by Calculated Risk on 8/19/2014 08:30:00 AM

Tuesday, August 19, 2014

Housing Starts increase to 1.093 million Annual Rate in July

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,093,000. This is 15.7 percent above the revised June estimate of 945,000 and is 21.7 percent above the July 2013 rate of 898,000.

Single-family housing starts in July were at a rate of 656,000; this is 8.3 percent above the revised June figure of 606,000. The July rate for units in buildings with five units or more was 423,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,052,000. This is 8.1 percent above the revised June rate of 973,000 and is 7.7 percent above the July 2013 estimate of 977,000.

Single-family authorizations in July were at a rate of 640,000; this is 0.9 percent above the revised June figure of 634,000. Authorizations of units in buildings with five units or more were at a rate of 382,000 in July.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in July (Multi-family is volatile month-to-month).

Single-family starts (blue) also increased in July.

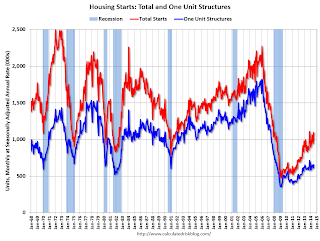

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was well above expectations of 963 thousand starts in July. Note: Starts for June were revised higher too.

This was a solid report with starts up 21.7% year-over-year in July.

Monday, August 18, 2014

Tuesday: Housing Starts, CPI

by Calculated Risk on 8/18/2014 08:45:00 PM

From Nick Timiraos at the WSJ: In Phoenix, a Realty Check as Market Moderates

Among the cities most battered by the 2006 bust, Phoenix was the first to snap back in 2011. Prices, off by 56% from peak, then rebounded sharply, trimming that drop by a third. The number of homes in some stage of foreclosure has fallen to about 4,300 homes today from more than 50,000 four years ago.The Phoenix market is slowly moving back to normal. There is still a ways to go until traditional buyers feel confident, but the sharp decline in distressed sales a clear positive.

Now, prices and sales are cooling off. Inventories of homes listed for sale have climbed to their highest level in three years while the number of houses sold in June fell 12% from a year earlier. ...

As the foreclosure boom that fueled much of the recovery fades, income and population growth are reasserting themselves as drivers of the housing market in places such as Phoenix. Meanwhile, lingering scars from the bust are playing out as some of the country's hottest housing markets struggle to pass the baton from bargain-hunting investors, who typically pay cash, to traditional buyers with mortgages.

Tuesday:

• At 8:30 AM ET, Consumer Price Index for July. The consensus is for a 0.1% increase in CPI in July and for core CPI to increase 0.2%.

• Also at 8:30 AM, Housing Starts for July. Total housing starts were at 893 thousand (SAAR) in June. Single family starts were at 575 thousand SAAR in June. The consensus is for total housing starts to increase to 963 thousand (SAAR) in July.

CoStar: Commercial Real Estate prices increased 10% year-over-year in June

by Calculated Risk on 8/18/2014 05:52:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Prices Steadily Advance In Second Quarter

CCRSI COMPOSITE PRICE INDICES ADVANCED STEADILY IN SECOND QUARTER. Despite a modest pull-back in June 2014, CCRSI’s value-weighted U.S. Composite Index advanced 2.3% in the second quarter of 2014, and 9.7% for the 12-month period ending in June 2014. Reflecting the impact of larger, core-like property sales, the value-weighted U.S. Composite Index is now in line with its prerecession highs reached in 2007. The equal-weighted U.S. Composite Index, which tracks smaller, more numerous property trades typical of those in secondary markets, is now beginning to catch up with its value-weighted counterpart. It advanced 2.4% in the second quarter and 10% for the 12 months ending in June 2014.

...

PROPERTY SALES ACTIVITY ESCALATES. Boosted by a strong second quarter, repeat sale transaction volume reached nearly $39.3 billion in the first half of 2014 , an increase of 14.5% from the first half of 2013, and roughly on a par with the first half-year totals reached in 2006-07. Repeat-sale pair volume increased 8.8% in the Investment Grade segment and 27.2% in the General Commercial in the first half of 2014 over the same period one year earlier. Meanwhile, only 8.7% of properties are selling at distressed pricing as of the second quarter of 2014 — the lowest distress sales rate since the fourth quarter of 2008.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is almost back to the pre-recession peak, but the equal weighted is still well below the pre-recession peak.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 30% at the peak, to 8.7% in June.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

LA area Port Traffic: A little soft due to strike in July

by Calculated Risk on 8/18/2014 01:43:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for June since LA area ports handle about 40% of the nation's container port traffic. IMPORTANT: There was a 5 day trucker strike at both the ports of Long Beach and Los Angeles that probably impacted traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.1% compared to the rolling 12 months ending in June. Outbound traffic was also down 0.1% compared to 12 months ending in June.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down slightly year-over-year in July, exports were also down slightly year-over-year.

Overall traffic was a little soft in July probably due to the short strike. It is possible traffic will be close to the pre-recession peaks over the next few months.

BLS: State unemployment rates little changed in July

by Calculated Risk on 8/18/2014 11:01:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in July. Thirty states had unemployment rate increases from June, 8 states had decreases, and 12 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia had unemployment rate decreases from a year earlier and one state had an increase.

...

Mississippi had the highest unemployment rate among the states in July, 8.0 percent. North Dakota again had the lowest jobless rate, 2.8 percent.

Click on graph for larger image.

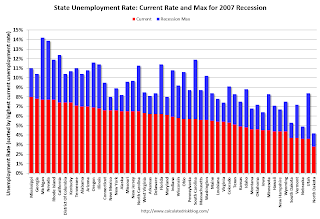

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Mississippi had the highest unemployment rate in July at 8.0%.

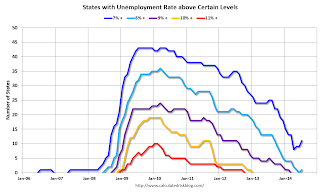

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).One state has an unemployment rate at or above 8% (light blue), and 11 states are still at or above 7% (dark blue).