by Calculated Risk on 8/04/2014 08:52:00 PM

Monday, August 04, 2014

Tuesday: ISM non-Manufacturing

First a note on housing inventory and more ...

I think it is a positive that existing home inventory is increasing. Sometimes rising inventory is a sign of trouble (I was pointing to increasing inventory in 2005 as a sign that the bubble was ending), but now inventory is so low that an increase is probably a positive.

This increase in inventory will also slow house price increases - the recent rate of increase in some areas was unsustainable - and getting inventory back to normal levels is another step towards a healthier market.

Also - another step towards normal is the continuing decline in the number of properties in foreclosure and the downward trend for mortgage delinquencies. (See Black Knight releases Mortgage Monitor for June that was released this morning for details).

And it even appears, according to the Fed Senior Loan Officer survey that lending standards might be easing a little (too loose is bad, but that isn't the problem right now).

Tuesday:

• At 10:00 AM, the ISM non-Manufacturing Index for July. The consensus is for a reading of 56.5, up from 56.0 in June. Note: Above 50 indicates expansion.

• Also at 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for June. The consensus is for a 0.6% increase in June orders.

Weekly Update: Housing Tracker Existing Home Inventory up 13.6% YoY on Aug 4th

by Calculated Risk on 8/04/2014 05:23:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for June and indicated inventory was up 6.5% year-over-year).

Fortunately Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data, for 54 metro areas, for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays.

Inventory in 2014 (Red) is now 13.6% above the same week in 2013. (Note: There might be an issue with the Housing Tracker data over the last few weeks - Ben is checking - but inventory is still up significantly).

Inventory is also about 2.4% above the same week in 2012. According to several of the house price indexes, house prices bottomed in early 2012, and low inventories were a key reason for the subsequent price increases. Now that inventory is back above 2012 levels, I expect house price increases to slow (and possibly decline in some areas).

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.

Fed Survey: Banks eased lending standards, "broad-based pickup in loan demand"

by Calculated Risk on 8/04/2014 02:00:00 PM

From the Federal Reserve: The July 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices

The July survey results showed a continued easing of lending standards and terms for many types of loan categories amid a broad-based pickup in loan demand. Domestic banks generally continued to ease their lending standards and various terms for commercial and industrial (C&I) loans. In contrast, foreign banks reported little change in standards and in most of the surveyed terms for C&I loans on net. Domestic respondents, meanwhile, also reported having eased standards on most types of commercial real estate (CRE) loans on balance. Although many banks reported having eased standards for prime residential real estate (RRE) loans, respondents generally indicated little change in standards and terms for other types of loans to households. However, a few large banks had eased standards, increased credit limits, and reduced the minimum required credit score for credit card loans. Banks also reported having experienced stronger demand over the past three months, on net, for many more loan categories than on the April survey.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Banks are loosening their standards for CRE loans, and for various categories of CRE (right half of graph).

The second graph shows the change in demand for CRE loans.

Banks are seeing a solid pickup in demand for all categories of CRE.

Banks are seeing a solid pickup in demand for all categories of CRE.This suggests (along with the Architecture Billing Index) that we will see an increase in commercial real estate development.

Goldman Sachs' Hui on House Price Seasonal Adjustments

by Calculated Risk on 8/04/2014 01:03:00 PM

A few excerpts from some analysis by Goldman's Hui Shan: "Are investors getting too pessimistic about US housing"

This month’s housing data showed weakness in both price and activity measures. On the price side, market consensus expected 0.3% month-over-month growth in the S&P Case-Shiller 20-City Composite. The actual print was -0.3%, the first decline since January 2012 when house prices bottomed. ...CR Note: This is similar to the argument I made last week A few comments on the Seasonal Pattern for House Prices. The seasonal adjustment should normalize over the next few years.

In our previous research, we showed that seasonal adjustments have become a tricky business for housing owing to heightened distressed sales over the past few years (see “Enough about the weather: Let’s talk seasonal adjustments”, Mortgage Analyst, February 28, 2014). In the US housing market, more people buy and sell homes in the summer than in the winter because of the school calendar. A thinner market in the winter implies that sellers typically accept lower prices to close transactions. As a result, seasonal factors would nudge prices up in the winter and down in the summer to arrive at the seasonally adjusted series. Normally, such adjustments are within the range of plus/minus one percentage point.

The recent housing downturn is the most severe in US history since the Great Depression, featuring a wave of distressed sales. According to the National Association of Realtors, at the worst of the crisis, nearly half of home sales were distressed. Because distressed sales take place throughout the year while non-distressed sales are more concentrated in the summer, distressed sales account for a larger share of total sales in the winter than in the summer. Also, because distressed properties tend to transact at a significant discount relative to non-distressed properties, they drag down observed transaction prices and the effect is more pronounced in the winter (when the distressed share is high) than in the summer (when the distressed share is low). This amplifies the normal seasonal pattern. In recent years, seasonal adjustments have expanded from the normal “plus/minus one percentage point” to “plus/minus three percentage points”.

As the housing market recovers and the share of distressed sales drops, the true underlying seasonal pattern is normalizing. However, seasonal factors are usually derived using data from the past 5-7 years. In other words, we are using the amplified seasonal factors to adjust more muted seasonal patterns, meaning pushing up house prices too much in the winter and also pushing down house prices too much in the summer. This is consistent with what we have seen over the past year: the S&P Case-Shiller house price index beat consensus expectations at the beginning of the year and it was surprisingly weak for the May reading. This seasonal adjustment problem is likely to persist in coming months, causing the next few months’ house price prints to appear softer than they really are.

emphasis added

Black Knight releases Mortgage Monitor for June

by Calculated Risk on 8/04/2014 09:05:00 AM

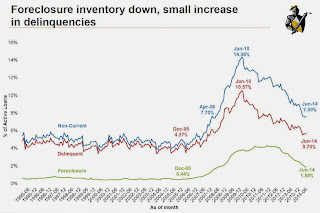

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for June today. According to BKFS, 5.70% of mortgages were delinquent in June, up from 5.62% in May. BKFS reports that 1.88% of mortgages were in the foreclosure process, down from 2.93% in June 2013.

This gives a total of 7.58% delinquent or in foreclosure. It breaks down as:

• 1,728,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,155,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 951,000 loans in foreclosure process.

For a total of 3,834,000 loans delinquent or in foreclosure in June. This is down from 4,785,000 in May 2013.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

From Black Knight:

An analysis of the month’s mortgage performance data showed that the nation’s inventory of loans in foreclosure is disproportionately distributed in states with judicial foreclosure processes. According to Kostya Gradushy, Black Knight’s manager of Research and Analytics, while foreclosure inventories have been declining nationwide, judicial states’ foreclosure inventories are 3.5 times that of their non-judicial counterparts.There is much more in the mortgage monitor.

“Nationally, the foreclosure inventory rate has declined for 26 straight months, and is currently at its lowest point since April 2008, but this can obscure the stark difference that remains between judicial and non-judicial states,” said Gradushy. “Although judicial states account for about 42 percent of all active mortgages, some 70 percent of loans in foreclosure are in these states. Today, the share of loans in foreclosure in judicial states is 3.23 percent – a significant decline from its January 2012 high of 6.6 percent, but still more than four times higher than the pre-crisis ‘norm.’ Further, more than 60 percent of the foreclosure inventory in judicial states has been past due for two years or more. In fact, these loans have been delinquent an average of 1,084 days, as compared to just 775 days in non-judicial states. The states with the highest number of average days past due for loans in foreclosure are all judicial states: New York and Hawaii are each above 1,300 days, while New Jersey and Florida both top 1,200 days. emphasis added