushing the list total down to 439 institutions with assets of $139.97 billion. A year ago, the list held 707 institutions with assets of $250.6 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Actions were terminated against First State Bank, Lonoke, AR ($256 million); The Business Bank, Appleton, WI ($253 million); First Financial Bank, Bessemer, AL ($183 million); Citizens State Bank, Hudson, WI ($146 million); South Georgia Bank, Glennville, GA ($125 million); and Golden State Bank, Upland, CA ($92 million Ticker: GSBB).

The FDIC told there are 354 institutions with assets of $110 billion on the Official Problem Bank List. Since their last update, the official list declined by 13.9 percent or 57 institutions, which the largest percentage decline over the past 13 quarters since the official list peaked at 888 institutions in the first quarter of 2011. The unofficial list fell by an identical 57 institutions since the last update from the FDIC on May 28, 2014.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Friday, August 29, 2014

Merrill and Goldman Forecasts for August Non-Farm Payrolls

by Calculated Risk on 8/29/2014 08:22:00 PM

The August employment report will be released next Friday, September 5th and the consensus is that 210 thousand payroll jobs were added in August. Here are two forecasts:

From economist Kris Dawsey at Goldman Sachs:

Employment indicators have strengthened a bit in August vs. July, including the employment components of the available service sector surveys, the Conference Board labor differential, and initial jobless claims. Our preliminary forecast for August payroll job growth is 240k, with the important caveat that we have yet to receive a few key pieces of data for the month, most notably the ISM nonmanufacturing report. ... With no special factors on weather, strikes, unusual composition in the prior month, fiscal policy issues, or obvious seasonal distortions, we think the August report should be a fairly “clean read” on the likely-strengthening underlying trend. We also anticipate a downtick of one-tenth in the unemployment rate to 6.1%, matching its prior cycle low set two months back. Should the participation rate give up its small July increase, the risk is skewed toward 6.0%, in our view.From Merrill Lynch:

The August employment report is likely to be healthy with nonfarm payroll growth of 245,000 and a decline in the unemployment rate to 6.1% from 6.2%. ... Early indicators of the labor market have all been encouraging with the conference board labor differential narrowing to -12.4% as an increase in respondents believe jobs have become plentiful. Initial jobless claims have remained low, hovering around 300,000, consistent with little firing. Moreover, manufacturing job growth should be strong as suggested by healthy surveys and recent industrial production data.

We expect the unemployment rate to fall back to 6.1%, reversing the increase last month.

Fannie Mae: Mortgage Serious Delinquency rate declined to 2.0% in July, Lowest since October 2008

by Calculated Risk on 8/29/2014 04:10:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in July to 2.00% from 2.05% in June. The serious delinquency rate is down from 2.70% in July 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier this week, Freddie Mac reported that the Single-Family serious delinquency rate declined in July to 2.02% from 2.07% in June. Freddie's rate is down from 2.70% in July 2013, and is at the lowest level since January 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Both Fannie and Freddie's serious delinquency rates will probably be below 2% in August.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.70 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in early 2016.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be close to normal in 2016.