by Calculated Risk on 8/05/2014 08:38:00 PM

Tuesday, August 05, 2014

Wednesday: Trade Deficit

The ISM manufacturing survey is almost always released before the BLS employment report for the same month, and frequently the ISM non-manufacturing survey also precedes the employment report. This didn't happen for July since the employment report was released on Friday August 1st.

Now that the surveys have been released, the ISM surveys suggested fairly strong hiring in July.

The ISM manufacturing employment index increased in July to 58.2%, from 52.8% in June. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector manufacturing payroll jobs increased about 25,000 in July.

The ISM non-manufacturing employment index increased in July to 56.0%, up from 54.4% in June. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector payroll jobs for non-manufacturing increased by about 232,000 in July.

Taken together, these surveys suggested around 257,000 jobs added in July - well above the 198,000 private sector jobs reported by the BLS. Of course these surveys indicate the number of firms hiring, not the number of people hired - and the relationship is "noisy" with timing issues too - but this is another positive employment indicator.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Trade Balance report for June from the Census Bureau. The consensus is for the U.S. trade deficit to be at $45.0 billion in June from $44.4 billion in May.

Phoenix Real Estate in July: Sales down 17%, Cash Sales down Sharply, Inventory up 35%

by Calculated Risk on 8/05/2014 04:42:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in July were down 17% year-over-year and at the lowest for June since 2008.

2) Cash Sales (frequently investors) were down about 43% to less than 25% of total sales. Non-cash sales were down only about 3% year-over-year. So the decline in sales is probably mostly due to less investor buying.

3) Active inventory is now increasing rapidly and is up 35% year-over-year - and at the highest level for July since 2011 (when prices bottomed in Phoenix).

Inventory has clearly bottomed in Phoenix (A major theme for housing in 2013). And more inventory (a theme this year) - and less investor buying - suggests price increases should slow sharply in 2014.

According to Case-Shiller, Phoenix house prices bottomed in August 2011 (mostly flat for all of 2011), and then increased 23% in 2012, and another 15% in 2013. Those large increases were probably due to investor buying, low inventory and some bounce back from the steep price declines in 2007 through 2010. Now, with more inventory, price increases should flatten out in 2014.

As an example, the Phoenix Case-Shiller index through May shows prices up less than 1% in 2014, and the Zillow index shows Phoenix prices up slightly year-to-date through June.

| July Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Jul-08 | 5,9741 | --- | --- | --- | 54,5272 | --- |

| Jul-09 | 9,095 | 52.2% | 3,269 | 35.9% | 38,024 | ---2 |

| Jul-10 | 7,101 | -21.9% | 2,901 | 40.9% | 42,887 | 12.8% |

| Jul-11 | 8,397 | 18.3% | 3,779 | 45.0% | 27,663 | -35.5% |

| Jul-12 | 7,152 | -14.8% | 3,214 | 44.9% | 20,384 | -26.3% |

| Jul-13 | 8,214 | 14.8% | 2,944 | 35.8% | 20,049 | -1.6% |

| Jul-14 | 6,790 | -17.3% | 1,681 | 24.8% | 27,081 | 35.1% |

| 1 July 2008 does not include manufactured homes, ~100 more 2 July 2008 Inventory includes pending | ||||||

Q2 2014 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 8/05/2014 01:11:00 PM

The BEA has released the underlying details for the Q2 advance GDP report.

Investment in single family structures is now back to being the top category for residential investment (see first graph). Home improvement was the top category for twenty one consecutive quarters following the housing bust ... but now investment in single family structures is the top category once again.

However - even though investment in single family structures has increased significantly from the bottom - single family investment is still very low, and still below the bottom for previous recessions. I expect further increases over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

Investment in single family structures was $188 billion (SAAR) (almost 1.1% of GDP).

Investment in home improvement was at a $179 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (just over 1.0% of GDP).

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased recently, but from a very low level.

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased recently, but from a very low level.

Investment in offices is down about 49% from the recent peak (as a percent of GDP) and increasing slowly.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 59% from the peak. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 67%. With the hotel occupancy rate at the highest level since 2000, it is likely that hotel investment will probably continue to increase.

These graphs show investment is now increasing, but from a very low level.

ISM Non-Manufacturing Index increased to 58.7%

by Calculated Risk on 8/05/2014 10:07:00 AM

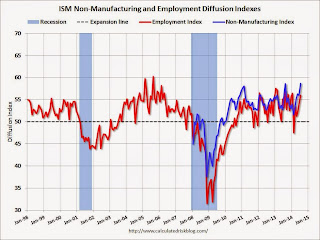

The July ISM Non-manufacturing index was at 58.7%, up from 56.0% in June. The employment index increased in July to 56.0%, up from 54.4% in June. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2014 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 54th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 58.7 percent in July, 2.7 percentage points higher than the June reading of 56 percent. This represents continued growth in the Non-Manufacturing sector. This month's NMI® is the highest reading for the index since its inception in January 2008. The Non-Manufacturing Business Activity Index increased to 62.4 percent, which is 4.9 percentage points higher than the June reading of 57.5 percent, reflecting growth for the 60th consecutive month at a faster rate. This is the highest reading for the index since February 2011 when the index registered 63.3 percent. The New Orders Index registered 64.9 percent, 3.7 percentage points higher than the reading of 61.2 percent registered in June. This represents the highest reading for the New Orders Index since August 2005 when it registered 65.3 percent. The Employment Index increased 1.6 percentage points to 56 percent from the June reading of 54.4 percent and indicates growth for the fifth consecutive month. The Prices Index decreased 0.3 percentage point from the June reading of 61.2 percent to 60.9 percent, indicating prices increased at a slightly slower rate in July when compared to June. According to the NMI®, 16 non-manufacturing industries reported growth in July. Respondents' comments indicate that stabilization and/or improving market conditions have positively affected the majority of the respective industries and businesses."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was solidly above the consensus forecast of 56.5% and suggests faster expansion in July than in June.

The NMI was at the highest level since its inception. New orders was very strong - and employment was up solidly.

CoreLogic: House Prices up 7.5% Year-over-year in June

by Calculated Risk on 8/05/2014 09:41:00 AM

Notes: This CoreLogic House Price Index report is for June. The recent Case-Shiller index release was for May. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 7.5 Percent Year Over Year in June

Home prices nationwide, including distressed sales, increased 7.5 percent in June 2014 compared to June 2013. This change represents 28 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 1.0 percent in June 2014 compared to May 2014.

...

Excluding distressed sales, home prices nationally increased 6.9 percent in June 2014 compared to June 2013 and 0.9 percent month over month compared to May 2014. Also excluding distressed sales, all 50 states and the District of Columbia showed year-over-year home price appreciation in June. Distressed sales include short sales and real estate owned (REO) transactions.

“Home price appreciation continued moderating in June with its slight month-over-month increase,” said Mark Fleming, chief economist for CoreLogic. “This reversion to normality that we are finally experiencing is expected to continue across the country and should further alleviate concern over diminishing affordability and the risk of another asset bubble.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.0 in June, and is up 7.5% over the last year.

This index is not seasonally adjusted, so a solid month-to-month gain was expected for June.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty eight consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty eight consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).However this was the smallest year-over-year gain since late 2012, and I expect the year-over-year increases to continue to slow.