by Calculated Risk on 8/05/2014 10:07:00 AM

Tuesday, August 05, 2014

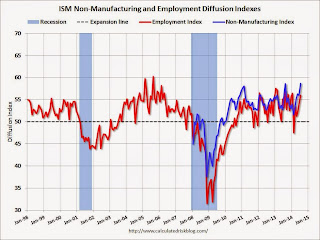

ISM Non-Manufacturing Index increased to 58.7%

The July ISM Non-manufacturing index was at 58.7%, up from 56.0% in June. The employment index increased in July to 56.0%, up from 54.4% in June. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2014 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 54th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 58.7 percent in July, 2.7 percentage points higher than the June reading of 56 percent. This represents continued growth in the Non-Manufacturing sector. This month's NMI® is the highest reading for the index since its inception in January 2008. The Non-Manufacturing Business Activity Index increased to 62.4 percent, which is 4.9 percentage points higher than the June reading of 57.5 percent, reflecting growth for the 60th consecutive month at a faster rate. This is the highest reading for the index since February 2011 when the index registered 63.3 percent. The New Orders Index registered 64.9 percent, 3.7 percentage points higher than the reading of 61.2 percent registered in June. This represents the highest reading for the New Orders Index since August 2005 when it registered 65.3 percent. The Employment Index increased 1.6 percentage points to 56 percent from the June reading of 54.4 percent and indicates growth for the fifth consecutive month. The Prices Index decreased 0.3 percentage point from the June reading of 61.2 percent to 60.9 percent, indicating prices increased at a slightly slower rate in July when compared to June. According to the NMI®, 16 non-manufacturing industries reported growth in July. Respondents' comments indicate that stabilization and/or improving market conditions have positively affected the majority of the respective industries and businesses."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was solidly above the consensus forecast of 56.5% and suggests faster expansion in July than in June.

The NMI was at the highest level since its inception. New orders was very strong - and employment was up solidly.

CoreLogic: House Prices up 7.5% Year-over-year in June

by Calculated Risk on 8/05/2014 09:41:00 AM

Notes: This CoreLogic House Price Index report is for June. The recent Case-Shiller index release was for May. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 7.5 Percent Year Over Year in June

Home prices nationwide, including distressed sales, increased 7.5 percent in June 2014 compared to June 2013. This change represents 28 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 1.0 percent in June 2014 compared to May 2014.

...

Excluding distressed sales, home prices nationally increased 6.9 percent in June 2014 compared to June 2013 and 0.9 percent month over month compared to May 2014. Also excluding distressed sales, all 50 states and the District of Columbia showed year-over-year home price appreciation in June. Distressed sales include short sales and real estate owned (REO) transactions.

“Home price appreciation continued moderating in June with its slight month-over-month increase,” said Mark Fleming, chief economist for CoreLogic. “This reversion to normality that we are finally experiencing is expected to continue across the country and should further alleviate concern over diminishing affordability and the risk of another asset bubble.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.0 in June, and is up 7.5% over the last year.

This index is not seasonally adjusted, so a solid month-to-month gain was expected for June.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty eight consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty eight consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).However this was the smallest year-over-year gain since late 2012, and I expect the year-over-year increases to continue to slow.

Monday, August 04, 2014

Tuesday: ISM non-Manufacturing

by Calculated Risk on 8/04/2014 08:52:00 PM

First a note on housing inventory and more ...

I think it is a positive that existing home inventory is increasing. Sometimes rising inventory is a sign of trouble (I was pointing to increasing inventory in 2005 as a sign that the bubble was ending), but now inventory is so low that an increase is probably a positive.

This increase in inventory will also slow house price increases - the recent rate of increase in some areas was unsustainable - and getting inventory back to normal levels is another step towards a healthier market.

Also - another step towards normal is the continuing decline in the number of properties in foreclosure and the downward trend for mortgage delinquencies. (See Black Knight releases Mortgage Monitor for June that was released this morning for details).

And it even appears, according to the Fed Senior Loan Officer survey that lending standards might be easing a little (too loose is bad, but that isn't the problem right now).

Tuesday:

• At 10:00 AM, the ISM non-Manufacturing Index for July. The consensus is for a reading of 56.5, up from 56.0 in June. Note: Above 50 indicates expansion.

• Also at 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for June. The consensus is for a 0.6% increase in June orders.

Weekly Update: Housing Tracker Existing Home Inventory up 13.6% YoY on Aug 4th

by Calculated Risk on 8/04/2014 05:23:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for June and indicated inventory was up 6.5% year-over-year).

Fortunately Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data, for 54 metro areas, for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays.

Inventory in 2014 (Red) is now 13.6% above the same week in 2013. (Note: There might be an issue with the Housing Tracker data over the last few weeks - Ben is checking - but inventory is still up significantly).

Inventory is also about 2.4% above the same week in 2012. According to several of the house price indexes, house prices bottomed in early 2012, and low inventories were a key reason for the subsequent price increases. Now that inventory is back above 2012 levels, I expect house price increases to slow (and possibly decline in some areas).

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.

Fed Survey: Banks eased lending standards, "broad-based pickup in loan demand"

by Calculated Risk on 8/04/2014 02:00:00 PM

From the Federal Reserve: The July 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices

The July survey results showed a continued easing of lending standards and terms for many types of loan categories amid a broad-based pickup in loan demand. Domestic banks generally continued to ease their lending standards and various terms for commercial and industrial (C&I) loans. In contrast, foreign banks reported little change in standards and in most of the surveyed terms for C&I loans on net. Domestic respondents, meanwhile, also reported having eased standards on most types of commercial real estate (CRE) loans on balance. Although many banks reported having eased standards for prime residential real estate (RRE) loans, respondents generally indicated little change in standards and terms for other types of loans to households. However, a few large banks had eased standards, increased credit limits, and reduced the minimum required credit score for credit card loans. Banks also reported having experienced stronger demand over the past three months, on net, for many more loan categories than on the April survey.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Banks are loosening their standards for CRE loans, and for various categories of CRE (right half of graph).

The second graph shows the change in demand for CRE loans.

Banks are seeing a solid pickup in demand for all categories of CRE.

Banks are seeing a solid pickup in demand for all categories of CRE.This suggests (along with the Architecture Billing Index) that we will see an increase in commercial real estate development.