by Calculated Risk on 8/25/2014 04:54:00 PM

Monday, August 25, 2014

New Home Prices: 43% of Home over $300K, 8% under $150K

Here are two graphs I haven't posted for some time ...

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in July 2014 was $269,800; the average sales price was $339,100. "

The following graph shows the median and average new home prices.

During the bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. With fewer distressed sales now, it appears the builders have moved to higher price points.

The average price in July 2014 was $339,100, and the median price was $269,800. Both are above the bubble high (this is due to both a change in mix and rising prices). The average is at an all time high.

The second graph shows the percent of new homes sold by price. At the peak of the housing bubble, almost 40% of new homes were sold for more than $300K - and over 20% were sold for over $400K.

And only 8% of homes sold were under $150K in July 2014. This is down from 30% in 2002 - and down from 20% as recently as August 2011. Quite a change.

Earlier on New Home Sales:

• New Home Sales at 412,000 Annual Rate in July

• Comments on New Home Sales

Comments on New Home Sales

by Calculated Risk on 8/25/2014 12:31:00 PM

The new home sales report for July was weak with sales at a 412,000 seasonally adjusted annual rate (SAAR), however combined with the upward revisions for the previous three months, total sales were somewhat above expectations. Sales for April, May and June were revised up a combined 33,000 sales SAAR.

The Census Bureau reported that new home sales this year, through July, were 266,000, Not seasonally adjusted (NSA). That is down 0.8% from 268,000 during the same period of 2013 (NSA). Basically flat compared to 2013.

Sales were up 12.3% year-over-year in July - but remember sales declined sharply in July 2013 as mortgage rates increased - so this was an easy comparison (I expect sales for July will be revised up too).

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The comparisons to last year will be easy for the next couple of months, and I still expect to see year-over-year growth later this year.

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to decline or move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 412,000 Annual Rate in July

by Calculated Risk on 8/25/2014 10:00:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 412 thousand.

June sales were revised up from 406 thousand to 422 thousand, and May sales were revised up from 442 thousand to 454 thousand.

"Sales of new single-family houses in July 2014 were at a seasonally adjusted annual rate of 412,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.4 percent below the revised June rate of 422,000, but is 12.3 percent above the July 2013 estimate of 367,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in July to 6.0 months from 5.6 months in June.

The months of supply increased in July to 6.0 months from 5.6 months in June. The all time record was 12.1 months of supply in January 2009.

This is now at the top of the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of July was 205,000. This represents a supply of 6.0 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

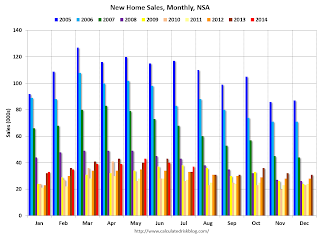

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2014 (red column), 37 thousand new homes were sold (NSA). Last year 33 thousand homes were also sold in July. The high for July was 117 thousand in 2005, and the low for July was 26 thousand in 2010.

This was below expectations of 425,000 sales in July, and sales were up 12.3% year-over-year.

I'll have more later today .

Black Knight (formerly LPS): House Price Index up 0.8% in June, Up 5.5% year-over-year

by Calculated Risk on 8/25/2014 08:54:00 AM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Up 0.8 Percent for the Month; Up 5.5 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services released its latest Home Price Index (HPI) report, based on June 2014 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The year-over-year increases have been getting steadily smaller for the last 9 months - as shown in the table below:

...

- Yearly increases in home appreciation continue to slow

- All 20 largest states and 40 largest metros again show month-over-month growth

- Nevada shows largest monthly gain among states, while Colorado and Texas continue to hit new highs

- Reno, Nev. home prices rise nearly 2 percent-- the most of any metropolitan area; Las Vegas still 42 percent off peak

| Month | YoY House Price Increase |

|---|---|

| Jan-13 | 6.7% |

| Feb-13 | 7.3% |

| Mar-13 | 7.6% |

| Apr-13 | 8.1% |

| May-13 | 7.9% |

| Jun-13 | 8.4% |

| Jul-13 | 8.7% |

| Aug-13 | 9.0% |

| Sep-13 | 9.0% |

| Oct-13 | 8.8% |

| Nov-13 | 8.5% |

| Dec-13 | 8.4% |

| Jan-14 | 8.0% |

| Feb-14 | 7.6% |

| Mar-14 | 7.0% |

| Apr-14 | 6.4% |

| May-14 | 5.9% |

| June-14 | 5.5% |

The Black Knight HPI is off 10.4% from the peak in June 2006 (not adjusted for inflation).

Note: The press release has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 41.8% from the peak in Las Vegas, off 34.9% in Orlando, and 31.4% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado and Texas (Denver, Austin, Dallas, Houston and San Antonio metros). Prices are also at new highs in San Jose, CA and in Nashville, TN.

Note: Case-Shiller for June will be released tomorrow.

Chicago Fed: "Index shows economic growth picked up in July"

by Calculated Risk on 8/25/2014 08:38:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth picked up in July

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.39 in July from +0.21 in June. Three of the four broad categories of indicators that make up the index made positive contributions to the index in July, and two of the four categories increased from June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to +0.25 in July from +0.16 in June, marking its fifth consecutive reading above zero. July’s CFNAI-MA3 suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in July (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.